Key takeaways:

- Blockchain is a strategic enabler in Dubai, transforming traditional business workflows by enhancing efficiency, transparency, and automation beyond cryptocurrency applications.

- Dubai’s supportive regulatory environment and government initiatives (e.g., VARA, Dubai Blockchain Strategy) create a clear, innovation-friendly framework, accelerating blockchain adoption.

- Integration with legacy systems through modular blockchain solutions enables enterprises to modernize operations without full infrastructure overhaul, reducing friction and operational risk.

- Combining blockchain with AI, IoT, and Big Data unlocks next-level automation and insights, positioning Dubai businesses for scalable, future-proof digital transformation.

Dubai’s strategic commitment to digital innovation is reshaping how businesses operate – placing efficiency, transparency, and automation at the forefront. As part of this transformation, blockchain development in UAE has moved beyond its association with cryptocurrency to become a core enabler of business process optimization.

From smart contracts in real estate to secure, real-time tracking in logistics, blockchain is helping enterprises eliminate inefficiencies, reduce operational friction, and improve data integrity across departments and partners.

For businesses, the question is no longer if blockchain should be considered, but where and how blockchain integration in Dubai can deliver measurable value.

In this article, we explore the tangible benefits of blockchain-driven process optimization, highlight real use cases across industries, and outline a structured path to successful integration. Whether you’re seeking answers on how blockchain is being used to automate business processes in Dubai, aiming to enhance compliance, or looking to build trust through transparency, this article has you covered.

It will help you evaluate blockchain’s role in your operations and guide you on moving from strategy to the implementation of blockchain for business process optimization in Dubai.

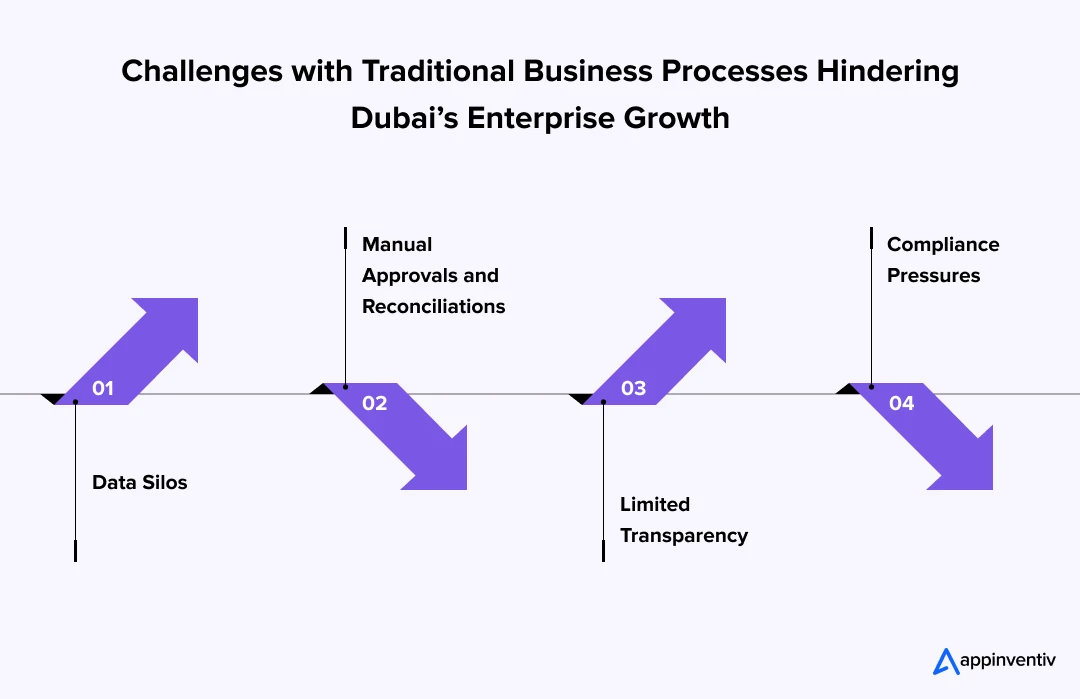

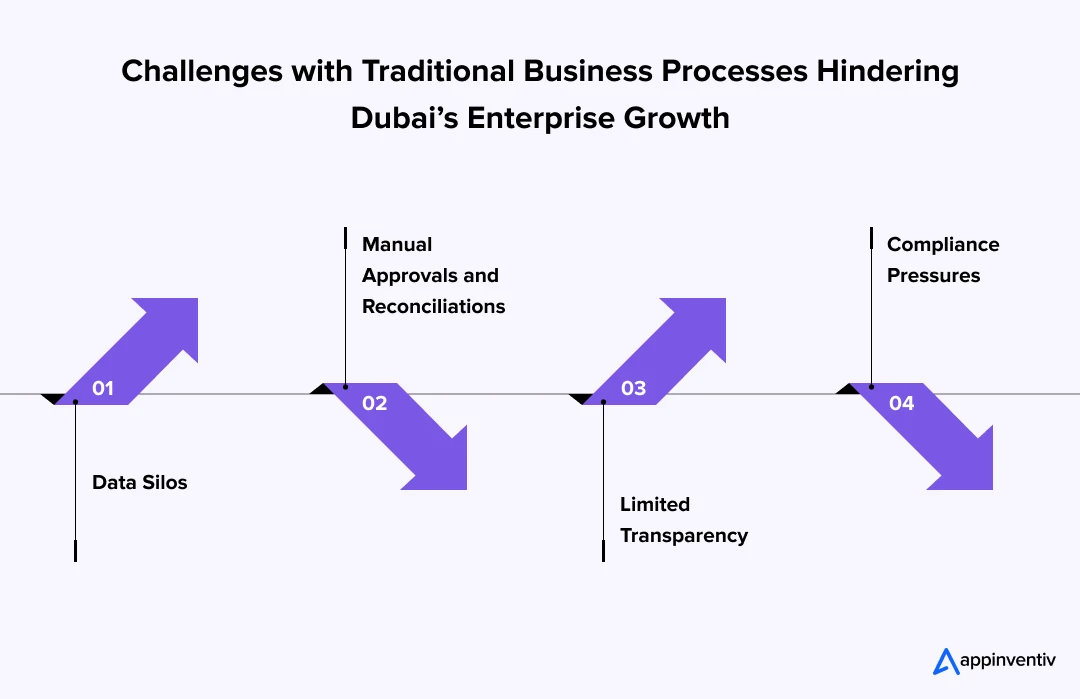

Why Traditional Business Processes Are Holding Dubai Enterprises Back

Despite Dubai’s rapid digital advancement, many enterprises still rely on legacy systems, fragmented workflows, and manual interventions that limit their ability to scale efficiently. In sectors like logistics, real estate, healthcare, and trade – where documentation, compliance, and multi-party coordination are critical – traditional processes are becoming a liability, not a strength. Key challenges include:

- Data Silos: Critical information is often scattered across departments or systems, making it difficult to gain a unified view or act in real time.

- Manual Approvals and Reconciliations: Process delays, human error, and lack of traceability create bottlenecks that slow down decision-making and service delivery.

- Limited Transparency: Whether it’s supply chain tracking or financial audits, lack of real-time visibility erodes trust with partners, regulators, and customers.

- Compliance Pressures: As regulations evolve, businesses are spending more time and resources ensuring adherence – often with outdated tools.

These inefficiencies are no longer just operational concerns, they directly impact competitiveness, customer satisfaction, and long-term sustainability. In an economy that’s becoming increasingly tech-led and performance-driven, optimization is not optional – it’s strategic.

Enterprise blockchain solutions Dubai offer a practical solution, not as a wholesale replacement of systems, but as a layer of trusted automation that connects stakeholders, enforces logic, and reduces administrative overhead – precisely what’s needed to modernize how business gets done in Dubai.

What is Blockchain-Driven Business Process Optimization?

Implementing blockchain in Dubai businesses refers to the strategic use of blockchain technology to streamline, automate, and secure core business workflows across organizational boundaries. Rather than functioning as a standalone system, blockchain acts as a shared, tamper-proof infrastructure that enhances how processes are executed, tracked, and governed.

At its core, blockchain technology integration introduces three transformational capabilities to business operations:

- Decentralized Workflow Execution: With smart contracts, business logic can be coded directly into the blockchain – automating transactions, approvals, or conditions without manual intervention.

- Real-Time, Single Source of Truth: Every participant in a business process can access the same verified data, eliminating redundancy and reconciliation.

- Immutable Auditability: All actions are recorded in a secure, chronological ledger, providing built-in compliance and traceability.

Unlike traditional optimization tools that operate in silos or require middleware to connect systems, blockchain for enterprises in Dubai enables process-level integration across partners, departments, and platforms. This is particularly valuable in Dubai’s ecosystem, where multi-party coordination – across regulators, vendors, and public entities, is often complex and high-stakes.

By embedding trust and automation at the infrastructure level, blockchain UAE empowers organizations to remove friction from their processes, reduce operational risk, and respond faster to business demands.

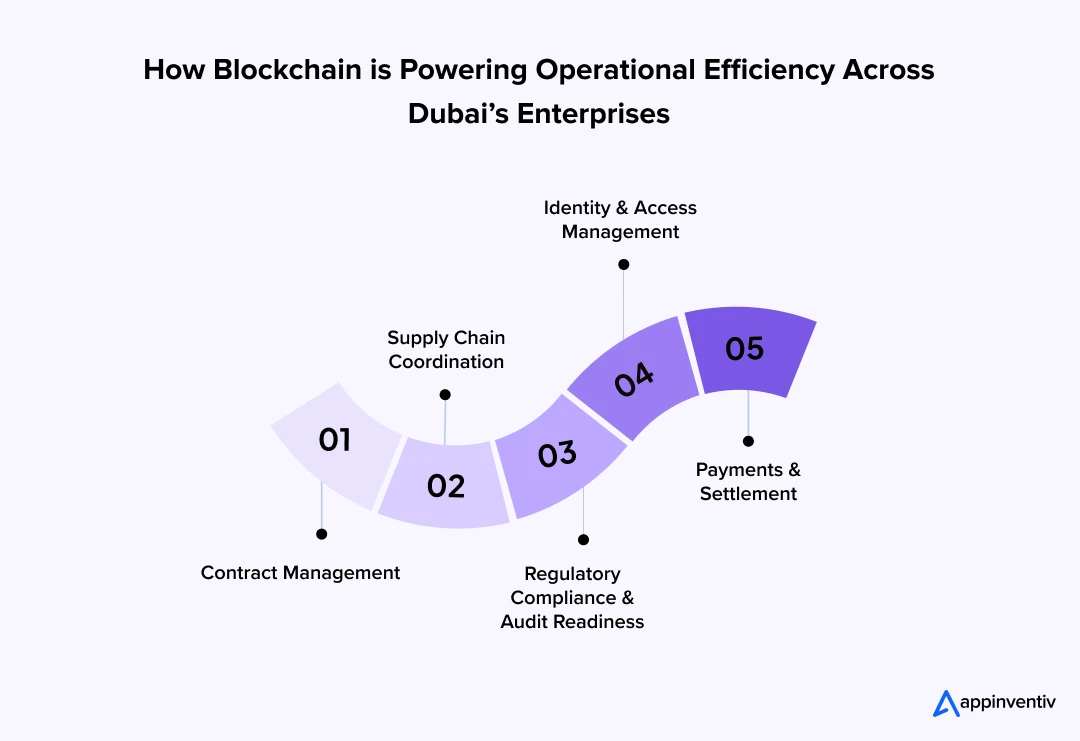

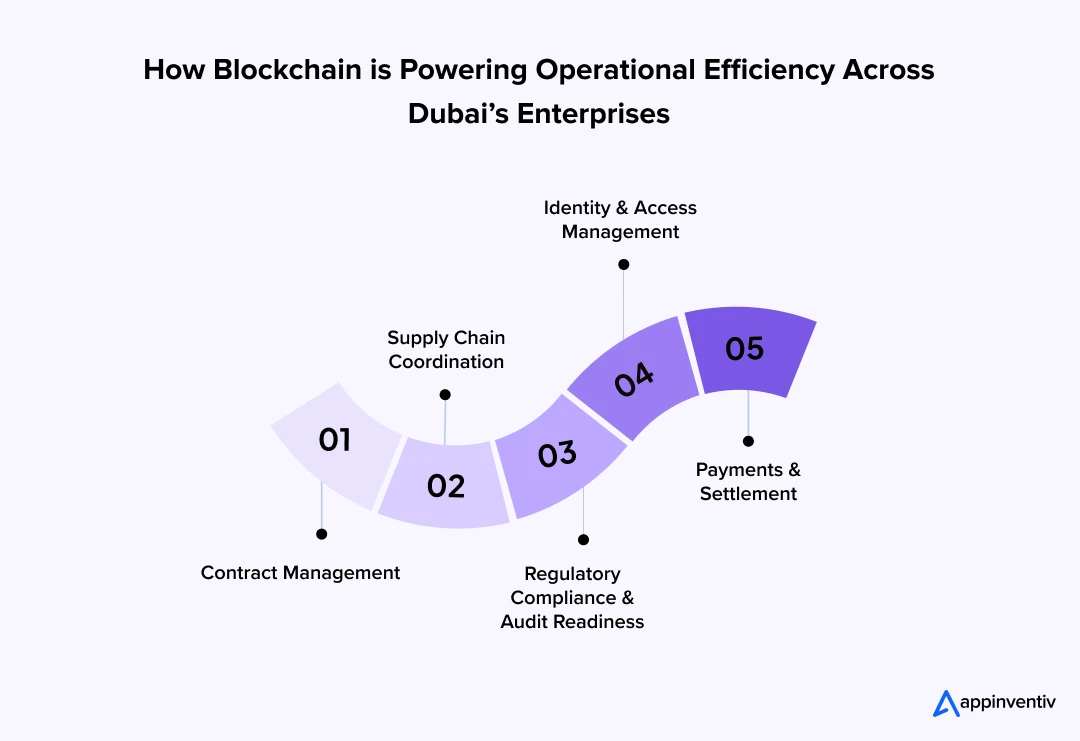

How Dubai is Using Blockchain to Streamline Core Business Processes

Dubai’s approach to blockchain isn’t driven by hype – it is rooted in operational reform. The government’s vision is focused on eliminating friction from business workflows, enhancing trust between stakeholders, and enabling end-to-end digitization across value chains.

These benefits of blockchain integration for Dubai enterprises align directly with the concept of business process optimization – the practice of rethinking and reengineering internal processes to reduce costs, speed up delivery, and improve output quality.

Below, we explore how Dubai is already applying blockchain in this context, offering models for other enterprises to follow.

Contract Management

Contract-based workflows are foundational to industries like real estate, construction, procurement, and legal services. Yet they’re also some of the most time-intensive – prone to version mismatches, unclear terms, and dependency on manual enforcement.

Dubai Land Department (DLD) tackled this by introducing smart contracts in property transactions. Once buyer and seller conditions are met, contracts automatically execute ownership transfer, initiate utility setup, and even trigger payments, without middlemen or paperwork. This not only accelerates deal closures but also reduces compliance risks, miscommunication, and human error.

For enterprise blockchain solutions in Dubai, this means contract lifecycle management systems can be reengineered using blockchain to integrate payment terms, milestones, and digital signatures, all backed by tamper-proof execution records. What used to take weeks now takes hours, bringing speed and certainty to high-value transactions.

Supply Chain Coordination

In logistics-heavy sectors, a single shipment may involve dozens of stakeholders: freight carriers, customs, warehouse partners, insurers, and clients. Traditional systems depend on siloed databases and sequential document flow, which slows operations and inflates costs.

Through the Digital Silk Road initiative, Dubai has begun digitizing trade workflows with blockchain, allowing all participants to access shared, verified documents like bills of lading, certificates of origin, and clearance stamps. The result of implementing blockchain in Dubai businesses – real-time visibility, faster approvals, and dramatically fewer disputes over cargo ownership or delays.

Blockchain supply chain in Dubai creates an immutable audit trail which ensures that the entire process, from shipment dispatch to delivery, is transparent, timestamped, and instantly verifiable. For businesses, this streamlines planning, reduces working capital lock-up, and strengthens trust across the supply chain.

Regulatory Compliance & Audit Readiness

Heavily regulated industries, such as healthcare, BFSI, and aviation, often suffer from bloated audit processes and error-prone compliance documentation. Traditional recordkeeping can’t always ensure tamper-resistance or real-time reporting.

Dubai Health Authority’s use of blockchain to manage medical licensing and credentials is a direct answer to this. Every action, whether a new license issuance, a renewal, or a revocation, is permanently recorded on-chain through blockchain integration in Dubai. This allows instant verification by hospitals, insurance providers, and regulators.

When applied to internal business processes, blockchain for regulatory compliance in UAE enables organizations to embed compliance controls directly into workflows. Imagine financial transactions that auto-check against AML or KYC rules before approval, or HR systems that generate auditable onboarding logs in real time. This shifts compliance from being reactive and manual to proactive and automated, cutting audit timelines and reducing regulatory risk.

Identity & Access Management

Customer and vendor onboarding often introduces delays due to identity verification requirements. Especially in industries like banking or telecom, KYC/AML compliance can stretch onboarding into multi-day processes.

Dubai’s UAE Pass, built on the standards of blockchain business process optimization in Dubai, enables citizens and residents to access government and private sector services using a single digital identity. No repeated paperwork, no redundant verification.

For enterprises in Dubai, blockchain integration enables seamless digital identity management within CRMs, HR tools, and ERP systems—facilitating instant onboarding, secure access provisioning, and streamlined cross-system integrations. This reduces process latency, improves security, and cuts down administrative workloads – especially valuable when scaling or entering new markets.

Payments & Settlement

One of the most impactful blockchain applications lies in finance. Payment processes, especially cross-border or high-volume ones, are typically burdened by intermediaries, reconciliation delays, and exposure to error or fraud.

Emirates NBD launched the Cheque Chain platform to track issued cheques using blockchain, reducing forgery and easing back-end validation. Meanwhile, Commercial Bank of Dubai has been testing blockchain-powered international transfers with reduced failure rates and settlement times.

For CFOs and finance leaders the path to blockchain development in UAE presents a way to process automation within accounts payable/receivable, treasury ops, and reconciliation. Payments can now be embedded within workflows, with programmable logic that ensures accuracy, conditional release, and near-instant settlement, freeing up working capital and strengthening cash flow predictability.

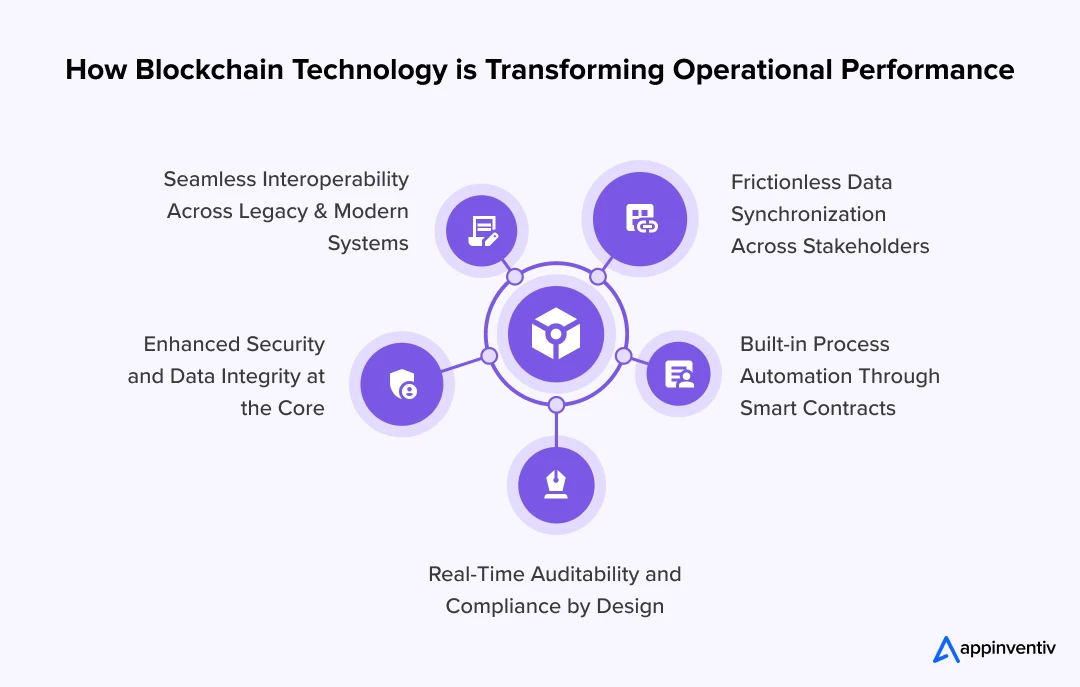

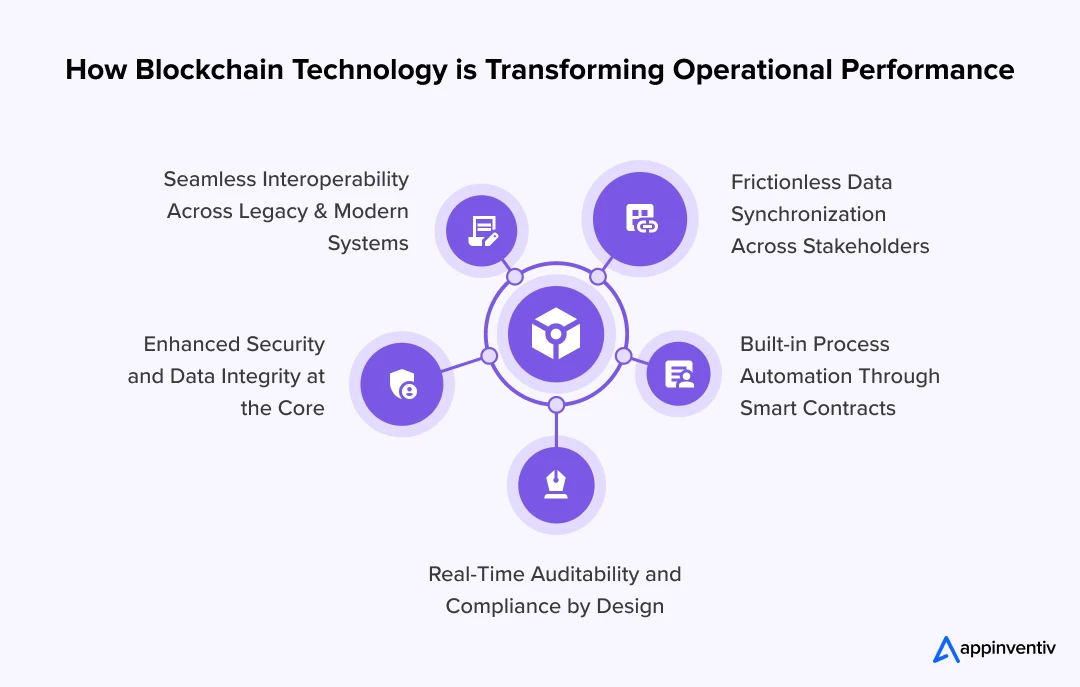

How Blockchain Redefines Operational Efficiency

Blockchain isn’t just a data storage innovation – it’s a framework for redesigning how organizations operate at a systemic level. From reducing friction in multi-party processes to embedding trust in automated transactions, it unlocks performance improvements that traditional IT systems struggle to deliver.

Below are key dimensions where blockchain for enterprises in Dubai fundamentally elevates operational efficiency:

1. Frictionless Data Synchronization Across Stakeholders

In conventional workflows, departments and partner organizations maintain siloed databases. Reconciliation becomes inevitable, introducing delays, discrepancies, and human error. Blockchain flips this model by offering a single source of truth – a shared, tamper-proof ledger accessible in real time by all authorized participants.

This not only accelerates multi-party workflows (e.g., vendor approvals, customs clearance, payment triggers) but also slashes administrative overhead tied to coordination and version control.

Efficiency Gain: Reduced reconciliation time, faster approvals, and minimized data disputes.

2. Built-in Process Automation Through Smart Contracts

Smart contracts are self-executing rules embedded into blockchain networks. They trigger actions when predefined conditions are met – such as releasing a payment once goods are delivered and verified.

This level of blockchain automation in Dubai streamlines repetitive processes like invoicing, milestone validation, payroll, compliance checks, or refund issuance, cutting out the need for manual intervention and boosting throughput.

Efficiency Gain: Less human effort, fewer errors, and faster cycle times.

3. Real-Time Auditability and Compliance by Design

Traditional audit trails are often fragmented and reactive. Blockchain allows real-time, immutable logging of every transaction, decision, or data change within a process, backed by cryptographic proof.

This not only enhances transparency across departments but reduces the time and cost associated with audits, investigations, and regulatory checks. Enterprises can now demonstrate compliance as it happens, not months later.

Efficiency Gain: Instant audit readiness, reduced compliance burden, and lower legal risks.

4. Enhanced Security and Data Integrity at the Core

Cyber threats and internal fraud erode operational efficiency by forcing costly workarounds and layered security protocols. Blockchain addresses this by making data tamper-resistant and traceable by design.

Whether it’s safeguarding customer data, validating product authenticity, or securing financial transactions, blockchain minimizes the likelihood of breaches, thereby preserving business continuity and trust.

Efficiency Gain: Lower security risk exposure, faster recovery, and trusted internal workflows.

5. Seamless Interoperability Across Legacy and Modern Systems

Blockchain doesn’t demand a full system overhaul. With APIs and off-chain integrations, it acts as a process orchestrator, tying together ERP, CRM, SCM, and third-party platforms into unified workflows – especially when dealing with cross-border or cross-entity operations.

This means enterprises can optimize existing tools by layering blockchain for transparency, logic, and automation – rather than replacing core infrastructure.

Efficiency Gain: Improved system compatibility, scalable transformation, and cost-effective modernization.

Blockchain doesn’t just optimize one department – it reshapes the connective tissue of enterprise processes. For Dubai-based companies looking to grow leaner, faster, and more resilient, blockchain isn’t a future investment, it’s an operational imperative.

Converging Blockchain with AI, IoT, and Big Data: The Next Leap for Dubai Enterprises

The true potential of blockchain unfolds when paired with complementary technologies already gaining traction across Dubai. AI enhances smart contract intelligence – making automated workflows not just faster, but also context-aware. IoT feeds real-time, sensor-driven data into blockchain networks, ensuring that process triggers (like shipment arrivals or machine performance) are accurate and immutable. Meanwhile, Big Data tools can analyze blockchain-stored information to uncover operational insights previously hidden in siloed systems.

Together, this convergence is fueling hyper-automated, transparent, and adaptive ecosystems – from autonomous supply chains to predictive maintenance frameworks and real-time trade financing.

For Dubai’s innovation-driven enterprises, combining blockchain with AI, Big Data, and IoT isn’t just digital transformation, it’s competitive evolution.

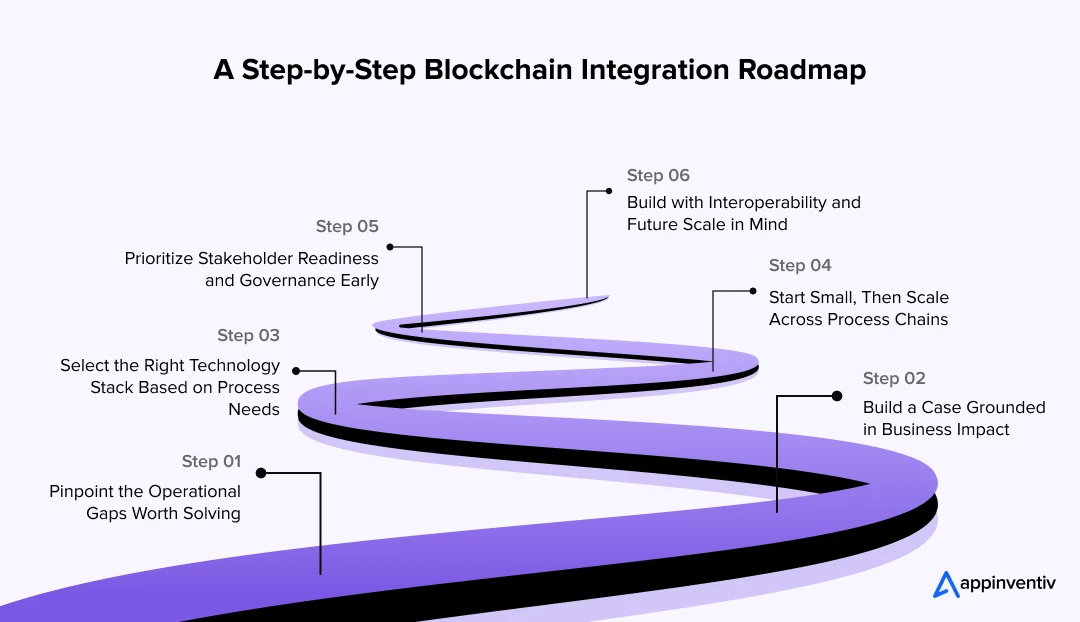

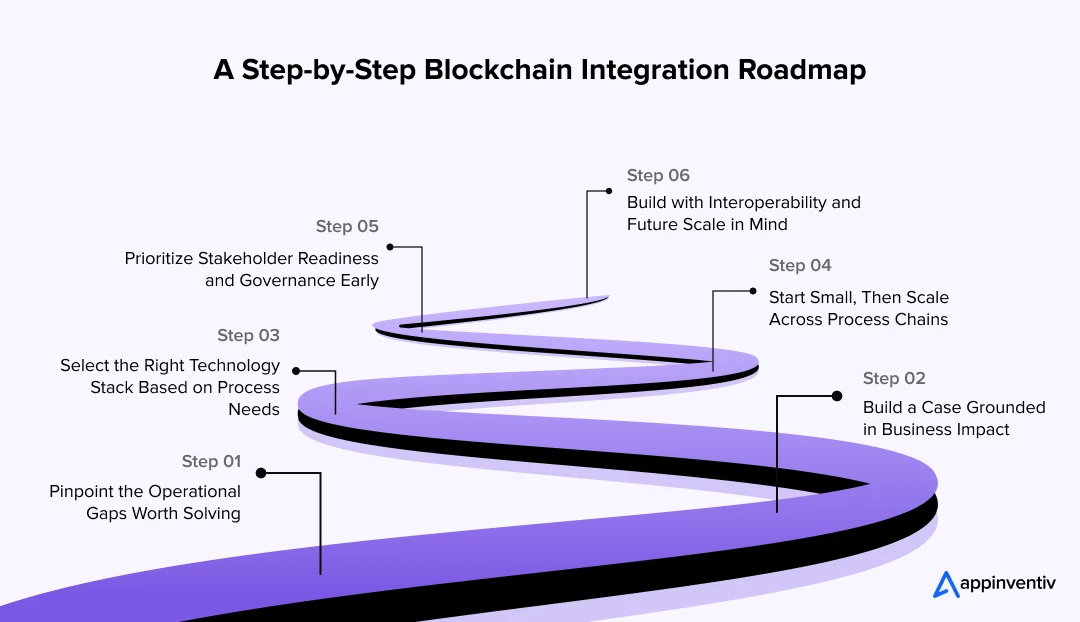

A Roadmap to Blockchain Integration for Business Process Optimization

For enterprises in Dubai aiming to modernize and streamline operations, blockchain presents a strategic opportunity – when implemented with intent and clarity. Here’s how businesses can begin the blockchain implementation without falling into the trap of experimentation without direction.

1. Pinpoint the Operational Gaps Worth Solving

Not every process needs blockchain – but many stand to gain from it. Look for workflows where multiple departments or partners rely on fragmented systems, where trust is low and verification is manual. Common examples include procurement approvals, cross-border shipments, invoice reconciliation, or regulatory submissions.

These friction points not only slow down decision-making but introduce cost and risk. Blockchain becomes valuable when it replaces intermediaries with code and real-time consensus, streamlining execution while reinforcing accountability.

2. Build a Case Grounded in Business Impact

Before writing code or selecting a platform, anchor the initiative in measurable business value. Whether it’s shortening settlement cycles, reducing compliance workload, or eliminating disputes with vendors, define the operational KPIs that matter most.

This clarity ensures that blockchain is integrated as a process enabler, not as a standalone innovation. It also helps align stakeholders, from operations to compliance,around a shared vision for transformation.

3. Select the Right Technology Stack Based on Process Needs

Blockchain adoption shouldn’t begin with a tech-first mindset. The use case should determine whether a permissioned network (like Hyperledger or Corda) is more appropriate than a public one (like Ethereum). Internal workflows often require access control, auditability, and integration with legacy systems – criteria that private blockchains are better equipped to handle.

Enterprises that serve consumers or interact with government-backed registries may consider hybrid models, allowing for selective transparency without compromising process control.

4. Start Small, Then Scale Across Process Chains

Rather than overhauling core systems immediately, the most successful blockchain journeys start with one well-defined process – such as digitizing contract execution or automating a supplier onboarding workflow. With the right integrations in place, businesses can test performance, gather user feedback, and validate outcomes before expanding the approach horizontally.

This phased rollout keeps complexity manageable and allows the organization to grow its blockchain competency alongside its infrastructure.

5. Prioritize Stakeholder Readiness and Governance Early

A process change of this magnitude requires more than technical upgrades, it needs organizational alignment. Blockchain often shifts how trust is distributed, how data flows, and how decisions are enforced. Legal teams must understand smart contract enforceability, finance teams must align with audit implications, and IT must ensure integration with enterprise systems.

In Dubai, where blockchain adoption is encouraged but still maturing, clear governance models and compliance checkpoints can make or break implementation.

6. Build with Interoperability and Future Scale in Mind

Processes evolve, partners change, and regulations shift. Blockchain systems should be designed with these realities in mind. Avoid rigid, one-off builds. Instead, use open protocols, flexible APIs, and modular smart contracts that can grow with the business.

Whether it’s connecting a supplier network across borders or aligning with a city-wide digital identity initiative, future-ready blockchain solutions will be the ones that adapt, not just deliver in version 1.0.

Blockchain’s potential for BPO lies in how precisely it’s applied – not how loudly it’s marketed. With Dubai’s regulatory support and infrastructure readiness, the path to process optimization is wide open. What’s needed is a structured, outcome-aligned roadmap – and the right partner to bring it to life.

Why Now is the Time to Act in Dubai

Dubai is no longer just exploring blockchain; it’s operationalizing it. What once began as a futuristic goal has now turned into structured execution of blockchain in UAE government across public services, financial systems, and enterprise workflows. This shift is backed by robust government strategies, regulatory clarity, and private sector participation – making now the inflection point for blockchain integration aimed at real business process optimization.

Government is Setting the Pace and the Direction

In 2017, Dubai launched the Dubai Blockchain Strategy, spearheaded by Digital Dubai and the Dubai Future Foundation, with the ambition to become the world’s first city fully powered by blockchain. The strategy focuses on enhancing government efficiency, enabling new industry verticals, and establishing international thought leadership. Today, those goals are being actively realized.

A recent example of blockchain use cases in the Dubai government can be seen in how Dubai’s Department of Finance is collaborating with Crypto.com to enable cryptocurrency payments for government services – a significant step toward the city’s goal of achieving 90% cashless transactions by 2026.

These aren’t isolated moves, they are ecosystem-level signals that the government is not just supportive but proactively building the infrastructure blockchain needs to thrive.

Also Read: Benefits of Blockchain for Government Services

A Regulatory Framework That Encourages (Not Hinders) Innovation

Unlike many global regions still caught in legal gray zones, Dubai has established a clear and flexible framework through the Virtual Assets Regulatory Authority (VARA). This body governs all virtual asset activities in the emirate, instilling trust and reducing risk for both startups and enterprises. Seeing the blockchain adoption in Dubai industries, there’s no surprise that over 700 blockchain and Web3 firms have set up operations in Dubai as of 2025.

This growing maturity has been further solidified by the UAE’s removal from the Financial Action Task Force (FATF) gray list in 2024 – an international endorsement of the country’s compliance, risk controls, and transparency.

Private Enterprises are no Longer Waiting

The private sector isn’t sitting on the sidelines either. Dubai-based DAMAC Group, for instance, recently announced a partnership with MANTRA to tokenize $1 billion worth of real estate assets, enabling faster transactions, better liquidity, and streamlined compliance through blockchain.

In parallel, Tether’s introduction of a dirham-pegged stablecoin is opening new doors for secure, real-time settlements in cross-border trade and fintech – an essential building block for financial processes and blockchain automation Dubai.

These aren’t just tech plays – these are the foundation for blockchain digital transformation UAE that directly impacts core business processes like settlement cycles, asset transfers, KYC, and reporting.

Tax Incentives, Talent Pools, and Global Visibility

From a business standpoint, Dubai also offers zero personal income tax, Free Zone exemptions, and streamlined licensing – factors that lower entry barriers and accelerate ROI. Combined with its appeal as a global innovation hub, it’s no surprise that blockchain startups and multinational tech firms alike are relocating operations here.

With public and private sectors aligned, infrastructure in place, and regulatory certainty achieved, Dubai has moved from possibility to readiness. For businesses aiming to optimize processes – from contract execution to cross-border payments and compliance – this is the moment to act, not observe.

How Appinventiv Can Help You Build a Blockchain-Optimized Business Process

At Appinventiv, we don’t just offer blockchain development services – we re-engineer your processes to unlock measurable business outcomes.

Whether you’re looking to accelerate settlements, automate compliance, or create audit-proof workflows, our approach begins with aligning blockchain capabilities with your business model. We deep-dive into your current operations, identify bottlenecks, and design decentralized workflows that are scalable, secure, and enterprise-ready – all in line with Dubai’s blockchain technology integration standards.

Our Process Includes:

- Blockchain Feasibility & Opportunity Mapping

As part of our blockchain consulting Dubai offering, we assess where blockchain genuinely adds value across your operations – from contract workflows and KYC processes to reporting and reconciliation.

- Custom Architecture & Platform Selection

Based on your use case and data sensitivity, we recommend the right tech stack – Ethereum, Hyperledger, Polygon, or private chains, ensuring cost-efficiency and speed-to-market.

- Modular, Scalable Development

We build smart contracts, token frameworks, and interoperable ledgers that seamlessly plug into your ERP, CRM, and legacy systems – no rip-and-replace required.

- Security, Governance & Regulatory Compliance

Every line of code is audit-friendly and at par with the blockchain security Dubai standards. We ensure GDPR, FATF, and VARA compliance, so your solution is ready for real-world deployment in Dubai and beyond.

- Post-Launch Support & Performance Monitoring

Blockchain for process optimization isn’t a one-time integration. We help you scale, optimize, and keep up with regulatory or protocol changes.

Trusted Blockchain Expertise with Cross-Industry Depth

At Appinventiv, we’ve architected enterprise-grade blockchain solutions that go beyond PoCs – building real, scalable products used by global audiences. While our flagship blockchain case studies aren’t MENA-specific, they showcase the kind of strategic thinking, technical depth, and platform experience we bring to every engagement.

Nova – A blockchain-powered education platform enabling secure, on-chain credential verification and transparent student lifecycle management.

Empire App – A hospitality ecosystem that leverages blockchain to ensure secure bookings, loyalty transactions, and vendor reconciliation.

Avatus – A decentralized social networking platform built around user-controlled identities and tokenized engagement mechanics.

These platforms demonstrate our ability to integrate smart contracts, build custom token economies, ensure regulatory compliance, and scale decentralized systems – capabilities that align directly with Dubai’s vision for blockchain-optimized government and enterprise operations.

FAQs

Q. How can blockchain integration streamline supply chain and trade processes for Dubai-based enterprises?

A. Blockchain supply chain in Dubai enables real-time, tamper-proof visibility across the process – from raw material sourcing to last-mile delivery. For Dubai-based enterprises, this means faster customs clearance (via smart contracts), reduced fraud in cross-border trade, and improved coordination between logistics providers, suppliers, and regulators. Platforms like Dubai Trade and Digital Silk Road already exemplify this transformation by offering blockchain-based documentation and transaction tracking.

Q. What are the main security and compliance benefits of blockchain for large organizations in Dubai?

A. Blockchain integration in Dubai offers immutable audit trails, cryptographic data protection, and role-based access – significantly strengthening enterprise data governance. In regulated sectors like finance, real estate, and healthcare, this ensures that all transactions are verifiable and compliant with local laws. Dubai’s alignment with global AML and KYC standards, combined with support from VARA, enables secure blockchain deployments with built-in regulatory confidence.

Q. Which business processes are most impacted by blockchain integration in Dubai?

A. Processes involving high friction, multiple intermediaries, or regulatory oversight benefit the most from blockchain business process optimization Dubai. These include:

- Contract management (via smart contracts in real estate and procurement)

- Payment settlements (through tokenization and stablecoins)

- Identity verification and KYC (for finance, healthcare, and government onboarding)

- Regulatory reporting (with real-time compliance logs)

- Supply chain tracking (especially in pharma, luxury, and food sectors)

Dubai-based firms are actively optimizing these functions with blockchain technology integration to reduce delays, costs, and errors.

Q. What steps should an enterprise take before integrating blockchain into legacy systems?

A. Enterprise blockchain solutions in Dubai should be built on these considerations:

- Identify friction- heavy processes where trust, transparency, or traceability are critical.

- Assess blockchain fit – not every use case needs decentralization.

- Define integration goals, such as faster settlements, fraud reduction, or real-time compliance.

- Choose the right tech stack – public vs. private chain, interoperability needs, and smart contract platforms.

- Engage with regulatory bodies to ensure compliance with VARA and other UAE frameworks.

- Pilot with modular architecture to avoid disrupting core systems during the transition.

Q. How does Dubai’s regulatory environment support blockchain adoption for enterprises?

A. Implementing blockchain in Dubai businesses is one of the most progressively charged ventures. The Virtual Assets Regulatory Authority (VARA) offers a licensing and compliance framework that promotes innovation while mitigating risk. Combined with the Dubai Blockchain Strategy, initiatives like Digital Dubai and free zone incentives give enterprises the legal clarity and support needed to deploy blockchain at scale – particularly in finance, supply chain, and digital identity.

Q. What are the challenges of implementing blockchain in Dubai businesses?

A. Dubai’s ecosystem is blockchain-ready, but businesses still face hurdles like integrating with legacy systems, navigating evolving regulations, and sourcing skilled talent. High upfront costs and aligning stakeholders across departments can also slow adoption. However, with the right strategy and tech partner, these challenges are manageable, especially in a region actively pushing blockchain innovation.

IT Managed & Outsourcing

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.