As businesses increasingly embrace digital payment wallets to streamline financial transactions and boost user satisfaction, one burning question often arises: how much will this cost? While digital wallets like Wero promise speed, security, and convenience, building one isn’t simple.

In Europe, the cost of developing a robust digital payment wallet app typically ranges from $40,000 to $300,000 (approximately €37,000 to €280,000) depending on the complexity and scale of features.

Whether you’re a startup dreaming of disrupting the payment game or an established enterprise aiming to enhance your financial interface, understanding these costs is crucial.

Let’s unravel the mystery behind the cost to develop a digital wallet app like Wero in Europe and explore what it takes to bring a sleek, secure, and seamless digital wallet to life.

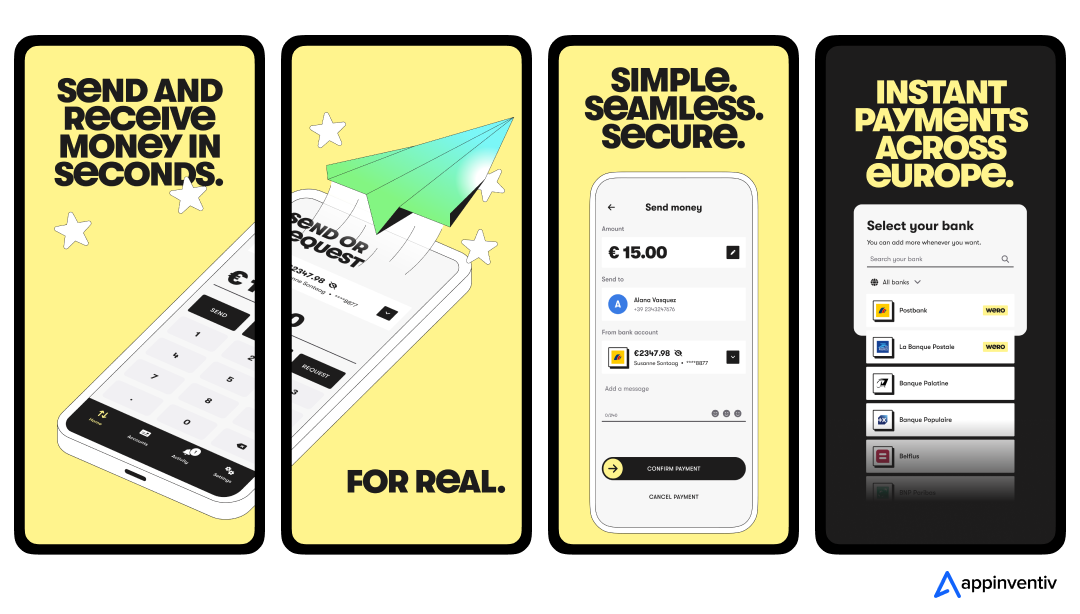

Wero: An Overview of the Digital Payment Wallet App

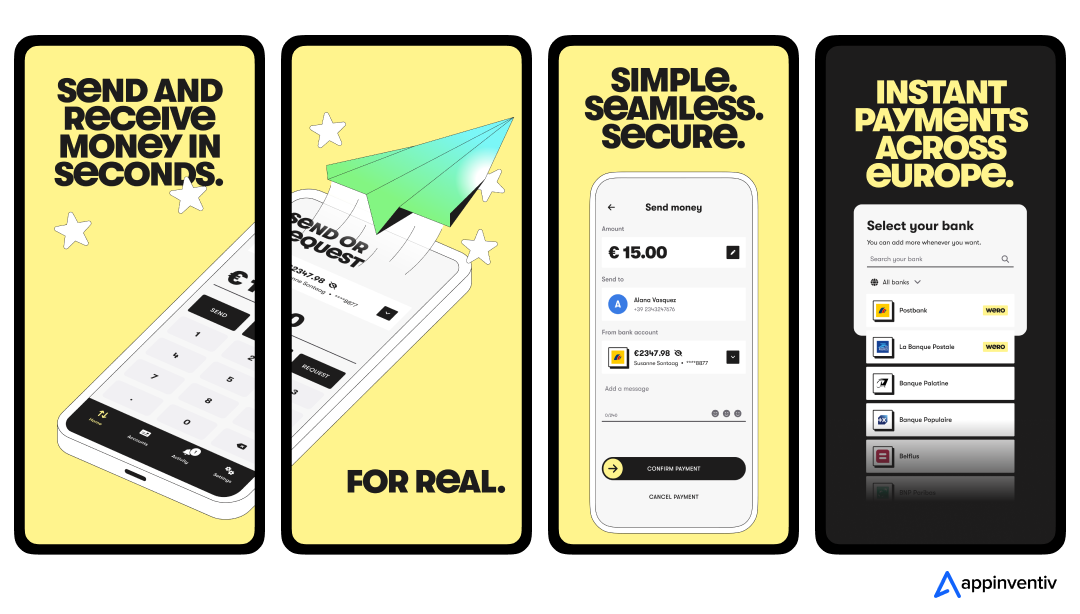

Wero, the digital payment wallet developed by the European Payments Initiative (EPI), is set to transform digital transactions across Europe with an innovative, fast, and secure solution. This digital wallet app development helps meet the growing demand for instant and accessible payments; Wero allows users to send and receive money instantly using a phone number or email address, thanks to its account-to-account transfer technology.

In France, Wero ensures a smooth transition from Paylib, where 35 million users will seamlessly migrate before Paylib’s planned discontinuation in 2025. The platform aims to offer more than basic transfers, introducing features like QR code payments, spend-sharing tools, and integration with e-commerce.

How Much Does It Cost To Develop an App Like Wero

Let’s explore the cost to develop a digital wallet app like Wero in Europe that ensures secure and seamless transactions.

The development cost can vary depending on features like multi-currency support, advanced security, and user-friendly interfaces. Typically, the price ranges between $40,000 to $300,000 (approximately €37,000 to €280,000), influenced by app complexity and development team expertise.

| App Complexity Levels |

Features |

Duration |

| Basic

($40,000 to $60,000) |

1. Simple UI

2. Basic Navigation

3. Limited Functionality

4. Standard Security Measures

5. Basic Database Integration

6. Essential Push Notifications

7. Single Platform Compatibility (iOS or Android) |

2 to 4 months |

| Moderate

($60,000 to $120,000) |

1. Enhanced UI

2. Improved Navigation Experience

3. Expanded Functionality

4. Enhanced Security Features

5. Integration with External APIs

6. Basic Offline Functionality

7. Cross-Platform Compatibility

8. Social Media Integration |

4 to 6 months |

| Complex

($120,000 to $300,000) |

1. Highly Polished UI/UX Design

2. Advanced Navigation Features

3. Rich Functionality with Custom Features

4. Robust Security Protocols

5. Seamless Third-party Integrations

6. Advanced Offline Capabilities

7. Real-time Updates

8. Advanced Analytics and Reporting

9. Multi-language Support

10. Cross-Device Compatibility |

6 to 9 months |

A Simple Formula to Estimate the Cost of Building a Digital Payment Wallet App Like Wero in Europe

To estimate the cost to develop a digital wallet app like Wero in Europe, consider two key factors: the total development hours needed and the hourly rates of the development team. A simple formula combining these variables can give you an idea of the overall app development cost.

| Total Cost = Development Hours × Hourly Rate |

For example, developing a digital payment wallet app like Wero in Europe with moderately complex features might require 1,200 development hours at an hourly rate of $50, resulting in a total cost of $60,000.

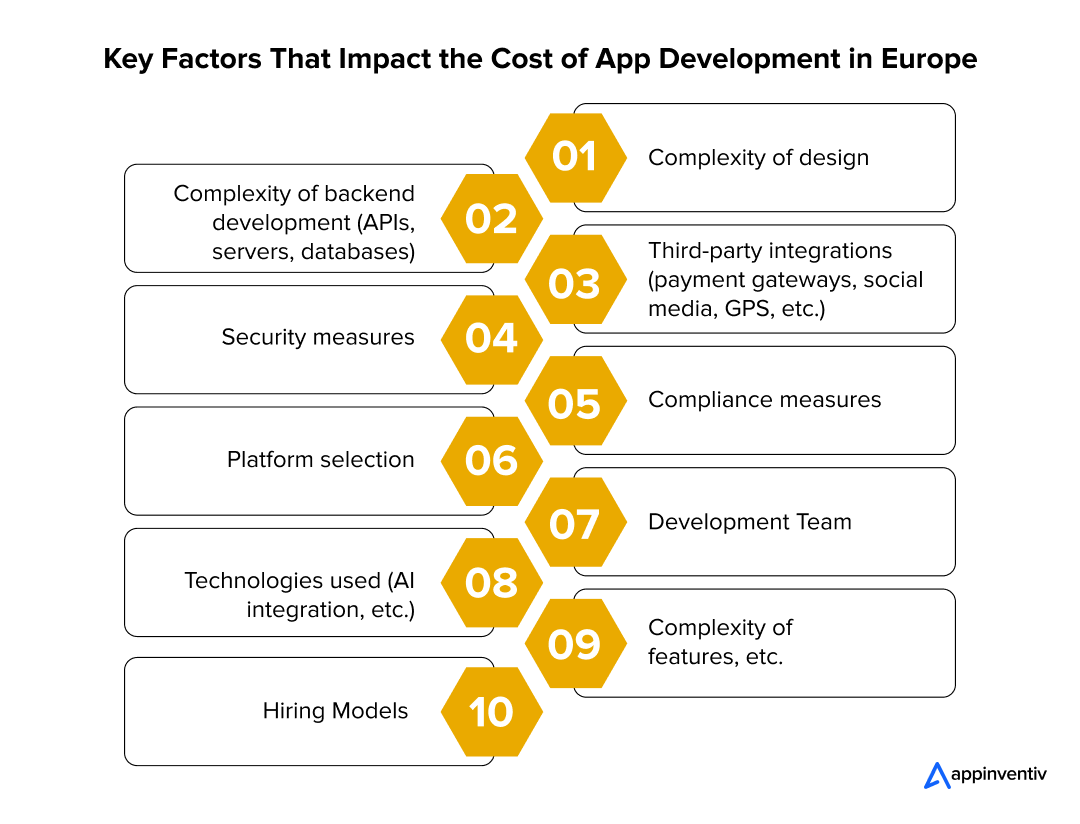

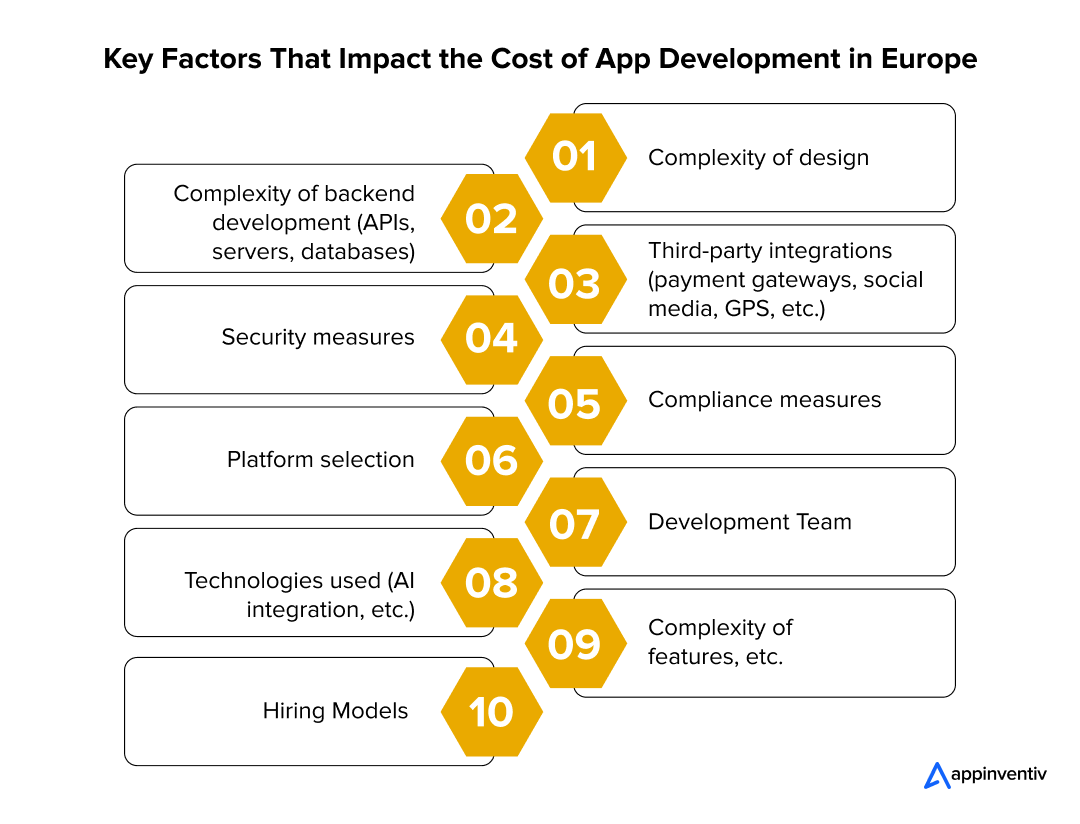

Significant Factors that Influence the Cost of Wero in Europe

Here are some valuable factors to consider: the complexity of features, the technology stack, the development team’s expertise, compliance with regional regulations, and more. Each of these elements plays a crucial role in determining the overall cost.

Complexity of Design

A digital payment wallet’s user interface (UI) and user experience (UX) design must be seamless, engaging, and intuitive. Designing such an app requires intricate planning to accommodate ease of navigation, multiple functionalities, and a visually appealing interface.

When considering digital wallet app development cost factors, remember that the more sophisticated and customized the design, the higher the cost to build a payment wallet app like Wero in Europe.

Cost Comparison Based on Design Complexity

| Design Complexity |

Estimated Cost |

| Basic UI/UX Design |

$6,000 – $30,000 |

| Custom/Advanced UI/UX Design |

$30,000 – $50,000+ |

Backend Development Complexity

A robust backend is crucial for handling transactions, managing user data, and ensuring smooth app operations. This involves setting up secure servers, APIs for payment processing, and efficient database management systems. The complexity increases with the number of users, transaction volume, and additional services like analytics, influencing the cost to build a digital wallet app like Wero in Europe.

Third-Party Integrations

Integration with third-party tools is essential for key features like payment processing, real-time notifications, and social media logins. Payment gateways (e.g., PayPal, Stripe), GPS services for location-based payments, and external APIs add to the cost to build a digital payment wallet app like Wero in Europe. Each integration requires compatibility testing and secure implementation to ensure functionality.

Cost Comparison Based on Third-Party Integrations

| Third-Party Integration |

Estimated Cost |

| Basic Integration (Single Payment Gateway) |

$2,000 – $10,000 |

| Complex Integration (GPS, Multiple APIs, Real-Time Analytics) |

$5,000 – $15,000+ |

Security Measures

Ensuring user trust and safety is non-negotiable for a digital wallet app. This includes implementing SSL encryption, biometric authentication, and advanced fraud detection systems. Developing these security layers to comply with European standards significantly adds to the cost to build a digital payment wallet app like Wero in Europe. Still, it is critical to the app’s success.

Cost Comparison Based on Security Measures

| Security |

Estimated Cost |

| Basic Security Measures (SSL, Data Encryption) |

$5,000 – $8,000 |

| Advanced (Biometrics, Multi-Factor Authentication, Encryption) |

$15,000 – $100,000+ |

Compliance Measures

Digital wallet apps in Europe must adhere to regulations like GDPR (for data protection) and PSD2 (for payment security). Compliance involves implementing consent management, secure APIs, and multi-factor authentication. Adapting the app to meet these legal standards requires time, effort, and specialized expertise. This approach enhances the cost to build a digital payment wallet app like Wero in Europe.

Platform Selection

The decision to develop the app for iOS, Android, or both platforms greatly affects the cost. Native apps offer better performance and user experience but are costlier to create than hybrid or cross-platform apps. Each platform has design guidelines and coding requirements, adding to the expense.

Cost Comparison Based on Platform Choice

| Platform |

Estimated Cost |

| Single Platform (iOS or Android) |

$30,000 – $100,000 |

| Cross-Platform (iOS and Android) |

$100,000 – $300,000+ |

Development Team

The cost to build a digital payment wallet app like Wero in Europe varies depending on whether you hire a local development team, outsource globally, or use freelance developers. A local European team offers better alignment with regulations and user preferences but is more expensive. Outsourcing to cost-effective regions can reduce costs but may require additional effort in managing timelines and communication.

| App Development Team |

Hourly Rates (Approx) |

| Project Manager |

$25 to $30 |

| Tech Lead (Backend / Frontend) |

$28 to $30 |

| Sr. Mobile App Developer |

$25 to $30 |

| Sr. Web & Backend Developer |

$24 to $30 |

| DevOps |

$25 to $30 |

| Business Analyst |

$20 to $25 |

| UX/UI |

$20 to $25 |

| QA |

$20 to $25 |

Technologies Used

Incorporating advanced technologies like AI, blockchain, or machine learning enhances the app’s functionality but increases digital payment app development cost in Europe. For example, AI can be used for fraud detection and personalized financial insights, while blockchain ensures secure and transparent transactions. The choice of technology depends on your budget and app requirements, fluctuate the cost to develop a digital wallet app like Wero in Europe.

| Tech Stack |

Cost Estimation |

| Basic Tech Stack (React Native, Flutter, PHP) |

$50,000 – $120,000 |

| Advanced Tech Stack (Python, AI, Blockchain) |

$120,000 – $250,000+ |

Feature Complexity

The cost rises with the addition of advanced features like peer-to-peer payments, multi-currency wallets, transaction categorization, and budgeting tools. Each feature requires unique design and development efforts, especially if tailored for a specific user base. Ensuring these features work seamlessly together adds to the cost to build a digital payment wallet app like Wero in Europe.

Cost Comparison Based on Features

| Feature |

Estimated Cost |

| Basic Features (Account setup, Secure logins, balance tracking) |

$30,000–$50,000 |

| Advanced Features (AI investment advice, real-time analytics) |

$100,000–$200,000 |

Hiring Model

Your hiring approach significantly influences costs and development speed. Building an in-house team ensures full control but incurs higher cost to build a digital payment wallet app like Wero in Europe. Outsourcing to a dedicated app development team or freelancers offers flexibility and cost-effectiveness but requires careful selection to maintain quality.

| Hiring Models |

Key Points |

Advantages |

Challenges |

| In-house Team |

Ideal for businesses needing full control over development. |

Direct supervision, tailored expertise. |

High upfront and ongoing costs. |

| Freelancers |

Best for small-scale or specific development tasks. |

Affordable, flexible hiring. |

Risk of delays and inconsistent quality. |

| Outsourcing |

Suitable for end-to-end app development with diverse expertise |

Scalability, reliable quality. |

Higher cost compared to freelancers. |

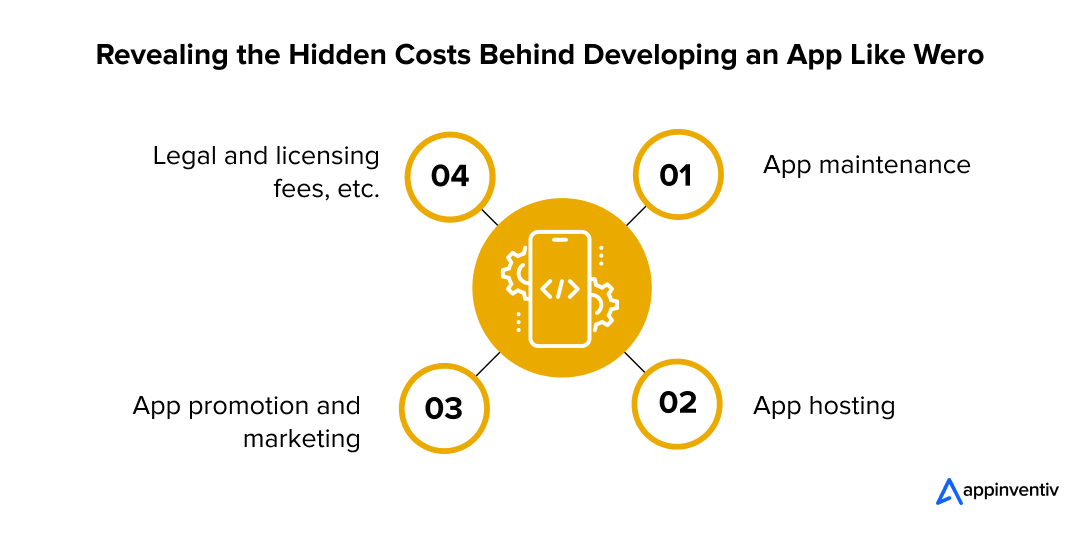

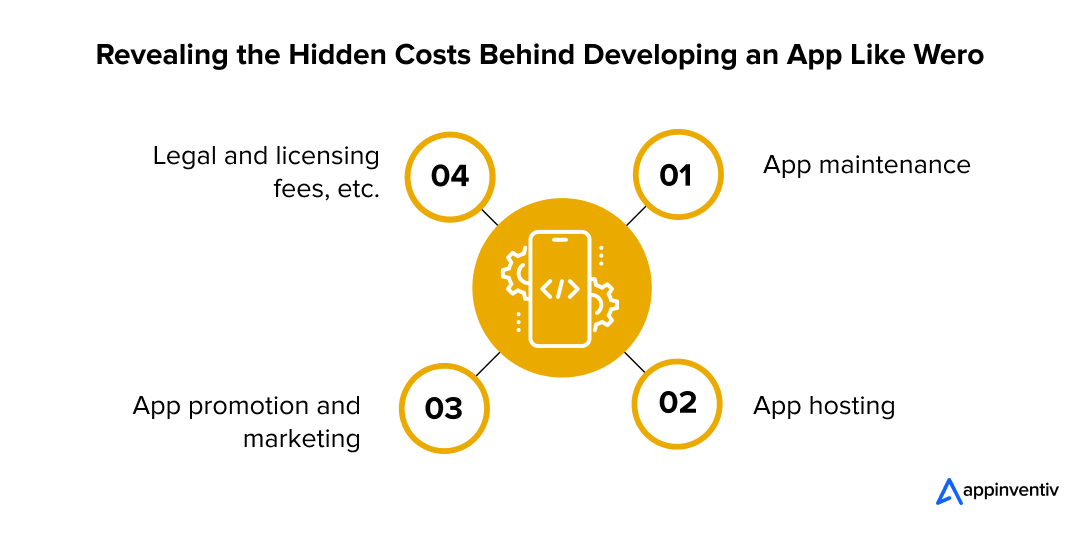

What are The Hidden App Development costs like Wero

Unexpected expenses often arise in app development, including charges for third-party services, ongoing maintenance, and regulatory compliance. These hidden costs can influence your total investment. Let’s delve into these overlooked digital wallet app development cost factors.

App Maintenance

App maintenance is not a one-time task but an ongoing process. It includes regular updates to add new features, fix bugs, and adapt to OS changes. Maintaining security protocols and ensuring smooth functionality are essential to satisfy and engage users. Ignoring maintenance can lead to glitches and a decline in user trust by influencing the cost to develop a digital wallet app like Wero in Europe.

Action Points:

- Schedule regular updates to incorporate new features, fix bugs, and stay compatible with the latest OS versions, saving cost to build a digital payment wallet app like Wero in Europe.

- Monitor app performance consistently to detect and resolve issues proactively.

- Allocate resources for ongoing security enhancements to protect user data.

- Create a feedback loop to address user concerns and improve satisfaction.

App Hosting

Hosting your app’s backend services, databases, and servers is a continuous expense. The costs depend on the app’s scale, traffic, and the level of performance required. For digital payment apps, high reliability is critical, which means investing in robust hosting solutions to prevent downtime or data breaches.

Action Points for App Hosting

- Choose a hosting solution that ensures scalability to handle growing traffic and user demands.

- Invest in high-reliability servers to minimize downtime and ensure smooth transactions.

- Implement robust data protection measures to safeguard sensitive information.

- Regularly review hosting expenses to optimize costs without compromising performance.

App Promotion and Marketing

Marketing is essential to attract users and establish your app in a competitive market. Expenses include social media advertising, influencer collaborations, referral programs, and app store optimization. Consistent promotion helps acquire users and build brand visibility and loyalty.

Action Points:

- Develop a comprehensive marketing plan, including social media, influencer partnerships, and referral programs.

- Use App Store Optimization (ASO) strategies to improve discoverability when you make an app like Wero.

- Track user acquisition metrics to assess the effectiveness of marketing efforts.

- Allocate a budget for consistent promotional activities to maintain brand visibility.

Legal and Licensing Fees

Digital payment apps must adhere to financial regulations and obtain various operating licenses. Costs can include consultations with legal experts, certification fees, data protection, and compliance with financial standards. Skipping these steps can result in hefty penalties and operational restrictions, influencing the cost to develop a digital wallet app like Wero in Europe.

Action Points:

- Research and comply with all regional and international financial regulations.

- Work with legal experts to obtain the necessary certifications and licenses.

- Ensure regular audits to maintain compliance with data protection standards.

- Factor legal and licensing fees into the overall budget to avoid unexpected costs.

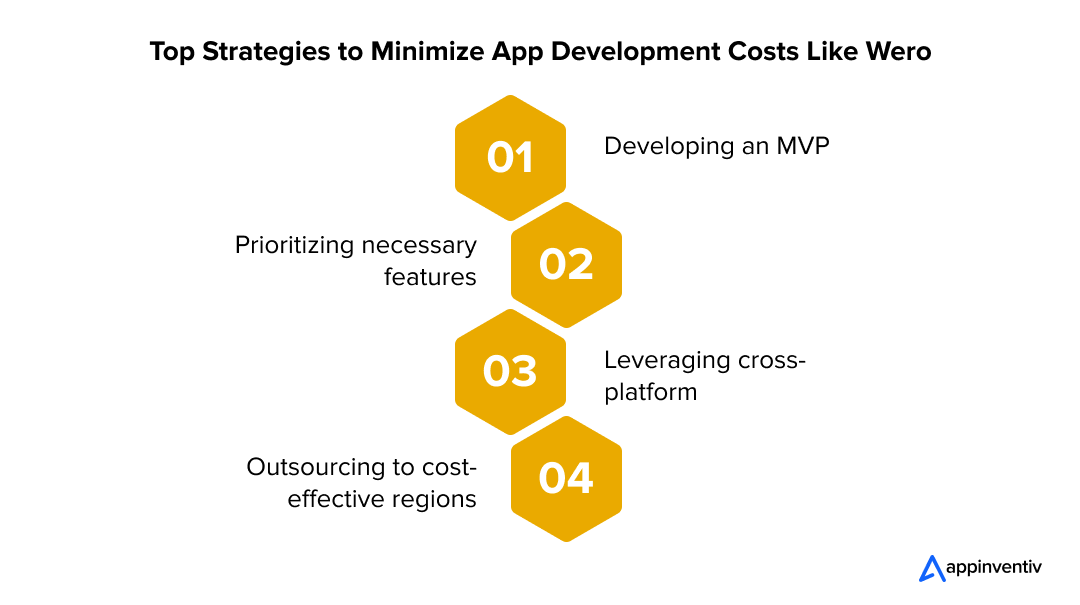

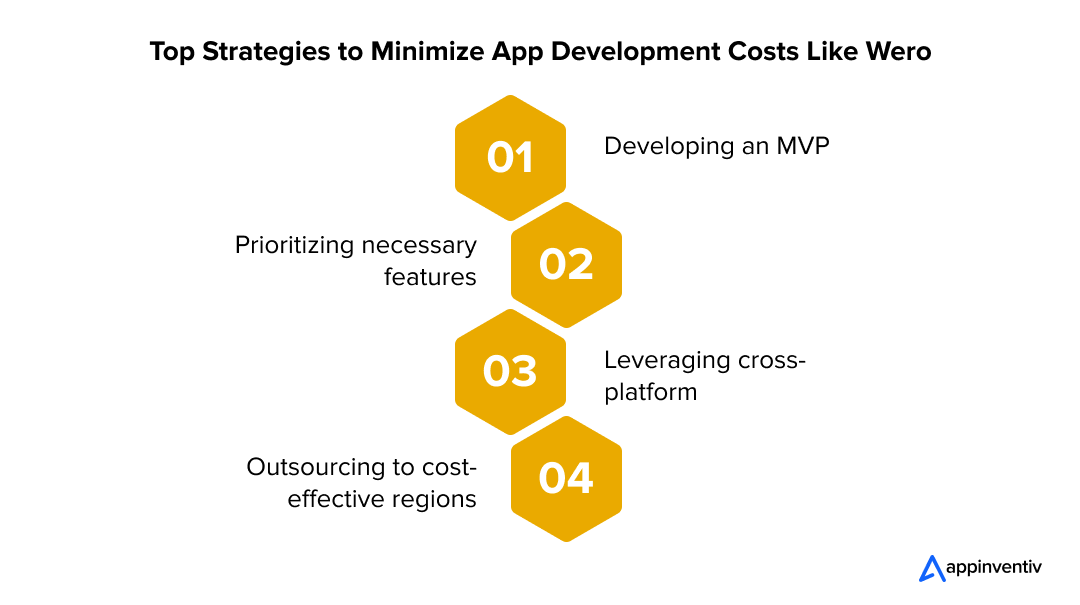

Best Practices to Optimize the App Development Costs Like Wero

Here are some strategies to help businesses manage and reduce app development expenses effectively: focus on streamlining processes, make informed decisions at every stage, and leverage the right resources. These approaches ensure cost-efficiency while maintaining the app’s quality and performance.

Developing an MVP

Starting with an MVP (Minimum Viable Product) helps you test the app’s core functionalities, such as secure payments and user authentication, without overinvesting. This approach allows gathering real-world feedback from early adopters to refine and enhance the app. It also minimizes time-to-market, ensuring you can respond to user needs quickly.

Quick Tips:

- Start with only the core functionalities to save mobile wallet app development cost in Europe.

- Collect real-world feedback from early users to refine the product.

- Prioritize speed to market when you make an app like Wero to meet user needs and maintain a competitive edge quickly.

- Use MVP insights to make informed decisions before scaling up and saving mobile wallet app development cost in Europe.

Prioritizing Necessary Features

Instead of overwhelming users with unnecessary functionalities, focus on essential features like seamless transactions, secure encryption, and intuitive navigation. Prioritize features that solve specific user pain points, such as quick money transfers or rewards management. Gradually add advanced capabilities based on user feedback and demand.

Quick Tips:

- When planning e-wallet app development costs in Europe, focus on features that address key user pain points first.

- Implement essential elements like secure payments and smooth navigation.

- Continuously gather feedback to refine and optimize functionalities.

- Roll out advanced features in stages based on user demand and interactions in order to build a digital wallet app like Wero.

Leveraging Cross-Platform Development

To maximize reach and minimize development costs, adopt cross-platform frameworks like Flutter or React Native. These frameworks allow you to develop apps for Android and iOS simultaneously, ensuring consistent user experiences across devices. This strategy speeds up development and simplifies updates and maintenance.

Quick Tips:

- Choose cross-platform frameworks to build for Android and iOS at once.

- Ensure a consistent user experience across all devices with a unified design.

- Save time and money with streamlined updates and easy maintenance.

- Utilize community support and documentation to accelerate development. This approach saves cost to build a digital payment wallet app like Wero in Europe.

Outsourcing to Cost-Effective Regions

Partnering with experienced development teams in cost-effective regions can significantly reduce development expenses without compromising quality. Regions like India or Eastern Europe offer access to skilled professionals at competitive rates. Outsourcing also brings expertise in the latest fintech trends and technologies, accelerating your app’s development.

Quick Tips:

- Partner with experienced teams in regions like India or Eastern Europe to minimize e-wallet app development cost in Europe.

- Ensure quality by working with professionals who understand fintech trends.

- Accelerate development timelines with agile teams that adapt quickly.

- Maximize cost efficiency without compromising expertise or deliverables.

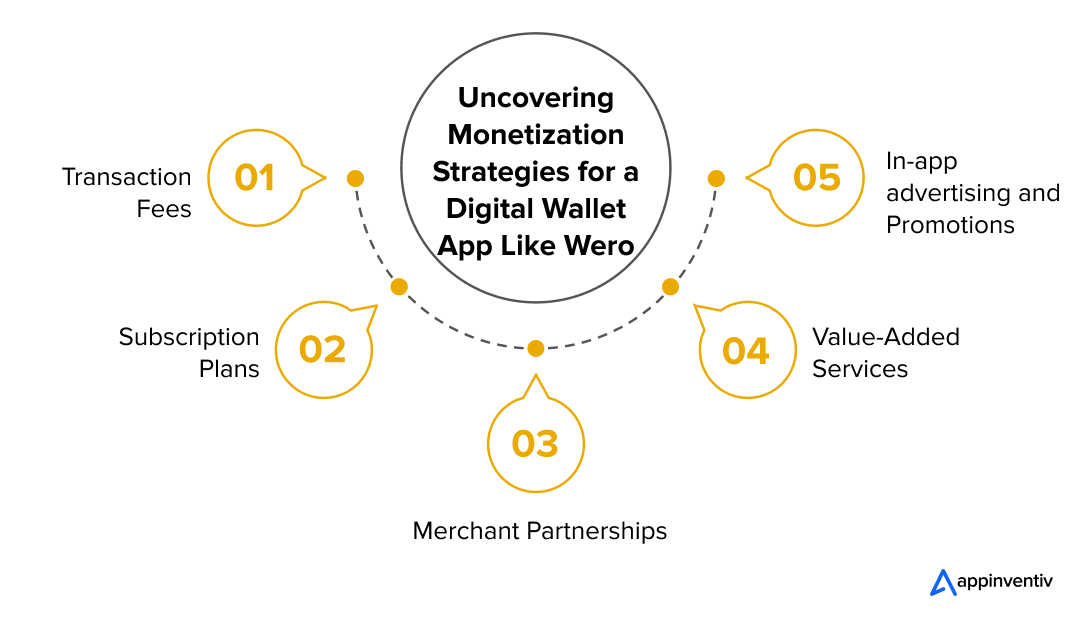

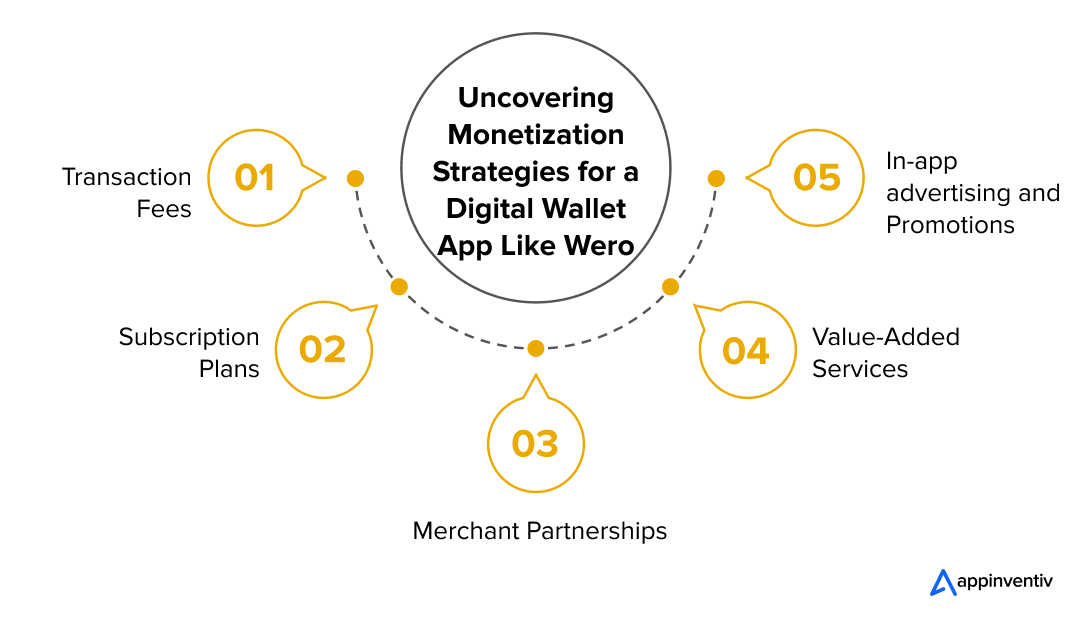

Monetization Strategies for a Digital Payment Wallet App like Wero

Several popular monetization models are commonly leveraged by digital payment wallet businesses to drive revenue. Here are a few widely adopted strategies:

Transaction Fees

Charge a small percentage or a flat fee for each transaction made through the wallet. This can include peer-to-peer transactions, merchant payments, or QR code transactions. Offering competitive rates will attract more users while ensuring revenue generation.

Subscription Plans

Offer premium subscription plans for frequent users and businesses. These plans can include benefits like higher transaction limits, faster processing times, dedicated customer support, and advanced analytics.

Merchant Partnerships

Collaborate with merchants and local businesses, offering them tailored payment solutions. Earn a commission from transactions processed through your wallet when merchants use your services. This can also include co-marketing opportunities to drive traffic.

Value-Added Services

Provide additional services such as financial planning tools, savings features, or credit lines. These offerings enhance the wallet experience and drive engagement while revenue is generated through interest rates or subscription fees.

In-app advertising and Promotions

Integrate targeted advertising and promotional offers within the wallet app. Partner with brands and businesses to showcase their services and products and earn revenue through sponsored placements and in-app promotions.

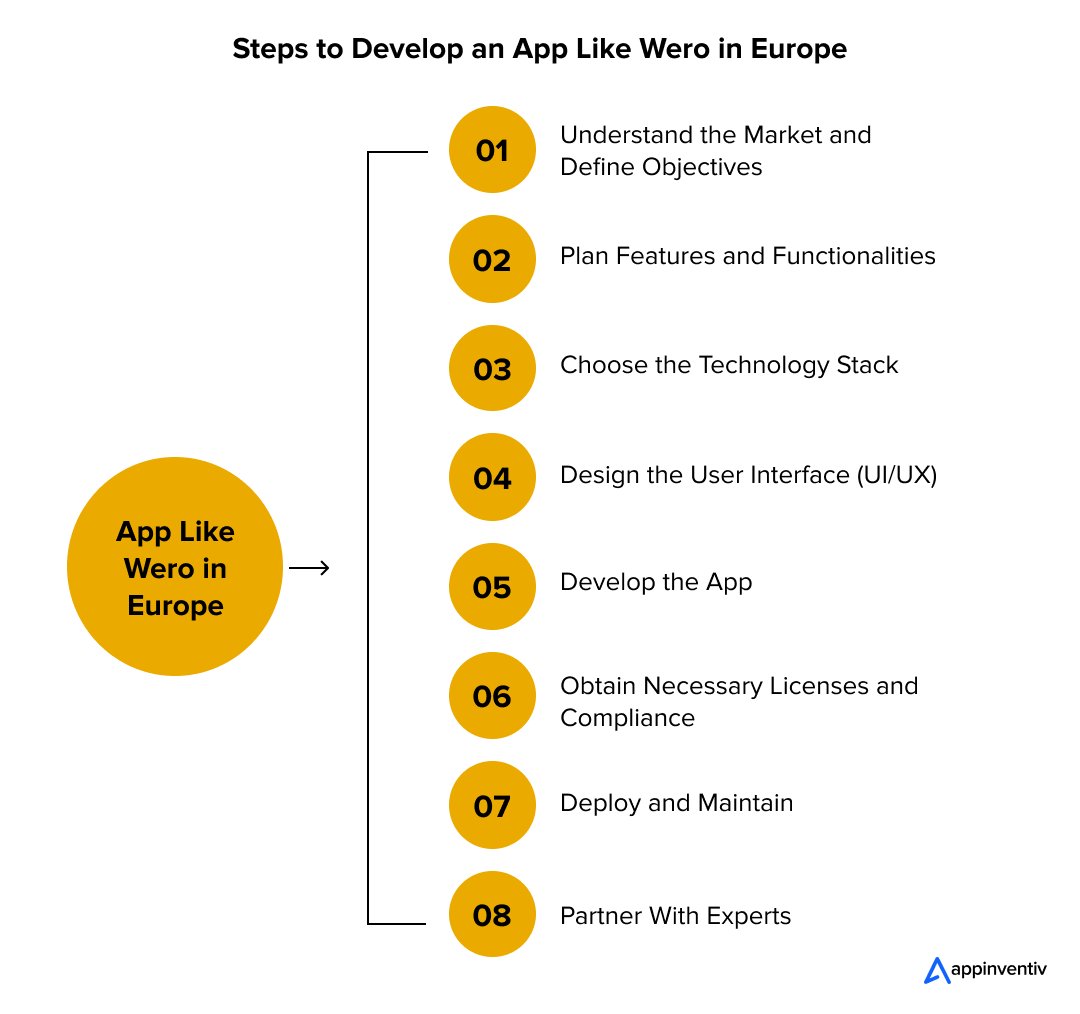

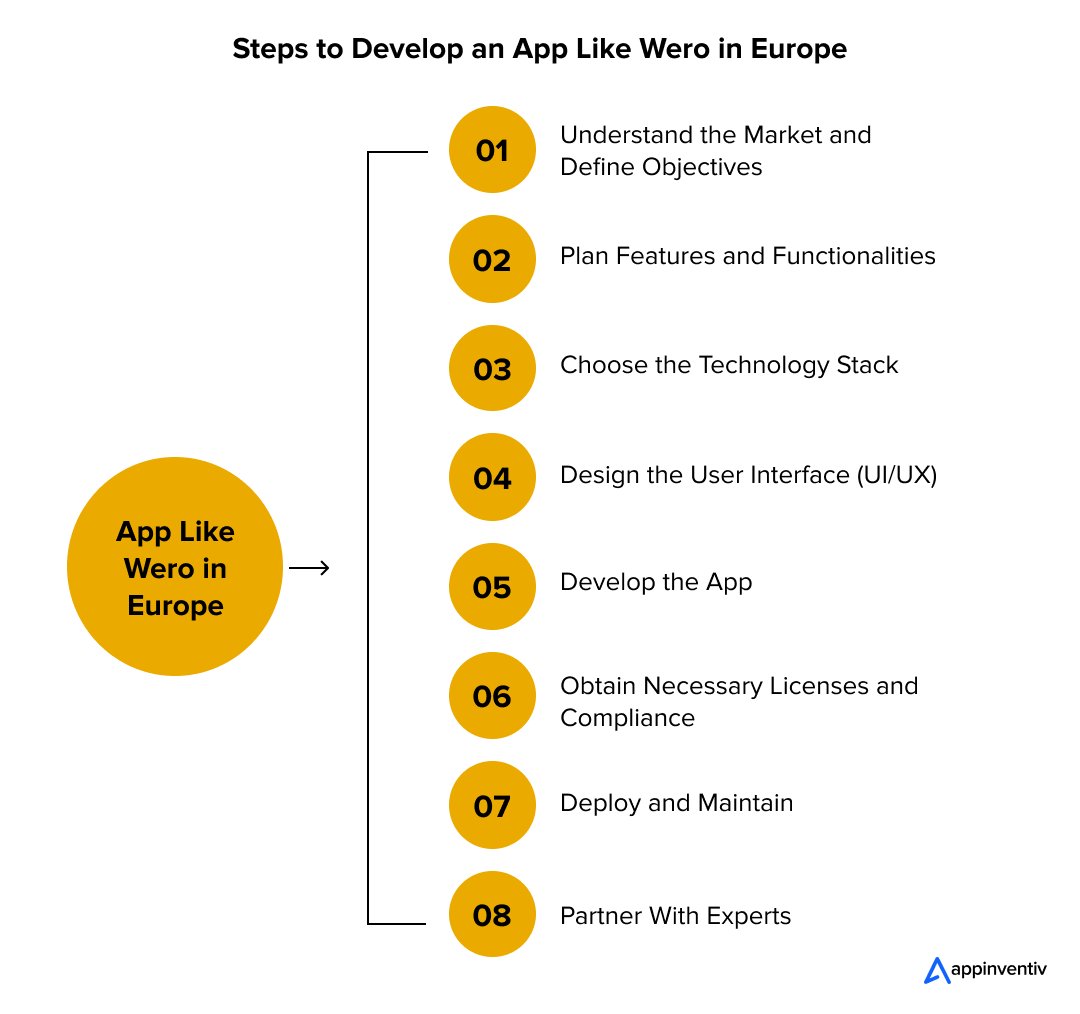

How to Develop An App Like Wero in Europe

Creating a digital payment wallet app like Wero requires a well-thought-out development process to ensure seamless transactions, high security, and user-friendly features. Here’s a comprehensive guide to developing a payment wallet app:

Understand the Market and Define Objectives

Before diving into development, research the digital payment market thoroughly. Identify your target audience, including their demographics, preferences, and pain points. Analyze competitors like Wero, PayPal, and Google Pay to understand their unique offerings and areas for improvement. Define clear objectives for your app—whether it will focus on peer-to-peer transactions, merchant payments, or broader use cases.

Plan Features and Functionalities

A successful digital wallet app relies on a strong feature set. Start with user registration, allowing options like email, phone numbers, and biometrics for ease of use. Enable the secure linking of bank accounts, adding or withdrawing funds, and using multiple payment methods like QR codes and NFC.

Include a transaction history section for tracking and ensure robust security with encryption and fraud detection features to create an app like Wero.

Choose the Technology Stack

Selecting the right technology stack is critical for performance and scalability. For the front end, use Swift or Kotlin for native apps or Flutter and React Native for cross-platform options. Backend technologies like Node.js or Python can handle transaction loads effectively.

Utilize secure databases like MySQL or MongoDB and integrate APIs for payment gateways, banking, and location-based services to develop digital wallet apps like Wero.

Design the User Interface (UI/UX)

Focus on creating an intuitive and visually appealing interface. Ensure that navigation is simple and accessible for users across different age groups. Use consistent branding, including colors and typography, to establish trust. Prototyping and user testing are vital to refine the design for a smooth user experience to create an app like Wero.

Develop the App

Adopt an agile development methodology to break the project into manageable sprints. Start with essential functionalities like payment integrations, user authentication, and fraud detection. Prioritize strategic mobile app testing to identify and fix bugs early. Incorporate feedback loops to improve the app iteratively, ensuring it meets user expectations to develop a digital wallet app like Wero.

Obtain Necessary Licenses and Compliance

Compliance with financial regulations is essential for a secure and legal payment app. Secure certifications like PCI DSS for handling transactions and ensure adherence to local laws such as GDPR or PSD2. Incorporate anti-money laundering (AML) measures to protect users and your platform from fraud.

Deploy and Maintain

Launch your app on platforms like Google Play Store and Apple App Store, following their specific guidelines. Post-launch, focus on gathering user feedback and rolling out regular updates to fix bugs and improve features. Invest in customer support channels, including chatbots or a dedicated team, to assist users effectively.

Partner With Experts

Choose a partner with the right skills and experience to develop a secure and scalable payment wallet app. A skilled partner can offer insights into advanced technologies and industry best practices, delivering tailored solutions that align with your business goals. Create a seamless, feature-rich digital wallet experience that stands out in a competitive market.

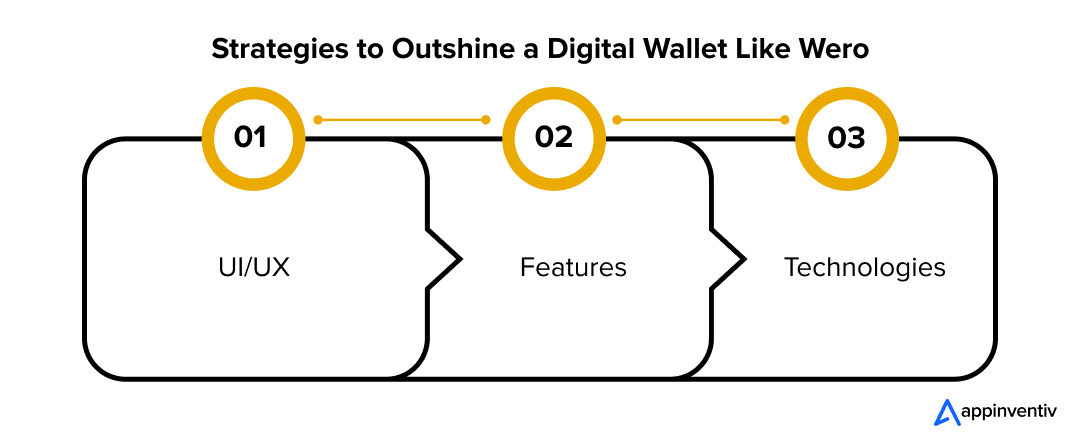

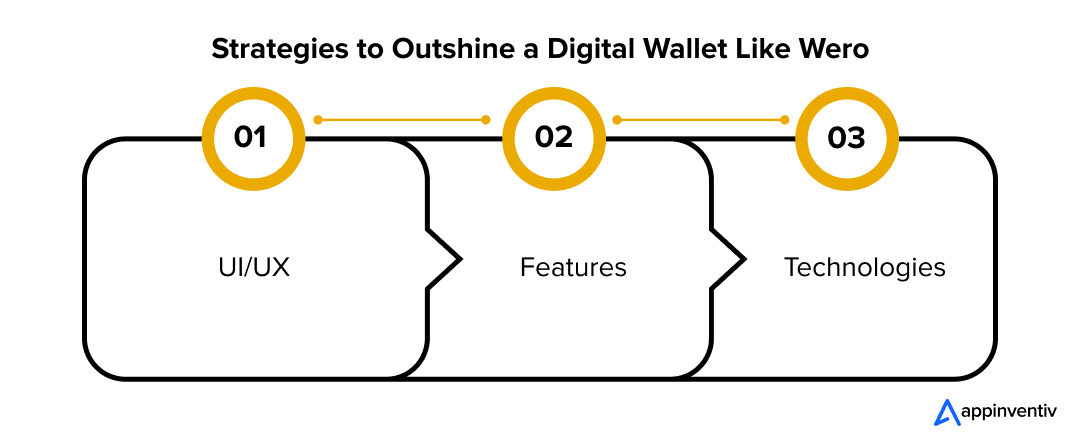

Best Practices to Make an App Better Than Digital Payment Wallet Apps like Wero

Following best practices is essential to creating an app like Wero. This includes focusing on user experience, robust security, seamless integration, and advanced features. Here’s a look at the process to develop a digital banking app like Wero.

UI/UX Best Practices

Simplify onboarding with clear instructions and multiple login options, like biometric authentication. Use intuitive layouts with minimal clutter and prominent icons for seamless navigation. Maintain a consistent design language and responsive interface for all devices, including accessibility features like multilingual support.

Key Components:

- Intuitive Interface: Simple and clean design for easy navigation

- Fast Load Times: Optimize performance for quick responsiveness

- User-Friendly Design: Consistent layouts and interactive elements

- Personalization Options: Allow customization of themes and preferences

- Accessibility Features: Support for multiple languages and voice assistance

- Error Handling Notifications: Clear and helpful error messages saves digital wallet app development costs in Europe

Must-Have Features

Ensure advanced security with encryption, multi-factor authentication, and fraud alerts. Support expense tracking and AI-powered financial insights for better wallet management. Offer diverse payment methods, including QR codes and cryptocurrency, along with engaging rewards programs like cashback and loyalty points.

Key Components:

- Seamless Peer-to-Peer Transfers: Fast and hassle-free transactions between users

- QR Code Integration: Easy payments via QR code scanning. It allows businesses to save digital wallet app development cost in Europe.

- Multi-Language Support: Cater to a diverse user base globally minimizes digital wallet app development cost in Europe.

- Security & Authentication Tools: Multi-factor authentication (MFA), fingerprint, and facial recognition

- Budget and Financial Tools: In-app savings, expense tracking, and budgeting insights

- Transaction History & Reporting: Detailed records for transparency and tracking

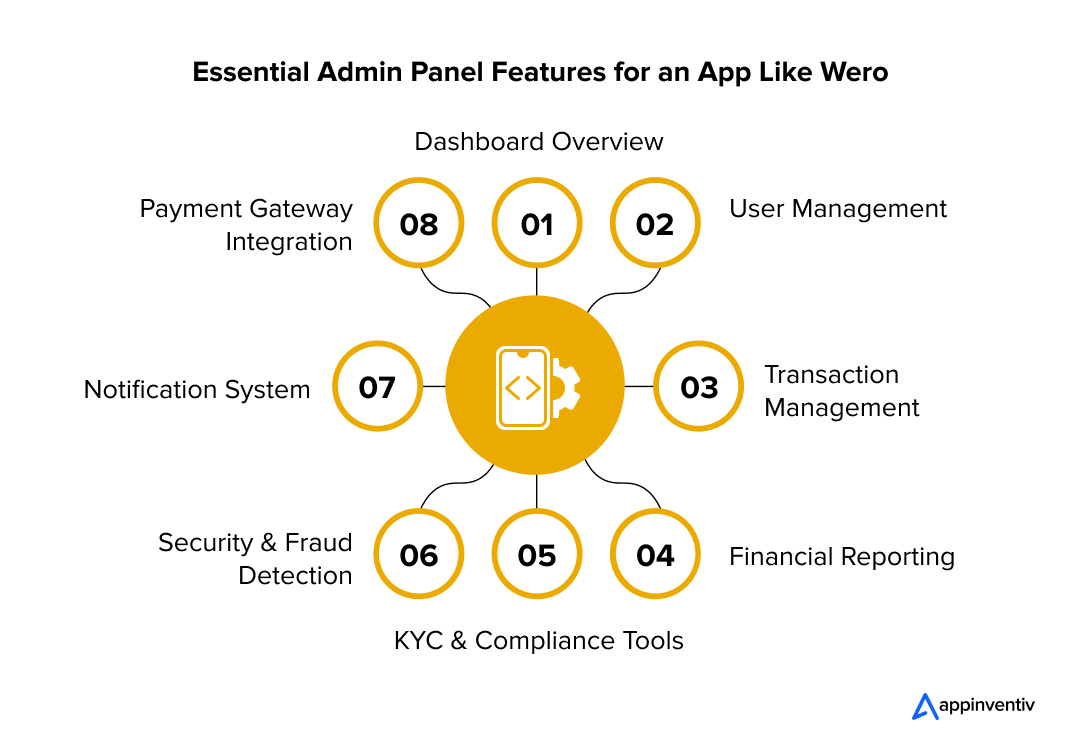

Let’s explore the features of a digital wallet app like Wero, which allows businesses to attract an audience and grow.

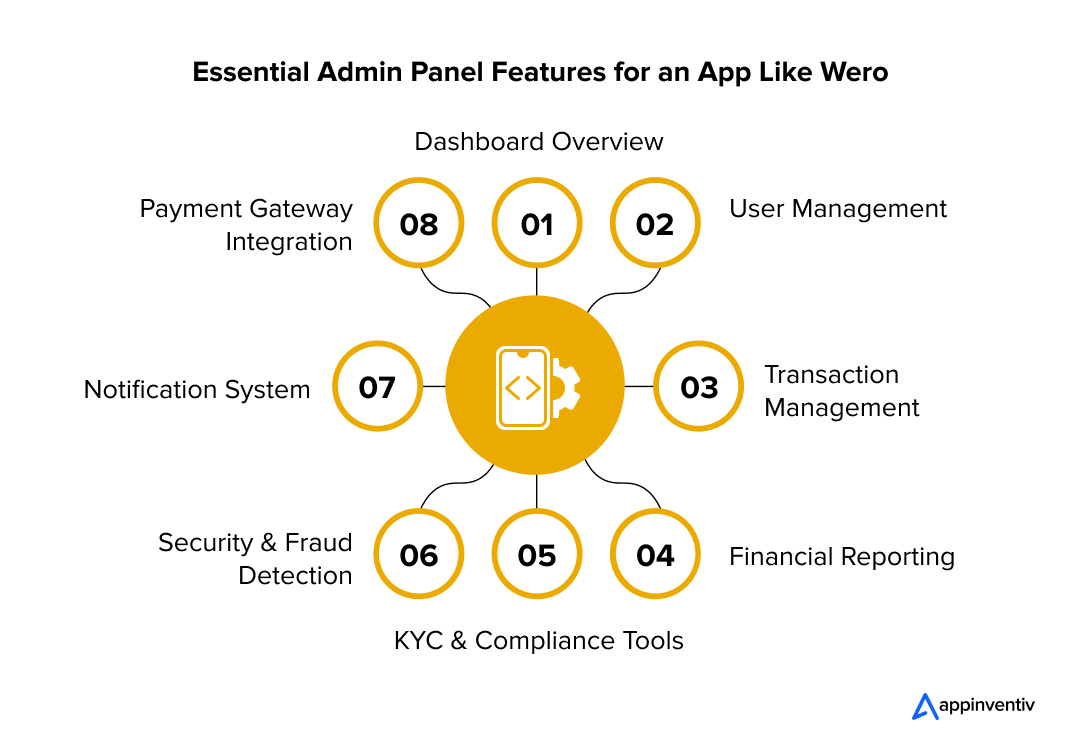

Admin Side Features

- Dashboard Overview

A real-time dashboard displaying key business metrics, transaction summaries, and revenue insights, ensuring quick decision-making and operational clarity.

- User Management

Enables easy monitoring and management of user accounts, including account activation, suspension, and detailed user information verification.

- Transaction Management

Facilitates tracking and overseeing all transactions, with filtering and sorting tools to view transaction details efficiently.

- Financial Reporting

Generates detailed financial and audit reports, which can be exported in multiple formats like PDF or Excel for transparent analysis.

- KYC & Compliance Tools

Ensures adherence to financial regulations by reviewing KYC documents and automating compliance checks for user verification.

- Security & Fraud Detection

Utilizes advanced algorithms to detect and prevent fraud in real-time, safeguarding transactions with multiple authentication checks.

- Notification System

Allows sending instant alerts to users via SMS, email, and push notifications for account activities and system updates, saves digital wallet app development cost in Europe.

- Payment Gateway Integration

Seamlessly integrates with multiple payment gateways, ensuring smooth transactions with real-time monitoring of gateway performance.

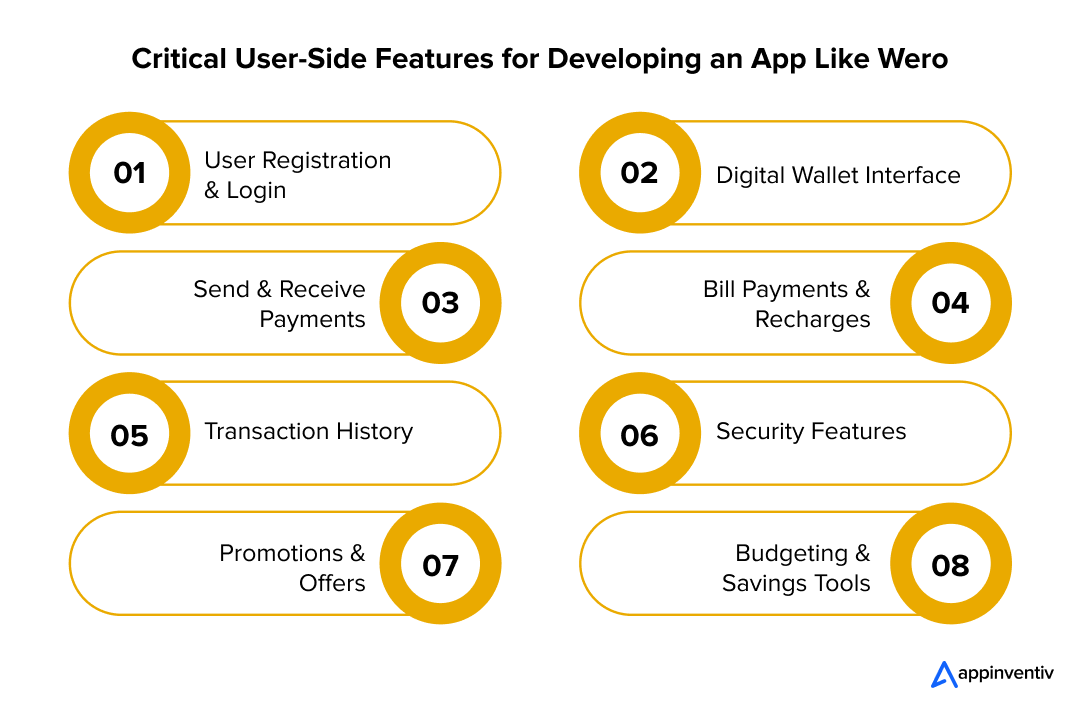

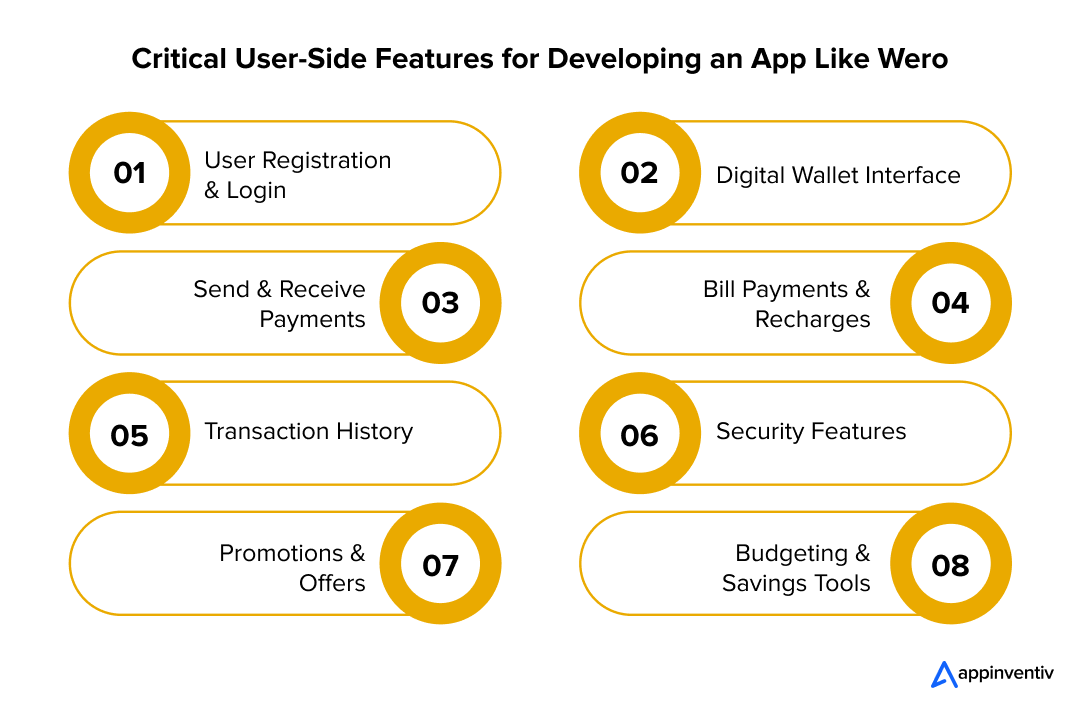

User Side Features

- User Registration & Login

Offers quick registration and login options through email, phone, social accounts, and secure two-factor authentication.

- Digital Wallet Interface

Provides a clear view of wallet balances and transaction details, making it simple to manage wallet finances.

- Send & Receive Payments

Facilitates fast, hassle-free peer-to-peer transactions, QR code scanning, and bank transfers.

- Bill Payments & Recharges

Enables users to pay bills for services like electricity, water, and internet and perform mobile recharge transactions.

- Transaction History

Allows users to view all past transactions, with filtering tools to search by date, amount, and transaction type.

- Security Features

Includes biometric login options like fingerprint, Face ID, and end-to-end encryption for transaction protection in order to build a digital wallet app like Wero.

- Promotions & Offers

Keeps users updated with cashback offers, discounts, and referral bonuses, enhancing loyalty and engagement.

- Budgeting & Savings Tools

Helps users track expenses, set financial goals, and save money through budgeting dashboards and reminders.

Technological Advancements

Leverage blockchain for secure transactions and AI for fraud detection and spending analysis. Use cloud computing for scalability and real-time processing. Add biometric authentication for enhanced security and integrate reliable gateways like Stripe or PayPal for seamless payments.

Key Components:

- Blockchain Integration: Ensure secure and transparent transactions to build a digital wallet app like Wero

- AI & Machine Learning Algorithms: For fraud detection and personalized recommendations

- Cloud Infrastructure: Scalable and reliable hosting solutions to build a digital wallet app like Wero.

- API Integration: Seamlessly connect with banks, third-party services, and merchants

- Cross-Platform Development Frameworks: Flutter, React Native for compatibility across devices

- Data Analytics Tools: For user insights, transaction trends, and business intelligence

Building a Wero-like App with Appinventiv’s Expertise

Appinventiv excels in delivering cutting-edge fintech app development services in UK or Europe, empowering businesses to bring their digital payment solutions to life. With a strong foothold in fintech development and a commitment to technical excellence, we are fully equipped to develop a secure, seamless, and user-friendly digital wallet app like Wero.

Proven Expertise Across 3000+ Projects: With over 3000 successful projects delivered across various industries, Appinventiv’s experience speaks volumes about our technical know-how and commitment to providing quality solutions.

A Global Workforce of 1600+ Specialists: Our diverse team of 1600+ professionals brings together creativity, technical expertise, and deep industry insights, ensuring a holistic approach to fintech app development.

Proven Track Record: With numerous successful projects under our belt, our track record demonstrates our ability to deliver on time. Notable Fintech clients include:

- Mudra: The idea for the Mudra Budget Management App was to give control over one’s money directly to the user; a seamless, intuitive budgeting and expense-tracking platform was to lead to maximum financial well-being and intelligent decision-making.

- EdFundo: We created the EdFundo Financial Literacy App, which teaches young users the basic principles of money management, investing, and budgeting through interactive lessons to help them make financial literacy easy, interesting, and accessible to everyone.

- AI Bank: We were working with AI Bank to develop the future of banking, an innovation that would use AI tools to streamline banking, provide better user experiences, and provide more personalized financial services, thus revolutionizing innovation in the bank.

Efficient and Collaborative Development Approach: We follow a client-centric development methodology focused on transparency, on-time delivery, and tailor-made solutions, ensuring that your digital wallet app aligns perfectly with your business goals and user expectations.

Recognition for Innovation and Excellence: Honored with the title of ‘Tech Company of the Year’ at the Times Business Awards 2023, Appinventiv is a trusted leader in delivering top-tier fintech solutions.

Choose Appinventiv to build a reliable and scalable digital payment wallet app that meets the highest European standards and drives your financial technology vision forward.

FAQs

Q. How much digital wallet app development cost?

A. The cost to develop a digital wallet app like Wero typically ranges between $60,000 and $300,000. This depends on the complexity of features, user interface design, platform compatibility (iOS/Android), and integration of payment gateways and security protocols. Advanced functionalities and custom solutions may push the cost toward the higher end.

Q. What are the benefits of a digital wallet app like Wero?

A. digital wallet app like Wero offers convenience, speed, and security, allowing users to make instant transactions effortlessly. It also provides budget tracking, real-time transaction monitoring, and personalized offers, ensuring a superior user experience. Additionally, integrating loyalty programs and financial tools encourages customer engagement and long-term retention.

Q. What are the factors affecting the cost to develop a Wero-like app?

A. The development cost is influenced by design complexity, technology choice, platform compatibility, and integration with third-party services like payment gateways. Other considerations include security protocols, scalability needs, custom features, and compliance with regional financial regulations, which ensure a smooth, reliable, and legally compliant user experience.

Product Development & Engineering

IT Managed & Outsourcing

Consulting Services

Data Services

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.