The era when customers patiently wrestled with repeated payment failures is long gone. Today, a tidal wave of payment service providers floods the market, captivating customers with hyper-personalized, frictionless payment experiences. Your customers no longer linger over why a payment fails—each glitch costs you a loyal buyer, stalls growth, and siphons off revenue.

Do failed payments affect more than just lost revenue?

According to the Report by LexisNexis:

- Operational Cost: Each failed payment costs an average of $12.10 to resolve.

- Staff Workload: 64% say failed payments hurt staff workload.

- Customer Satisfaction: 37% of businesses experience a poor impact on customer service.

As a payment service provider, you must eliminate payment complexity and deliver seamless, secure solutions, ensuring customers enjoy a supremely easy and navigable experience.

That’s where payment orchestration software development comes into play. Rather than each merchant maintaining different payment gateways, all this can be centralized into one system that automates routing, optimizes cost, and ensures the transaction is sent through the most reliable channel. This reduces failed payments and improves cash flow, security, and global scalability.

Building a payment orchestration platform correctly requires a strategic approach. It is not just a matter of adding multiple providers—it is ensuring compliance, security, and real-time analytics, and it keeps the system flexible for future needs.

This article will discuss why a payment orchestration platform is vital, what goes into developing one correctly, and the challenges that businesses must prepare for. We will also break down the essential elements, like payment orchestration platform development cost and process, to help you understand how well-designed orchestration of payments can help streamline operations and enhance the customer experience.

Why is Payment Orchestration Evaluated?

Before the arrival of payment orchestration as a game-changer in modern payments, businesses needed to go through several Payment Service Providers and had individual integrations. Thus, this approach often resulted in operational inefficiencies, increased costs, poor customer experience, and other challenges that took a toll on service efficiency.

Retailers, SaaS companies, and financial institutions used to handle multiple payment gateways that required their settlement periods, currency limitations, and security requirements. Handling such systems required huge IT resources, and any change – such as introducing a new payment method- was costly in terms of time and money.

For example:

- Hobby Lobby is a leading retailer that has attracted criticism for failing to support popular modern payment methods such as Apple Pay. This has led to customer dissatisfaction and abandonment of purchases.

- Meanwhile, companies in Latin America faced their own highly diversified payment landscape or a lot of processors that had to be managed alongside the increased fraud rates. This led to scaling pain and inefficiency in operations.

Payment orchestration has come as a response to these pain points of acquiring a centralized system that enables a simplified way to streamline payments, optimize transactional success rates, and improve security.

Payment Orchestration vs Payment Gateway

| Aspects |

Payment Orchestration |

Payment Gateway |

| Core Functions |

Integrates and orchestrates multiple payment services, including routing, fraud detection, and analytics. |

Facilitates the authorization and processing of a single transaction securely. |

| Integration |

Single API connects to multiple gateways/processors, simplifying scaling and management. |

Requires separate payment integration for each gateway, increasing complexity with scale. |

| Transaction Routing |

Smart routing optimizes based on cost, speed, reliability, or location. |

Fixed routing to one processor, no optimization. |

| Payment Options |

Supports diverse methods (credit cards, e-wallets, bank transfers, etc.) across providers. |

Limited to supported methods of a single provider (e.g., credit cards only). |

| Complexity |

More complex setup but simplifies long-term management. |

Simpler setup but less flexible as needs grow. |

| Scalability |

Ideal for high-volume or global businesses; scales easily with growth. |

Scaling requires additional gateways and is suited for small to medium businesses with simpler needs. |

| Fraud Detection |

Built-in tools for advanced fraud prevention across transactions. Like using Financial Fraud Detection with Machine Learning. |

Basic fraud checks often rely on external tools. |

| Cost Efficiency |

Reduces fees by routing to cost-effective providers; single integration lowers overhead. |

Higher long-term costs with per-transaction fees and multiple integrations. |

Why Businesses Need a Payment Orchestration Platform

A Payment Orchestration Platform (POP) isn’t just a tool—it’s a game-changer, harmonizing multiple payment providers, optimizing success rates, and unlocking global markets with the finesse of a maestro conducting a symphony. Let’s dive into the benefits of Payment Orchestration, which aims to thrive in 2025 and beyond.

Global Expansion

The global payment orchestration platform market is expected to grow at a compound annual growth rate (CAGR) of 24.7% from 2023 to 2030. A payment orchestration platform allows businesses to collect more currencies and seamlessly add local and international payment methods in one transaction that crosses borders. In addition, it automates the compliance process of regional regulations, reducing legal complexities and avoiding failing payments.

Enhanced Payment Success Rates

By dynamically routing transactions through the most reliable PSPs, a payment orchestration platform minimizes failures and boosts approval rates. If a provider experiences downtime, the system reroutes payments instantly, ensuring a frictionless checkout experience.

Cost Optimization

Smart routing reduces processing fees by selecting the most cost-effective PSP for each transaction. Businesses can also efficiently manage currency conversion and cross-border fees, leading to long-term savings that offset payment orchestration platform development costs.

Compliance and Security

It provides in-built fraud detection, encryption, and compliance automation for PCI-DSS, PSD2, and GDPR. This makes the system more secure, reduces risks, and protects the consumer’s data.

Better Customer Experience

Customer satisfaction and loyalty require seamless payment experiences. Payment orchestration enables faster approvals, fewer failed payments, and multi-method payments, making for a frictionless checkout experience. Enhanced security features like fraud prevention and encryption boost trust and confidence in online transactions.

Increased Revenue

Enhanced revenue scope is one of the biggest benefits of Payment Orchestration. More successful transactions mean fewer declined payments, cash flow, and a retained customer. It will allow for dynamic routing through the most cost-effective and reliable PSPs with minimized transaction decline, improved conversion rates, and revenue generation.

Scalability and Flexibility

As businesses scale, so does their payment requirement. A payment orchestration platform is built with scalability in mind, making it easy to incorporate new payment methods, currencies, and PSPs without major overhauls. This ensures business readiness to satisfy global demands and accommodate market trends while supporting further growth without major disruptions.

Common Use Cases of Payment Orchestration

Payment orchestration isn’t a one-size-fits-all solution—it adapts to different industries based on their unique payment needs. Here’s how various sectors leverage payment orchestration to streamline their transactions:

1. E-commerce & Retail

E-commerce/online retailers require smooth checkout experiences for maximum conversion. Payment orchestration enables them to:

- Offer diverse payment methods, including digital wallets, BNPL (Buy Now, Pay Later), and regional PSPs.

- Eliminate cart abandonment for failed transactions by automatically routing to another payment provider.

- Route global payments for optimum cost and speed through the processing gateway for each transaction.

2. SaaS & Subscription Services

For recurring payment businesses, handling failed transactions is a nuisance. Payment orchestration helps by:

- Automating retries for failed payments using smart routing.

- Handling different custom billing models (monthly, annual, pay-per-use) easily.

- Reducing involuntary churn by ensuring successful transactions across geographies.

Bonus Read: How Much Does it Cost to Build a Custom Billing Software?

3. Travel & Hospitality

The travel industry relies on cross-border transactions, making multi-currency support essential. Payment orchestration impacts travel companies by:

- Allowing customers to pay in their preferred currency while minimizing conversion fees.

- Reducing chargebacks through fraud detection and alternative verification methods.

- Managing high transaction volumes during peak seasons efficiently.

4. Financial Services & FinTech

Security and compliance are very important in financial transactions. Financial software development also includes payment orchestration as an added functionality that enhances these aspects by:

- Providing real-time fraud detection and risk management tools.

- Ensure compliance with international regulations, such as PSD2, PCI DSS, and local data protection laws.

- Provide an integrated payment platform that manages all digital and conventional payment channels.

With these tailored applications, payment orchestration transforms how industries handle transactions, ensuring seamless and efficient payment processing.

Payment Orchestration Platform Examples

The following are the key payment orchestration platform examples, such as Stripe, Adyen, and Braintree, that provide global payment processing, security, and smart transaction routing. Depending on their requirements, businesses can select the most suitable provider: multi-channel support, AI-driven optimization, or seamless PSP integration.

1. Stripe Payment Orchestration

Stripe is one of the leading global payment platforms with AI-driven smart routing capabilities. It lets businesses process transactions on multiple, diverse payment gateways, currencies, and regional destinations while being optimized for cost and success rates. With built-in fraud detection, automated compliance, and extensible API, Stripe makes payment orchestration easy for large, medium, and small businesses.

2. Adyen

Adyen provides an end-to-end multi-channel payment solution, enabling businesses to process online, in-app, and in-store transactions without hassle. Its advanced fraud protection tools and real-time transaction monitoring minimize risks while maintaining high payment approval rates. Adyen also supports compliance regulations globally, making it a great choice for enterprises operating in multiple markets.

3. Braintree

The service, owned by PayPal and Braintree, gives businesses flexible and scalable payment orchestration. It supports payments made in credit cards, digital wallets, and local payment methods, allowing customers to choose how they would prefer their transactions. With developer-friendly APIs, fraud prevention tools, and smooth integration with the PayPal ecosystem, Braintree helps its businesses manage payments efficiently while staying safe and compliant.

Key Features of Payment Orchestration Software

Payment Orchestration Platforms (POPs) are packed with features designed to streamline, optimize, and future-proof a business’s payment ecosystem. Here are the key Features of Payment Orchestration Software that provide a competitive edge and enhance the impact of payment orchestration services.

When implementing payment orchestration software, companies must focus on the following key features:

1. Multi-Gateway Integration

A payment orchestration platform can integrate several Payment Service Providers, allowing companies to make payments from different gateways. This ensures higher redundancy, reducing dependency on a single provider while improving payment acceptance rates across various regions.

2. Smart Routing

The platform intelligently directs transactions to the most optimal PSP based on cost, success rate, location, and currency compatibility. If a gateway is down or processing slowly, the system automatically reroutes the payment, ensuring a smooth and uninterrupted payment experience.

3. Fraud Prevention

Real-time monitoring with AI-powered fraud detection identifies suspicious transactions before they are completed. It examines patterns, detects anomalies, blocks potentially fraudulent activities, reduces chargebacks, and increases security.

Bonus Read: How Much Does It Cost to Build a Fraud Detection Software?

4. Automated Settlements & Reconciliation

Businesses avoid manual processing errors and delays by automatically settling funds. The platform also reconciles payments across different PSPs, ensuring accurate financial records and smooth cash flow management.

5. Tokenization & Encryption

Sensitive payment information is converted into secure tokens, which are not accessible by unauthorized parties. Encryption further secures transaction details, ensuring businesses comply with security standards like PCI-DSS.

6. Subscription & Recurring Payments

The platform also supports automated billing models, including subscriptions, recurring invoices, and flexible payment plans. This means businesses can streamline revenue collection while making the process more convenient for customers.

7. Real-Time Analytics & Reporting

Comprehensive dashboards offer detailed insights into payment trends, transaction success rates, and revenue performance. The data received from analytics & reporting in fintech can be used by businesses to optimize their payment strategies, reduce costs, and improve customer experience.

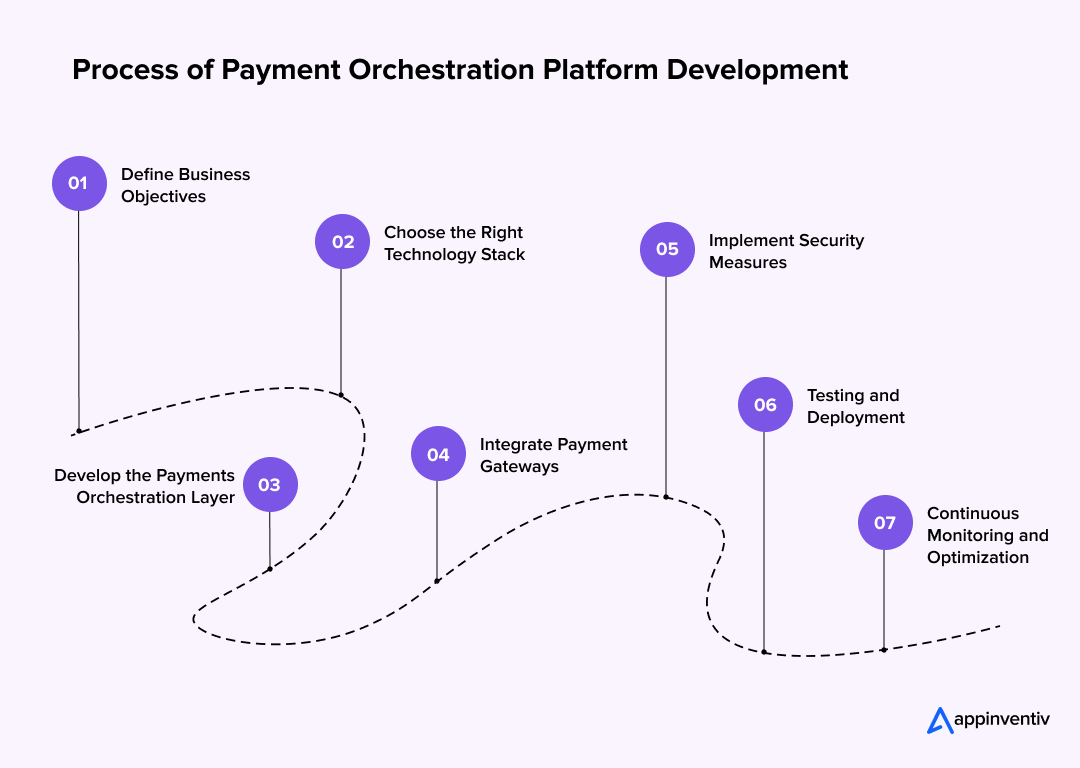

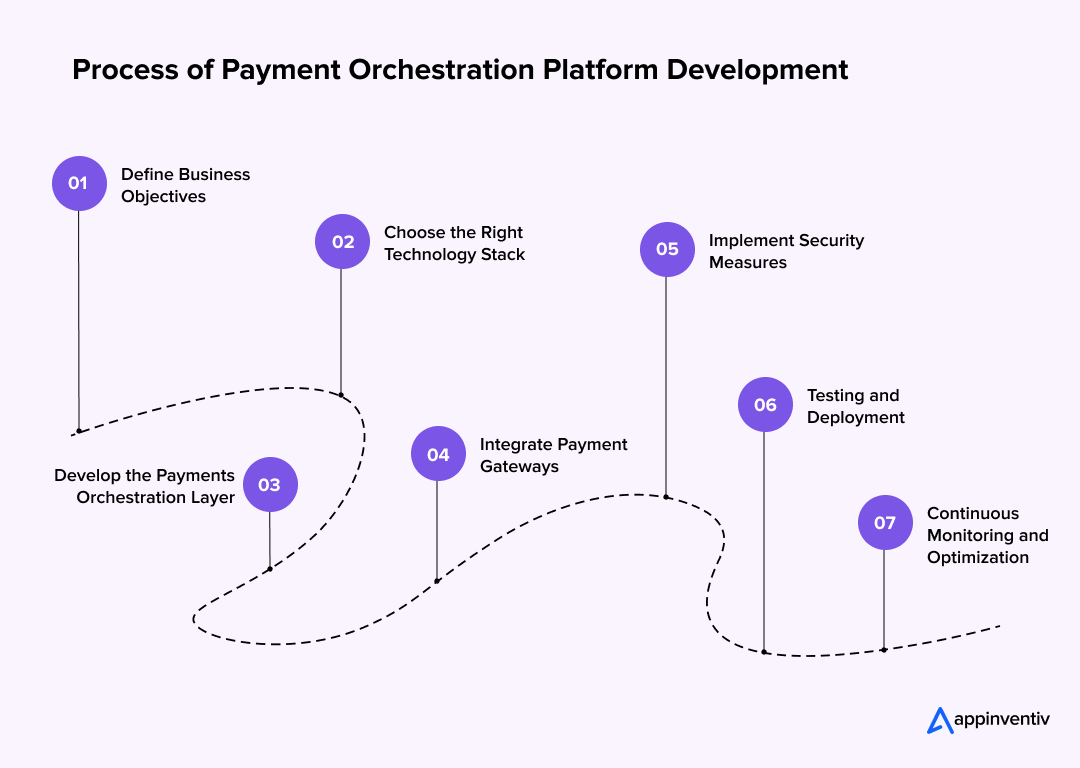

The Payment Orchestration Platform Development Process

The Payment Orchestration Platform Development Process includes seven important steps:

1. Define Business Objectives

Before diving into payment orchestration software development, businesses need a clear roadmap. The main goals might be international expansion, lowering the costs of processing payments, increasing the success rate, or meeting regional regulatory requirements. This is where setting such objectives will assist in deciding which features, integrations, and scalability options best fit the platform.

2. Choose the Right Technology Stack

A robust and scalable payment orchestration system architecture is critical for handling high transaction volumes securely. Businesses should leverage:

- Cloud-based infrastructure (AWS, Azure, Google Cloud) for scalability and reliability.

- API-driven payment orchestration system architecture to enable smooth integration with multiple PSPs, banks, and third-party tools.

- AI and ML-based fraud detection to improve security and minimize chargebacks.

Bonus Read: AI Tech Stack: Choosing the Right AI Technology for Your Business

3. Develop the Payments Orchestration Layer

This platform’s core handles transaction routing, automated settlements, and compliance management. The payments orchestration layer ensures payments are dynamically processed through the most efficient gateway while handling error detection, fallback mechanisms, and real-time monitoring.

4. Integrate Payment Gateways

Businesses should integrate multiple Payment Service Providers (PSPs) to maximize redundancy and flexibility. This allows regional adaptability, better transaction success rates, and cost-efficient payment processing.

5. Implement Security Measures

Security is a no-compromise in a payment transaction. Businesses must ensure that the company meets PCI-DSS, tokenize credit card details from the database, use end-to-end encryption on the transaction, and fraud detection tools to prevent unauthorized activities.

6. Testing and Deployment

Rigorous end-to-end testing ensures the system functions smoothly across different payment gateways and geographies. This includes testing for load handling, transaction failures, fraud detection, and compliance adherence before deployment.

7. Continuous Monitoring and Optimization

After launching, businesses must continuously monitor payment performance, security vulnerabilities, and transaction trends. AI-driven analytics can help refine routing strategies, optimize processing fees, and improve fraud detection mechanisms to enhance efficiency over time.

Challenges with Payment Orchestration

Payment orchestration is efficient and scalable but has problems with all of them, including regulatory compliance, integration complexity, security risks, and high up-front costs. However, proper technology, strategy, and continuous optimization will enable businesses to cross the hurdles and benefit in the long term through payment processing.

1. Regulatory Compliance

The largest risk is the ever-shifting vista of international and regional payment regulations. Businesses must contend with PCI-DSS, PSD2, GDPR, and others that vary from jurisdiction to jurisdiction. Non-compliance may attract penalties and reputational damage. A well-designed payment orchestration solution will have features like automated checks for compliance.

Also Read: Financial Regulatory Compliance Software Development

2. Integration Complexity

Multiple PSPs require an API management system that can efficiently communicate between platforms. Businesses must handle different protocols, data formats, and security measures across PSPs, making the integration process time-consuming and technically demanding. Thorough testing and quality assurance are important to avoid transaction failures and system downtime.

3. Data Security Risks

Data or cloud security risks associated with high volumes of sensitive customer data handled by the payment orchestration platform are on the priority list for cyber threats. Preventing a breach of sensitive information or an unauthorized transaction calls for tokenization, encryption, fraud detection, and multi-layer authentication. Ongoing monitoring and assessments against constantly changing risks build resilience to attacks.

4. High Initial Investment

The setup of the payment orchestration platform requires upfront costs for infrastructure, security implementation, and compliance certifications. However, the long-term ROI comes in cost savings due to lower transaction fees, higher success rates, and streamlined operations, making it a cost-effective solution.

Breakdown of the Payment Orchestration Platform Development Cost

Payment orchestration platform development cost ranges from $30,000 to $300,000, depending on the project’s specific demands. This wide range is influenced by the project’s scale, technological complexity, and the development approach chosen.

Costs by Complexity Levels

The payment orchestration platform development cost depends largely on its complexity. Basic solutions with essential features can cost less, while advanced or custom solutions demand higher investments due to extensive functionality and scalability.

| Complexity Level |

Estimated Cost |

| Basic |

$30,000 – $70,000 |

| Intermediate |

$70,000 – $150,000 |

| Advanced/Custom |

$150,000 – $300,000+ |

Costs by Development Stages

This platform development process is divided into multiple stages, each contributing to the overall cost. From planning to post-launch maintenance, every stage has distinct tasks and expenses.

| Development Stage |

Estimated Cost |

| Planning |

$5,000 – $10,000 |

| Design |

$10,000 – $20,000 |

| Development |

$50,000 – $150,000 |

| Launch |

$10,000 – $30,000 |

| Maintenance |

$10,000 – $20,000 annually |

Estimating Costs

Estimating the cost for payment orchestration software development involves analyzing team size, complexity, and development hours. Understanding the required features and technical resources helps calculate an approximate budget.

| Cost Formula:

Total Cost = (Hourly Rate × Development Hours) + Additional Costs (tools, licenses, etc.)

For Example: Total Cost= ($100×1,000hours)= $100,000 |

Time and Effort Estimates

The time required for development is directly proportional to the software’s complexity and the size of the development team. Each stage, from planning to deployment, demands effort across design, coding, testing, and more.

- Basic Software: 4-6 months with a small team.

- Intermediate Software: 6-12 months with a mid-sized team.

- Advanced Software: 12+ months with a larger team.

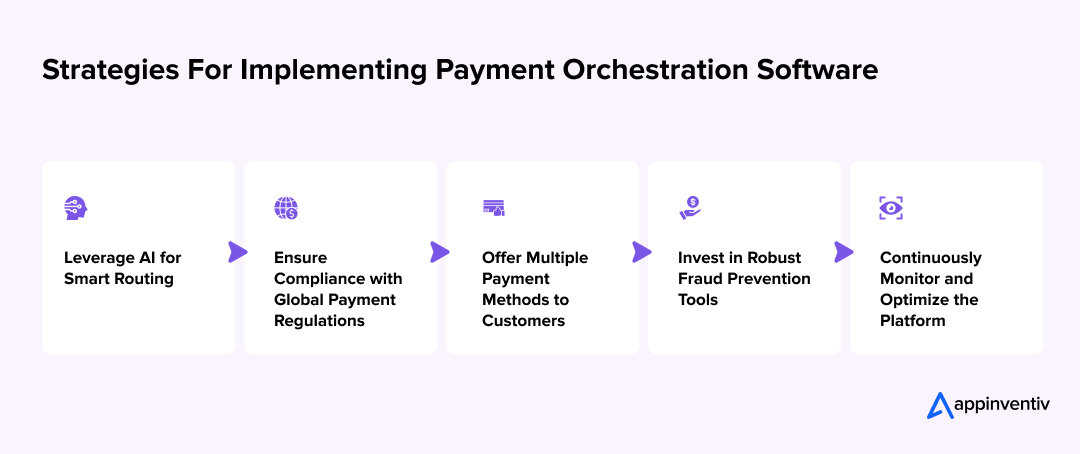

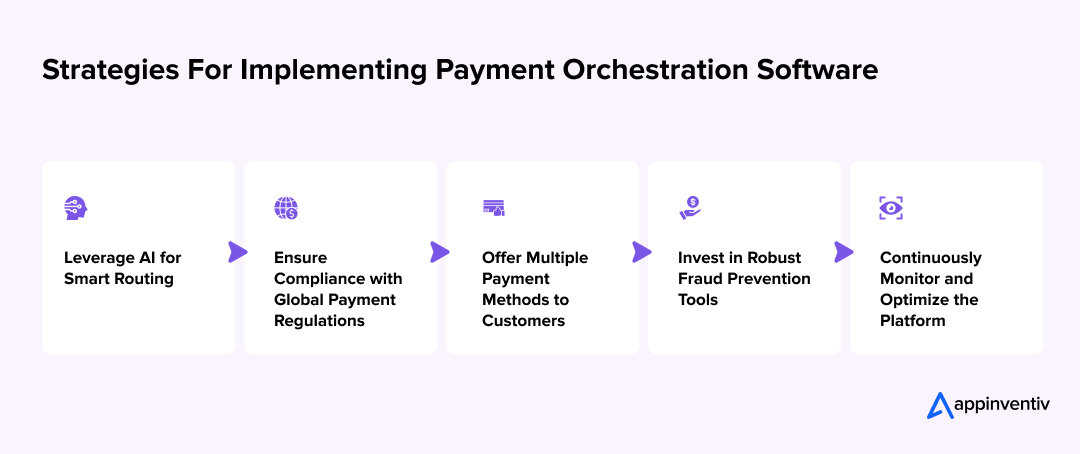

Best Practices For Implementing Payment Orchestration Software

Implementing AI-driven optimization, complying with regulatory security requirements, and real-time monitoring are necessary to enable payment orchestration software. Companies following these best practices will ensure customers enjoy a seamless, scalable, and cost-effective payment experience.

1. Leverage AI for Smart Routing

Smart routing enables AI to analyze success rates, transaction costs, and network availability to route transactions through the most efficient and cost-effective payment provider. This ensures that failed payments are reduced to the minimum, thus improving conversion rates.

2. Ensure Compliance with Global Payment Regulations

A company should ensure adaptation to regional and international financial rules like PCI-DSS, PSD2, and GDPR to avoid fines and ensure safe transactions. So, without glitches, a payment orchestration platform must comply with built-in security checks across geographies.

3. Offer Multiple Payment Methods to Customers

In addition, delivering many payment options to customers, including credit cards, digital wallets, and alternative payment methods, will improve convenience and enhance the probability of a successful conversion. The platform should support Local payment methods to reach a global market effectively.

4. Invest in Robust Fraud Prevention Tools

The multi-layered approach using AI, machine learning, and real-time monitoring helps detect and mitigate risks before the processing of transactions. Features such as tokenization and encryption enhance security and automatically reduce fraud and chargeback rates.

5. Continuously Monitor and Optimize the Platform

From the trend in payments, regulatory change, and fraud patterns, the method of orchestrating will evolve. Regular performance analysis and transaction monitoring update orchestration to ensure efficiency, security, and scalability.

Future Trends in Payment Orchestration

As digital payments progress, payment orchestration will soon be seen in a significantly new light. Here are a few emerging trends that are sure to redefine the landscape:

AI-Powered Fraud Detection

As cyber threats rise, so does the requirement for AI-driven fraud detection. Machine learning algorithms study transaction patterns to identify fraudulent activities in real-time and thus prevent them; this reduces chargebacks and unauthorized transactions.

Bonus Read: Top 10 Cybersecurity Measures for Businesses in 2025

Blockchain-Based Payments

Blockchain is now entering into payment orchestration. It gives the following advantages:

- Faster Settlements: Smart contracts allow for near-instant settlement but without intermediaries.

- Enhanced Security: Decentralized ledgers lower the fraud and data breach risk.

- Lower Transaction Fees: Reducing dependency on traditional banking networks minimizes costs.

Open Banking & Embedded Payments

Open banking programs are changing how businesses access financial data and make transactions. Payment orchestration platforms can use open APIs to:

- Enable seamless bank-to-bank payments, reducing reliance on card networks.

- Improve customer experiences by offering direct payment options with lower fees.

- Enhance financial inclusivity by integrating more payment methods.

Regulatory Shifts (PSD3 & Beyond)

This PSD3, to be implemented in the European Union, is supposed to bring even stronger authentication and fraud prevention requirements.

- Enhanced Strong Customer Authentication (SCA) requirements.

- Greater consumer protection against fraud.

- Improved transparency and access to financial services.

Partnering with Appinventiv for Advanced Payment Software Development

Being a fintech software development company, Appinventiv specializes in payment software development with innovations, security, and scalability tailored to the needs of your modern businesses.

We will help you build payment orchestration software from scratch or enhance your existing FinTech infrastructure with seamless integration, compliance, and high-performance execution.

With a rich experience in fintech delivery, our payment software development expertise provides businesses with streamlined transactions, AI-driven fraud detection, and minimized payment processing costs. We cover multi-gateway integration, smart routing, real-time analytics, and regulatory compliance to make the payment ecosystem more robust and future-proof.

Here’s why Appinventiv is the ideal choice for your business:

- Expertise That Stands Out: We have a proven track record of success, having developed numerous high-performance features and functionalities across various sectors, including finance. Our portfolio demonstrates our ability to deliver complex projects with precision and excellence.

- Leading with Innovation: We don’t just build software; we innovate beyond that. We are known for integrating cutting-edge technologies like AI, blockchain, and IoT to provide functional and forward-thinking solutions that keep our clients ahead of the digital curve.

- Security at Its Core: In fintech, security is paramount. We prioritize robust security protocols, ensuring your software adheres to the latest security measures to protect sensitive data and comply with international regulatory standards.

- Proven Client Success: Our client testimonials speak for our success in maintaining excellence for our clients. They appreciate timely delivery, exceptional performance, and a high-quality software solution.

If you want to transform your payment operations with advanced orchestration technology, our fintech development experts can design, implement, and scale a solution that drives efficiency and business growth. Let’s collaborate to revolutionize your payment infrastructure with a state-of-the-art solution that sets new standards in the financial industry.

FAQs

Q. What is Payment Orchestration?

A. Payment orchestration simplifies all the complexities of multiple payment providers: it centralizes all transactions in one place and automatically processes it. It doesn’t work from a solitary gateway but dynamically routes transactions to the most efficient and cost-effective provider, thereby reducing failures and maximizing approval rates.

Q. How Does Payment Orchestration Work?

A. Payment Orchestration Works in the following steps:

- Transaction Initiation: The process is initiated by a customer selecting a payment method and submitting the required details. If it is on a credit card, digital wallet, or bank transfer, the platform captures the information and is encrypted for secure transmission.

- Smart Routing: Unlike routing a single transaction through the same provider, the platform picks the best-suited PSP according to parameters like the success rate of transactions, amount charged as a fee, compatibility in terms of currencies, and even geolocation. This maximizes approval rates and reduces unnecessary costs.

- Transaction Processing: When routed, it is authenticated and checked for fraud, either 3D Secure or biometric verification. This system crosschecks the transactional data against its risk models and compliance with regulatory standards, such as PCI-DSS.

- Settlement & Reconciliation: Once successfully processed, money is automatically settled between banks, PSPs, and merchants. The platform will also generate real-time reports and insights to enable businesses to monitor revenue, recognize trends, and optimize payment strategies.

Q. What’s the Difference Between a Payment Orchestrator and a Payment Gateway?

A. A payment gateway connects the business to PSPs to process the transaction. On the other hand, a payment orchestrator will optimize and auto-manage the whole payment flow across multiple PSPs for easier efficiency and cost savings.

Q. What is the Payments Orchestration Layer?

A. A Payments Orchestration Layer (POL) is a centralized system that streamlines and optimizes the entire payment process by integrating multiple payment providers, routing transactions intelligently, and enhancing efficiency. It is a strategic middleman, ensuring seamless, cost-effective, and scalable business payment operations.

Q. How Does Payment Orchestration Improve Transaction Success Rates?

A. It keeps the failure of a transaction that comes with downtime, network problems, or declined payments to a minimum by constantly routing transactions to the most reliable and cost-effective payment provider.

Q. What are the components of Payment Orchestration System Architecture?

A. A Payment Orchestration System Architecture refers to a structured framework that typically consists of several interconnected components:

- Integration Layer

- Routing Engine

- Transaction Processing Module

- Fraud and Risk Management Layer

- Analytics and Reporting Engine

- Configuration and Workflow Manager

- Scalability and Resilience Framework

Q. What Are the Cost Factors in Payment Orchestration Platform Development?

A. The overall payment orchestration platform development cost is based on the integrations needed from gateways, security protocols, fraud prevention tools, compliance measures, and AI-driven automation to optimize the process.

Q. Can Payment Orchestration Support Subscription Billing?

A. Yes, it supports businesses in maintaining subscription payments. It automatically provides auto-invoicing, flexible billing cycles, and renewals, thus simplifying subscription management.

Q. How Do I Choose the Right Payment Orchestration Provider?

A. A business should measure provider suitability through global coverage, fraud-prevention ability, integration ease, scalability, and adherence to regulatory standards.

Product Development & Engineering

IT Managed & Outsourcing

Consulting Services

Data Services

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.