What if you could earn money just by shopping?

It sounds almost too good to be true, but cashback apps have made it a reality for millions of consumers.

These apps have quickly become a favorite tool for savvy shoppers, offering instant rewards on everyday purchases. Various platforms now lead the charge, turning routine shopping trips into saving opportunities.

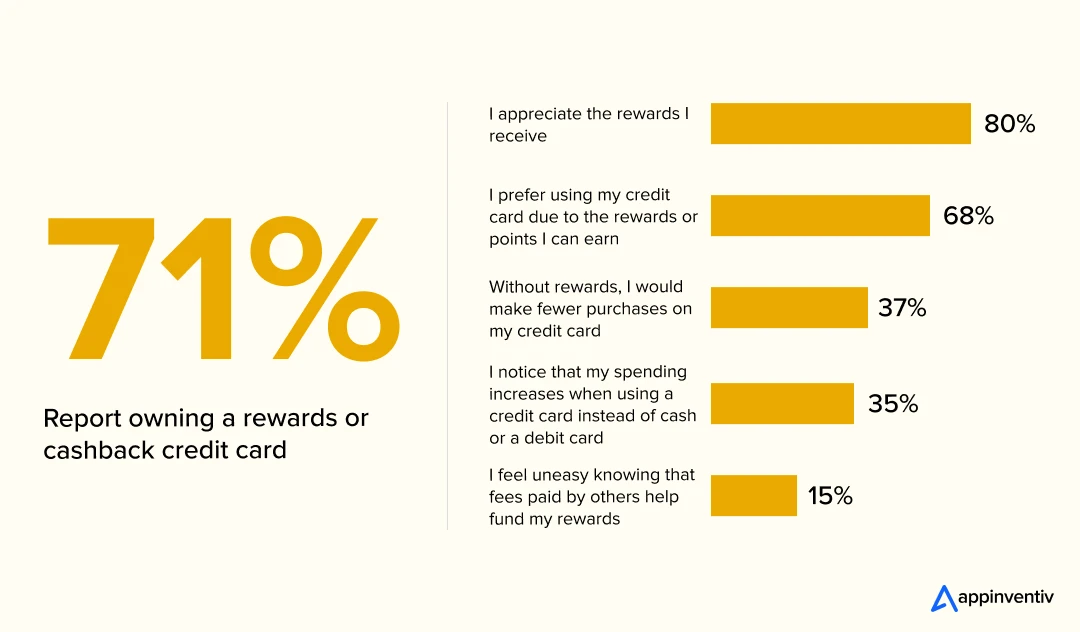

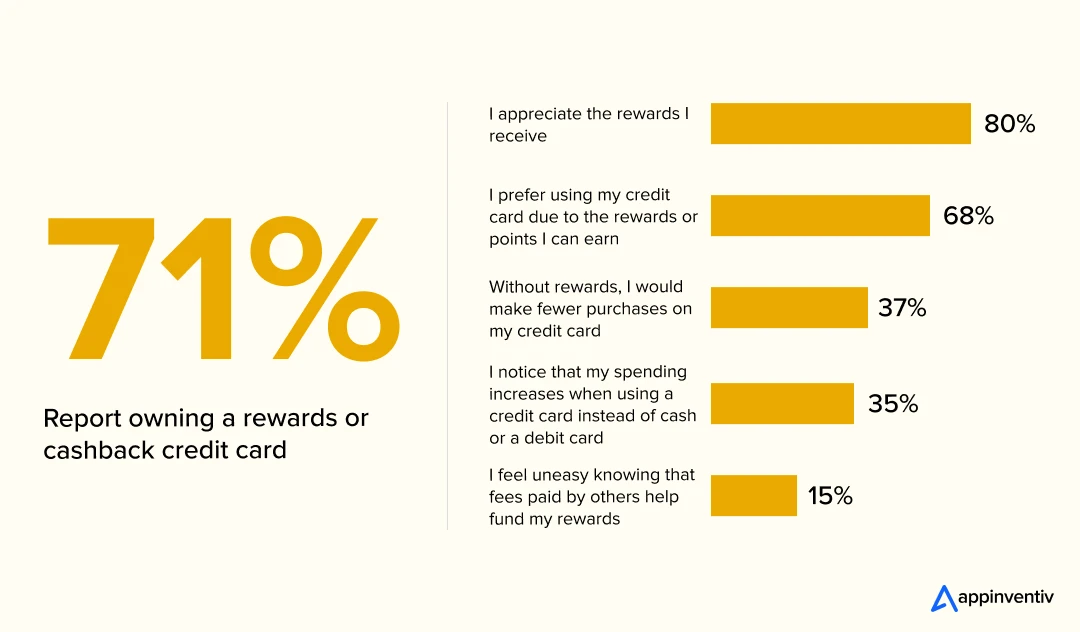

According to a survey conducted between April 31 and May 1 among 1,081 adults, 71% of respondents reported owning a rewards or cashback credit card. Additionally, 68% preferred using credit cards to earn rewards and points .

While these apps are a win for users, the real question is: “How do cashback apps make money?”

Offering rewards to shoppers sounds like a generous deal, but businesses behind these platforms need a sustainable way to profit. The secret lies in various cashback app revenue models and monetization strategies that ensure these apps remain financially viable while offering attractive incentives.

Mastering these app monetization strategies is key to success if you want to understand how these platforms operate and incorporate similar strategies into your business.

Let’s explore the inner workings of money-back apps and how they generate revenue while keeping customers satisfied.

The Basics of Cashback Apps

cashback apps are digital tools designed to reward consumers for their purchases by offering a percentage of their spending in cash or reward points. These apps aim to encourage consumer spending by providing an incentive in the form of cash or benefits. The apps typically partner with retailers, service providers, and e-commerce platforms to give users access to exclusive deals, promotions, and cashback offers.

The purpose of these apps is twofold:

- For Consumers: They provide a way for shoppers to earn financial rewards on their purchases, helping them save money over time.

- For Businesses: They help drive sales, encourage repeat customers, and increase brand loyalty by offering incentives for availing their products or services through their platform.

How do Cashback Apps Make Money?

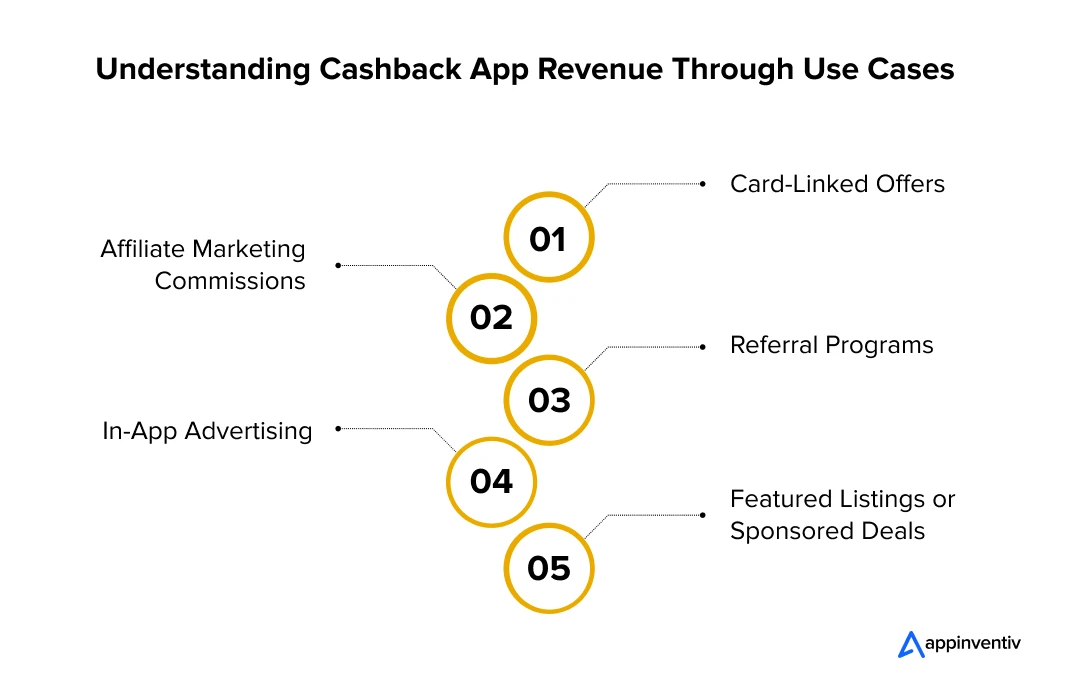

Cashback app revenue models play a crucial role in ensuring the sustainability and profitability of cashback apps. By implementing effective strategies, businesses can balance offering valuable rewards to users while maintaining financial growth and success. Let’s check out some of the top cashback app monetization strategies:

In-App Advertising

Monetize your cashback app by displaying ads from third-party networks within the app. This approach takes advantage of the app’s user base, earning revenue based on ad impressions or interactions. Additionally, users may be incentivized with extra cashback for engaging with these ads, driving more interaction and increasing ad revenue.

Loyalty Programs

Some apps integrate loyalty programs where users can accumulate points or rewards through regular shopping or app engagement. These points can be redeemed for higher cashback rates, gift cards, or exclusive offers. Merchants pay to integrate these programs, which enhances user retention and drives sales while providing more incentives for app users.

Also Read: Cost to Develop a Loyalty and Rewards App Like Smile

Affiliate Marketing

Moneyback apps frequently partner with eCommerce platforms or brands to earn commissions from sales made through the app. When users click on links or ads within the app and make purchases, the app earns a share of the sale, which is passed on to users as cashback. This model allows businesses to generate passive income from user transactions without directly selling products.

Product Partnerships

Cashback apps may collaborate with specific brands or products to offer exclusive cashback deals. These partnerships often include co-marketing efforts, with both parties promoting the app and its rewards. In return for driving sales, the app earns a commission or receives funding to promote the brand’s products, generating extra revenue.

Cross-Promotions

Money-back apps can leverage cross-promotions with other apps or services, encouraging users to try out different apps or services in exchange for additional cashback rewards. This model allows app developers to generate revenue by exchanging user traffic or forming strategic partnerships with businesses outside their primary industry.

Referral Programs

Many cashback apps offer referral programs where users can invite friends or family to join in exchange for rewards. When referred users make purchases or complete specific actions, both the referrer and the referee receive cashback or credits. This model encourages user growth and helps expand the app’s user base.

Premium Memberships

Some money-back apps offer a subscription-based premium membership, where users pay a monthly or yearly fee for enhanced benefits. These may include higher cashback rates, exclusive deals, or faster payout options. This model creates a consistent revenue stream, providing users with greater value and encouraging loyalty and retention.

Sponsored Offers

Cashback apps often showcase sponsored promotions or special deals from merchants willing to pay for visibility. These promotions may include limited-time cashback offers or exclusive discounts, and merchants compensate the app for featuring their deals. This provides a steady revenue stream while offering users attractive opportunities to earn more cashback.

Merchant Partnerships

Cashback apps team up with merchants to offer exclusive deals and discounts to users. In return, the app earns a fee from the merchant for driving traffic and sales to their stores, whether online or in-person. This creates a mutually beneficial relationship where merchants increase sales while users receive cashback rewards. This revenue generation model for cashback apps ensures that both parties will benefit.

Data Monetization

Cashback apps can generate revenue by analyzing user data such as purchasing behavior and demographic information. This data is valuable to advertisers, marketers, and retailers, who can use it for targeted campaigns. While this model can be profitable, it requires careful management to protect user privacy and comply with data protection regulations.

How do the Cashback App Revenue Models Benefit Both Users and Retailers?

Cashback platforms’ revenue models create a win-win situation for users and retailers. Users benefit from earning rewards on their purchases, enhancing their shopping experience, while retailers gain increased sales and brand exposure through app-driven transactions. Let’s understand this in more detail through this table.

| Revenue Model |

Benefits for Users |

Benefits for Retailers |

| Affiliate Marketing |

Users earn cashback on purchases made through the app, offering savings on their transactions. |

Retailers gain increased exposure and sales through the app’s user base, paying only for completed sales. |

| In-App Advertising |

Users can earn extra cashback or rewards by interacting with ads, making the experience more valuable. |

Retailers can target specific user segments with ads, expanding reach and driving conversions. |

| Sponsored Offers |

Users enjoy exclusive promotions, time-limited deals, and higher cashback opportunities. |

Retailers can drive sales by featuring their offers to a targeted, engaged audience. |

| Loyalty Programs |

Users earn rewards or points for repeat shopping, which can be redeemed for increased cashback or exclusive offers. |

Retailers enhance customer retention and encourage repeat purchases by rewarding loyalty. |

| Product Partnerships |

Users can access exclusive cashback offers or discounts for specific products or brands. |

Retailers benefit from increased visibility and sales by offering special promotions through the app. |

| Cross-Promotions |

Users receive additional cashback for exploring new apps or services, broadening their rewards. |

Retailers can extend their reach by partnering with other apps attracting a new, relevant customer base. |

| Merchant Partnerships |

Users access exclusive discounts and cashback offers from their preferred merchants. |

Retailers benefit from increased traffic and sales by partnering with the cashback app. |

| Referral Programs |

Users can earn rewards for referring others, expanding their benefits, and growing the app’s user base. |

Retailers gain new customers through referrals, leveraging existing users to drive growth. |

| Data Monetization |

Users receive personalized offers based on their shopping behavior and preferences. |

Retailers can optimize marketing campaigns and personalize offers using valuable user data. |

| Premium Memberships |

Users can access enhanced cashback rates, exclusive offers, or faster payouts, providing greater value. |

Retailers benefit from a loyal, paying customer base that accesses premium features, ensuring steady revenue. |

Also Read: How Much Money Can You Earn Through An App?

The Profit Strategies of Cashback Apps: Use Cases with Real-Life Examples

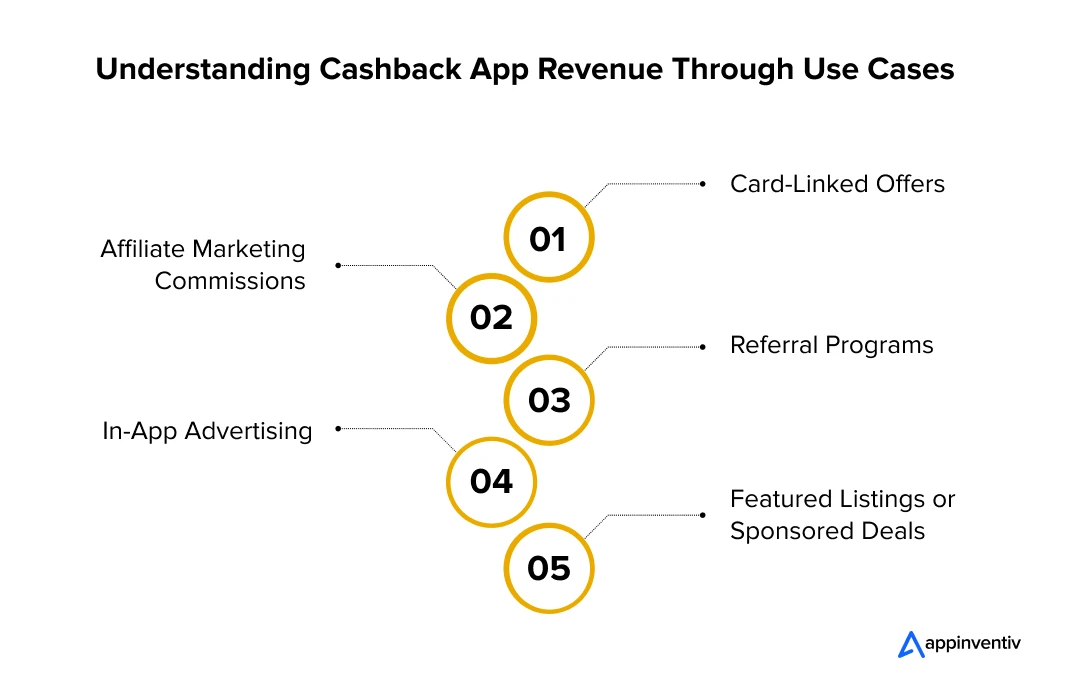

Cashback apps make money through various use cases by partnering with retailers and service providers, earning commissions on user purchases. Let’s navigate this through a few popular use cases and real-life examples.

Card-Linked Offers

How it Works

Users link their debit or credit cards to the app, automatically tracking purchases at participating retailers. The app earns a commission from the retailer for qualifying transactions and shares a portion with the user as cashback. This hassle-free system drives frequent usage and consistent revenue for the app.

Real Example: Drop

Drop simplifies earning rewards by partnering with brands like Uber, Starbucks, and Amazon, providing cashback whenever linked cards are used at these retailers.

Users earn cashback whenever their linked cards are used at these retailers, making accumulating rewards with everyday purchases effortless. This seamless integration boosts user engagement and drives app profitability.

Affiliate Marketing Commissions

How it Works

As intermediaries, money-back apps drive retailers’ sales through referral links. Retailers pay a commission for these referrals, and the app shares a portion of this with users as cashback while keeping the rest as profit.

Real Example: Rakuten

Rakuten (formerly Ebates) collaborates with big names like Target and Walmart. Users earn cashback on purchases, while Rakuten earns commissions from partner retailers.

This creates a mutually beneficial cycle that rewards users while generating steady revenue for the app. Rakuten’s broad network of retail partners also increases its reach and profitability.

Referral Programs

How it Works

Cashback apps grow their user base by offering referral incentives. Existing users are rewarded for inviting friends, while new users receive bonuses, creating a winning strategy that boosts engagement and revenue.

Real Example: Fetch Rewards

Fetch Rewards offers bonus points to the referrer and the referred user, encouraging app downloads and active participation at minimal marketing costs.

This dual-reward system not only drives app adoption but also fosters long-term user retention by increasing the platform’s perceived value.

In-App Advertising

How it Works

Retailers and advertisers pay for ad placements within the app, such as banners, videos, or targeted offers. These ads are often tailored to user preferences, increasing click-through rates and driving sales while boosting app revenue.

Real Example: Shopkick

Shopkick partners with brands to display ads and offers, reward users with engagement points, encourage purchases, and increase ad revenue.

By offering rewards for interaction, Shopkick enhances user engagement and helps brands reach the right audience with highly relevant promotions, making it a mutually beneficial advertising model.

Featured Listings or Sponsored Deals

How it Works

Retailers pay cashback apps for premium placement on the app’s homepage or highlighted sections. This increases the visibility of their deals, attracts more users, and boosts their sales. This model greatly benefits the retailer (who gains customers) and the app (which earns additional revenue).

Real Example: Dosh

Dosh features special promotions for brands like Hilton and Sephora. These brands pay a fee to appear in premium positions, ensuring higher visibility among Dosh’s active users, driving sales, and earning commissions.

By securing top-tier placements, these brands can generate more traffic to their offers, while Dosh benefits from increased ad revenue and enhanced user engagement through these high-visibility deals.

Overcoming Challenges to Build a Profitable Cashback App

Building a profitable cashback app requires overcoming several key challenges. Addressing these challenges head-on can turn such apps into a sustainable and profitable business model. Let’s examine those.

1. Competitive Cashback Rates

High cashback rates attract users but reduce profit margins, making sustainability difficult.

Solution: Negotiate better retailer commissions and introduce loyalty-based cashback tiers to balance user appeal and profitability.

2. User Acquisition and Retention

High marketing costs and user switching between apps make acquiring and retaining customers challenging.

Solution: Leverage data-driven personalization, referral incentives, and gamified rewards to build long-term user loyalty.

3. Data Privacy & Security

Handling sensitive financial data poses risks of data breaches and demands strict compliance with privacy regulations.

Solution: Employ robust encryption, regular audits, and compliance frameworks to safeguard user data and maintain trust.

4. Fraud Detection

Fraudulent activities like fake transactions or referral abuse can lead to significant revenue losses.

Solution: Use ML-based fraud detection tools to minimize misuse and implement clear terms and penalties.

5. Competition in the Market

Competing with numerous cashback apps requires continuous differentiation and innovation to stay relevant.

Solution: Cashback apps’ unique features, such as exclusive partnerships, card-linked offers, or value-added services, can help your app stand out.

6. Maintaining Profitability

Balancing high cashback payouts with operational expenses and revenue fluctuations is a constant struggle.

Solution: Diversify revenue through in-app ads, premium subscriptions, and anonymized data insights while managing costs effectively.

Understanding the Different Categories of Cashback Apps

Cashback apps come in various forms, catering to user needs and preferences. Each type provides unique benefits, allowing users to earn rewards in a way that suits their shopping habits. Let’s have a detailed look at those.

1. Retail-Focused Cashback Apps

These apps collaborate with online and brick-and-mortar stores to offer cashback on purchases across various categories, such as electronics, fashion, and home goods. Users usually earn rewards by making purchases through the app or clicking special links that lead to the retailer’s website. With partnerships across various retailers, these apps enable users to earn cashback from regular shopping activities.

2. Grocery Cashback Apps

Grocery cashback apps target savings on everyday grocery shopping by offering cashback on specific items or brands. Users can earn rewards after meeting a minimum spend or purchasing selected products from participating grocery stores. These apps help users save money on essential items like food, beverages, and household goods, often providing personalized offers based on shopping history.

3. Gas Cashback Apps

Gas cashback apps are designed to help users save on fuel costs by providing cashback at participating gas stations. Users can earn cashback on fuel purchases by linking a payment method or showing the app at the pump. These apps are especially beneficial for drivers and frequent travelers, offering savings on fuel and sometimes additional rewards on specific promotions.

4. Credit Card-Linked Cashback Apps

Credit card-linked cashback apps automatically track purchases made with linked credit cards, offering cashback without requiring extra steps. The rewards are typically credited to the app or the user’s bank account. This app simplifies the cashback process, as users don’t need to manually activate offers or remember to make purchases through a specific app.

5. In-Wallet Cashback

In-wallet cashback apps store the cashback rewards within the app’s virtual wallet, allowing users to redeem them later for future purchases, gift cards, or cash transfers. These apps allow users to accumulate rewards over time and use them whenever convenient, without worrying about expiration dates or restrictions on how they can be spent.

6. Bank-Linked Cashback Apps

These apps link directly to users’ bank accounts, automatically offering cashback on eligible transactions in categories like dining, travel, and entertainment. The cashback is credited to the user’s linked bank account, making the process seamless and automatic. Bank-linked cashback apps eliminate the need for users to maintain separate accounts or payment methods, making it an easy and integrated solution.

7. Receipt/QR Scanning Cashback Apps

Receipt or QR scanning cashback apps allow users to earn rewards by scanning receipts or QR codes after making purchases. Users upload their receipts or scan codes from qualifying transactions to receive cashback. These apps are ideal for users who want to earn rewards on everyday purchases from various stores without shopping through a specific platform.

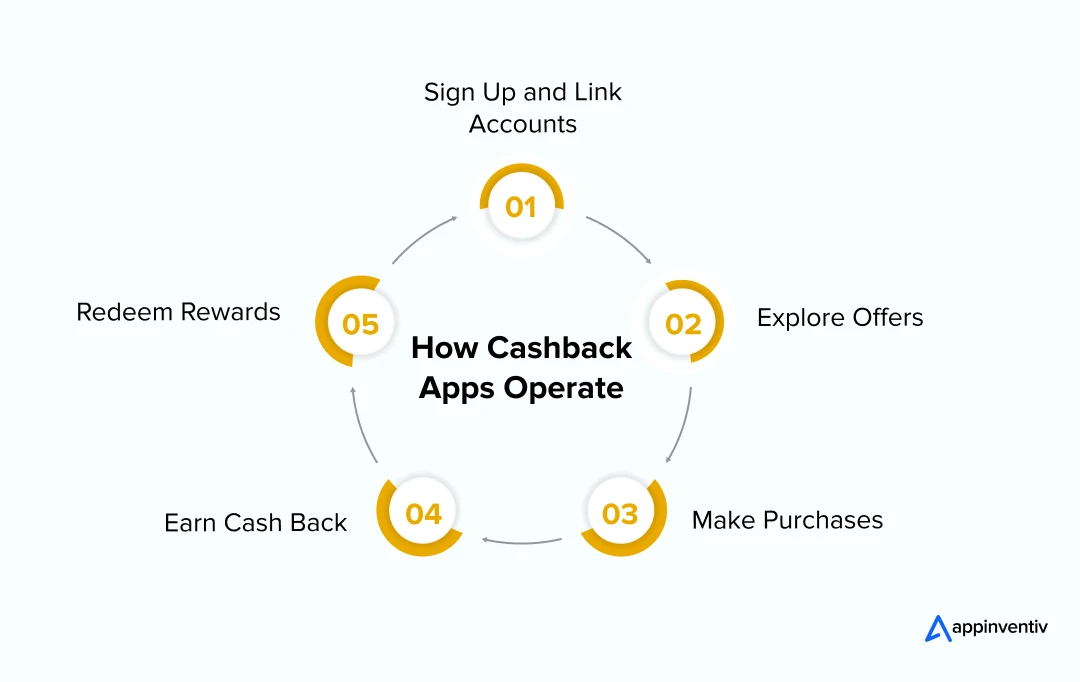

How do cashback Apps Work?

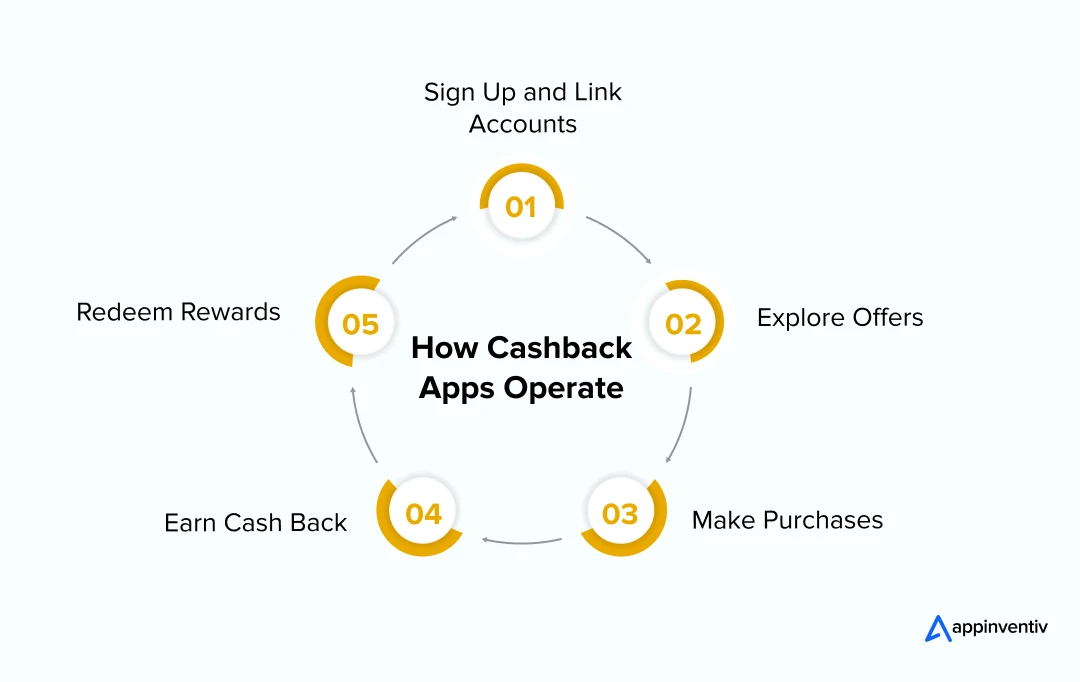

Cashback apps or money back apps work by allowing users to easily earn a percentage of their purchase amounts back when they shop at partnered stores or online platforms. Here’s a step-by-step breakdown of how these apps typically function:

- Sign Up and Link Accounts: Users install the cashback app and create an account by connecting their bank, credit, or debit cards to the app.

- Explore Offers: After logging in, users can browse a selection of participating retailers or discover exclusive deals and promotions through the app.

- Make Purchases: Users proceed to shop either in-store or online via the app or by using their linked payment methods at participating locations.

- Earn cashback: Once a purchase is made, the app monitors the transaction and credits the user with the appropriate cashback or reward points.

- Redeem Rewards: The earned rewards can be redeemed in various ways, such as bank transfers, gift cards, or applied as account credits for future purchases.

What Lies Ahead for Cashback Apps in a Digital World

Cashback apps are transforming how consumers save money and engage with brands, and their evolution shows no signs of slowing down. The future holds exciting trends that promise to enhance user experiences, boost business opportunities, and redefine the rewards ecosystem:

- AI-driven personalization will deliver highly tailored deals based on user behavior and preferences.

- Deeper integration with digital wallets, cryptocurrencies, and contactless payments will ensure smooth reward experiences.

- Subscription-based models will offer premium perks, such as higher cashback rates and exclusive rewards.

- Collaborations with industries like travel, healthcare, and utilities will expand cashback opportunities beyond retail.

- Sustainability-focused rewards will incentivize purchases from eco-friendly and socially responsible brands.

- Gamified features and social elements will make earning cashback interactive and engaging.

By embracing these trends, cashback apps will remain indispensable to modern consumers and a critical tool for businesses.

Design Your Perfect Cashback App with Appinventiv

Appinventiv, a trusted FinTech app development services provider, specializes in building customized cashback apps that blend cutting-edge technology with user-centric design to meet your unique business needs. Our expertise ensures secure, scalable, and feature-rich solutions that drive customer engagement and brand loyalty.

Whether for retail, groceries, or fuel, we deliver tailored apps that offer seamless user experiences and redefine savings. Focusing on innovation and market relevance, we build cashback apps that help businesses thrive in competitive markets.

Partner with us to transform your cashback app vision into a powerful tool for growth and success.

Let’s build the future of rewards together with cashback app development.

FAQs

Q. How does the cashback app work?

A. Cashback apps collaborate with retailers, brands, and service providers to reward users with a percentage of their spending. Users can earn these rewards by shopping through the app, linking their payment methods, or uploading receipts. The accumulated cashback can be redeemed as cash, gift cards, or discounts.

Q. How do cashback apps generate revenue?

A. Cashback apps primarily generate revenue through affiliate marketing, retailer collaborations, and promotional campaigns. By driving sales to partner businesses, they earn a commission on each successful transaction. A portion of this commission is shared with users as cashback rewards.

Many apps diversify their revenue streams through premium subscriptions, sponsored brand placements, and targeted advertisements, offering businesses greater visibility and engagement opportunities. By following the best app monetization model, businesses can ensure joint success where retailers benefit from increased sales, users enjoy attractive rewards, and the app sustains its profitability and growth.

To learn more about how do cashback apps make money, connect with our experts now.

Q. What are some of the top trends in cashback app monetization?

A. Here are some of the latest trends in app monetization:

- Integrating cryptocurrency rewards

- Leveraging blockchain for transparency

- Offering personalized cashback

- Enhancing gamification elements

- Focusing on subscription-based premium features

Q. What are some tips for making a cashback app profitable?

A. Here are some of the vital tips to make a cashback app profitable:

- Maximize Earnings Through Tracking: Implement effective tracking systems to monitor user spending, reward distribution, and partner sales, ensuring accurate cashback allocation and commission generation.

- Build a Strong User Base: Focus on acquiring a loyal user base through targeted promotions, referral programs, and seamless onboarding experiences that encourage regular usage.

- Enhance Conversion Rates: Optimize the app’s interface and user journey to make it as easy for users to make purchases, claim rewards, and return for repeat transactions.

- Leverage Marketing Campaigns for Growth: Run tailored marketing campaigns, including influencer partnerships, seasonal offers, and push notifications, to increase app visibility, engagement, and user retention.

Product Development & Engineering

IT Managed & Outsourcing

Consulting Services

Data Services

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.