Every business that offers credit-based services faces a common challenge: recovering outstanding payments without damaging customer relationships. While large enterprises have structured collection processes, many mid-sized and small businesses still rely on manual follow-ups, spreadsheets, or outdated software.

The result? Missed payments, inefficient tracking, and compliance risks that lead to financial losses.

Debt collection software development changes this equation by automating communication, tracking debtor interactions, and ensuring compliance with financial regulations. But building such a system isn’t just about integrating payment reminders and automated calls. It requires a deep understanding of legal frameworks, data security, and behavioral science to encourage repayments while maintaining a professional relationship with debtors.

Moreover, modern debt collection solutions are evolving with the rise of AI and predictive analytics. They identify high-risk accounts and personalize communication strategies to maximize recovery rates.

With such advancements, how do you initiate the software development for the debt collection process that balances efficiency, compliance, and customer-centricity? Let’s break it down in this article.

Understanding the Debt Collection Software Stakeholders

Before diving into debt collection management software development, it’s essential to understand who will be using your software and their specific requirements. Debt recovery needs vary across industries, and a well-strategized solution must align with the unique challenges of each user group.

So, by identifying the key stakeholders early on, you will be able to build a software that not only streamlines debt collection but also ensures compliance, enhances efficiency, and improves recovery rates – all the while keeping you aligned with the expected benefits of debt collection software development.

Financial Institutions & Banks

Banks, credit unions, and lending institutions deal with high volumes of outstanding loans, mortgages, and credit card payments. For them, a debt collection software for banks is about following up on missed payments and maintaining long-term customer relationships and adhering to strict financial regulations.

They will require a highly secure, compliant, and scalable automated debt collection software that integrates seamlessly with their existing banking systems. Features like automated payment reminders, AI risk assessment and management, and customizable reporting tools will be critical in helping them manage debt recovery at scale.

Businesses with Subscription or Credit-Based Models

Companies operating on a subscription or credit-based model, such as SaaS providers, telecom companies, and utility service providers, frequently deal with late or failed payments. Unlike traditional debt collectors, they often aim to recover dues without disrupting the customer experience. They will want to invest in debt collection automation software development that can:

- Detect failed transactions in real time and initiate automated retries

- Manage dunning processes with dynamic payment reminders and incentive-based recovery strategies

- Offer self-service portals where customers can review outstanding payments and settle dues easily

By automating these processes, collection software for debt buyers will be able to reduce churn and improve overall cash flow.

Debt Collection Agencies

Third-party collection agencies handle debt recovery for multiple businesses, often managing thousands of overdue accounts simultaneously. Given the volume and complexity of their operations, you will need to build debt collection software that provides:

- Intelligent automation in enterprises streamlines case handling and ensure timely follow-ups

- Multi-channel communication support (calls, emails, SMS, and letters) for effective debtor outreach

- Regulatory compliance tools to align with laws like the Fair Debt Collection Practices Act and avoid legal repercussions

A flexible debt collection agency software development system that allows customization based on client requirements will be crucial for agencies working across various industries.

Legal Firms Handling Debt Recovery

Law firms specializing in debt collection follow a different approach, often focusing on high-value or legally escalated cases. Their requirements will center around compliance, documentation, and case tracking. They will need the efforts of debt recovery software development to be around:

- Generation of legal notices and formal collection letters automatically

- Secure document management for contracts, payment agreements, and court-related paperwork

- A built-in escalation workflow to track cases moving from standard collection to legal proceedings

AI Integration in the legal industry embeds databases and regulatory tools that are key differentiators for software catering to this segment.

Individual Creditors & Small Businesses

Small business owners, freelancers, and independent landlords often lack access to advanced debt collection software, relying instead on manual tracking methods like spreadsheets or emails. For them, an easy-to-use, lightweight solution will be ideal.

A mobile-friendly debt collection management software that enables quick invoicing, automated payment reminders, and one-click legal actions will significantly simplify debt recovery. Since these users may not have legal expertise, the software should also provide compliance guidance and simple escalation options when required.

Key Features of Debt Collection Software

The debt collection software features largely depend on the target users and business model. A bank handling high-value loans will have different needs than a freelancer recovering unpaid invoices. However, certain core capabilities will be necessary across all solutions to ensure efficiency, compliance, and a seamless recovery process.

Below is a breakdown of those essential and advanced features that will enhance the effectiveness of debt collection app development.

System of Record

A centralized System of Record and smart data discovery will store all debtor data, transaction history, payment records, and case details in one place. This will ensure:

- Secure and structured storage of financial and legal documents

- Easy access to debtor profiles and case progress tracking

- Data integrity and compliance with regulatory requirements.

Commercial debt collection software development for larger organizations will also include role-based access control, allowing different stakeholders (agents, compliance officers, legal teams) to access only relevant data.

Decision Engine

An advanced Decision Engine will help businesses segment debtor portfolios, classify accounts, and define collection strategies. This feature will:

- Allow user-defined segmentation based on risk levels, payment history, or account size

- Use Decision Trees to automate workflows based on debtor response patterns

- Enable real-time testing of different collection strategies without IT intervention.

Investing in AI debt collection software development can further enhance recovery rates by predicting debtor behavior and optimizing outreach strategies.

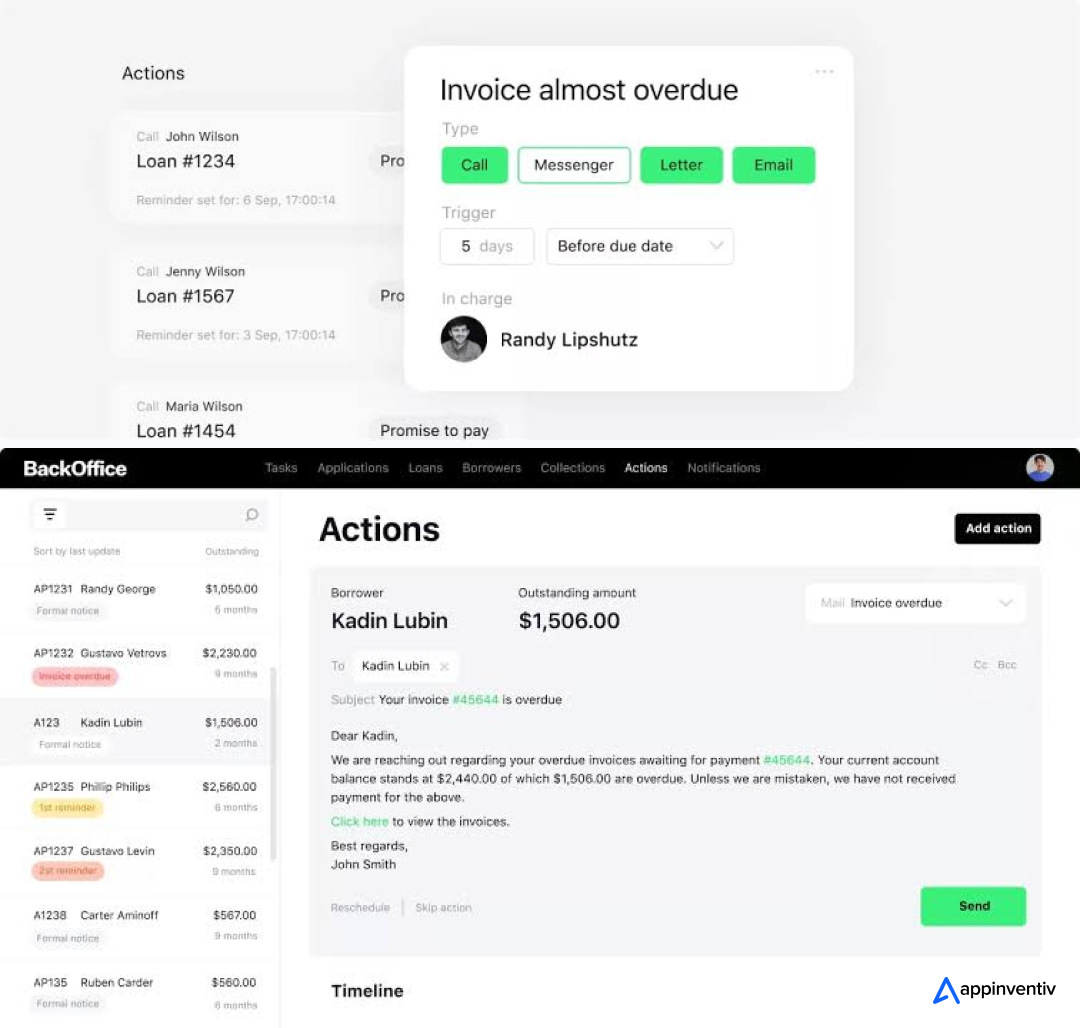

Workflow & Automation Management

Debt collection involves multiple stages, from initial reminders to escalations. Adding a strong workflow management system in the debt collection software development deliverables will:

- Automate case assignments, follow-ups, and legal escalations

- AI copilots ensures workflow transformation and allow businesses to configure workflows based on different debt collection scenarios

- Reduce manual intervention while ensuring timely and consistent communication

Customizable workflows will be critical for agencies handling diverse debt portfolios and businesses that need tailored collection strategies.

Omnichannel Customer Experience

A smooth and professional debtor experience can significantly improve collection success. Software development for debt collection should create scope for supporting multiple communication channels, including:

- Emails with automated follow-ups and personalized messaging

- SMS & WhatsApp reminders with payment links

- IVR & Call Management for automated and human-assisted outreach

- Chatbots & AI Assistants for instant query resolution

This ensures debtors receive timely notifications via their preferred channels, increasing response rates.

Self-Service Platform

Providing a Self-Service Portal will empower debtors to:

- View outstanding balances, due dates, and repayment options

- Make payments securely through multiple gateways

- Raise disputes and track their resolution status

A self-service approach can reduce friction and improve recovery rates for businesses focused on maintaining customer relationships (such as telecom providers and subscription-based services).

Accounts & Receivable Management

Debt collection software for banks should offer robust Account Management and Receivable Tracking to:

- Maintain detailed debtor profiles with past interactions and payment behavior

- Automate invoice generation and overdue tracking

- Provide reconciliation tools for accurate financial reporting

For businesses handling large volumes of transactions, an AI-driven receivable prediction model can help anticipate late payments and take proactive action.

Compliance & Dispute Management

Regulatory compliance is critical in debt collection, as non-compliance can lead to legal risks and reputational damage. To be a part of the leading debt collection software examples, your platform should include:

- Built-in compliance tracking (e.g., FDCPA, GDPR software compliance, TCPA adherence)

- Automated legal documentation for notices and dispute resolution

- Audit trails & case tracking to maintain regulatory transparency

Agencies working across multiple jurisdictions will require dynamic compliance frameworks that adapt to different regional laws.

System Integrations

Seamless integration with third-party systems will enhance efficiency. The platform post debt collection app development should support:

- Choosing the right CRM integrations to align with existing customer data

- Accounting software connections (e.g., QuickBooks, Xero) for automated financial reconciliation

- Payment gateway support to process transactions securely

- Legal and regulatory databases for automated compliance checks

Reporting & Analytics

When you build debt collection software with a robust Reporting & Analysis for fintech module, it will help businesses track performance, optimize collection strategies, and ensure compliance. The software should offer:

- Customizable dashboards with real-time collection metrics

- Portfolio analysis to identify trends in debtor behavior

- Recovery rate tracking to assess effectiveness over time.

For larger enterprises, AI-powered predictive analytics can help forecast recoveries and optimize strategies dynamically.

Configurable & Customizable Platform

No two debt collection processes are identical, so the software should be highly configurable. Customization options usually include:

- Adjustable workflows to align with specific business needs

- Custom templates for notices, payment reminders, and legal documents

- Role-based access for different teams and stakeholders

A flexible architecture will be especially important for SaaS-based models catering to diverse industries.

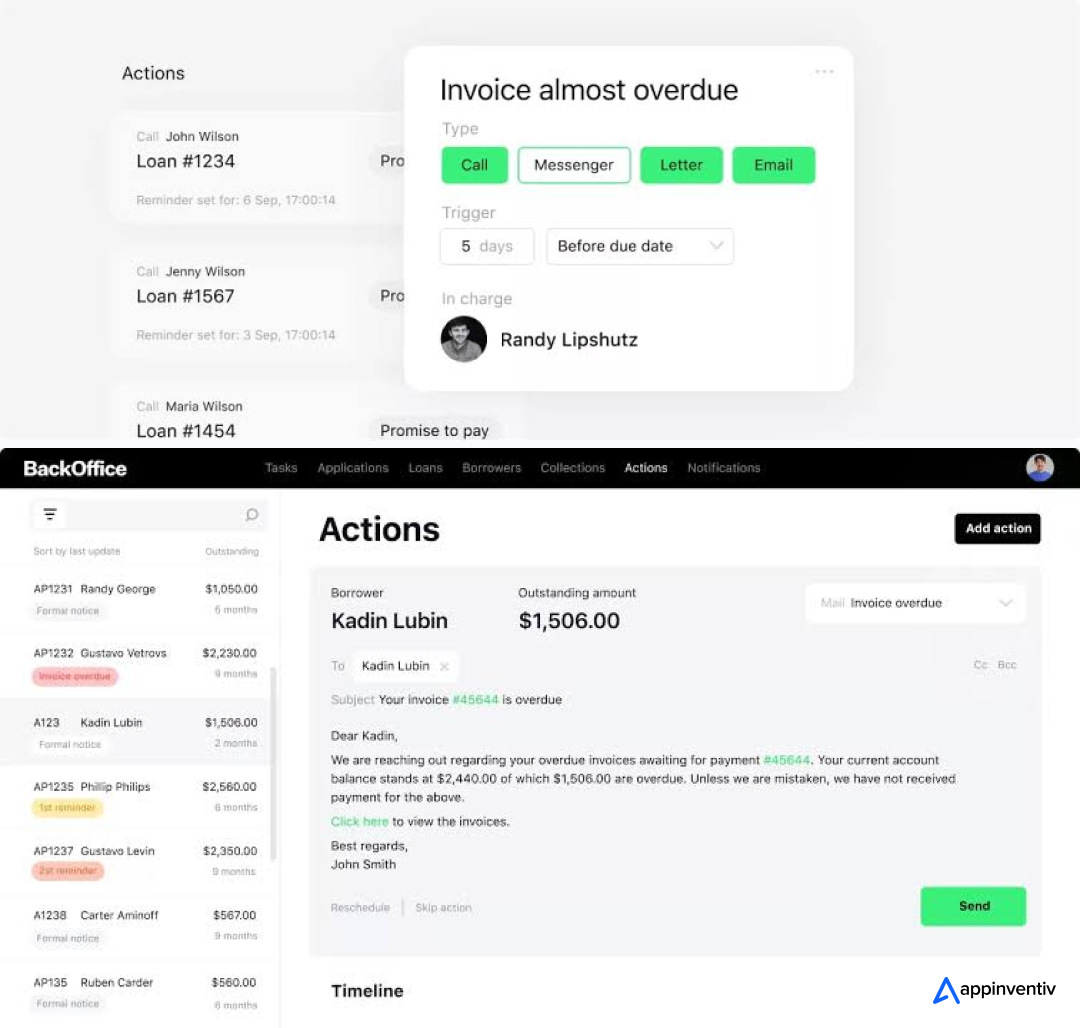

Design Guidelines for Debt Collection Software

A well-designed debt collection platform is not just about functionality; it must also be intuitive, scalable, and compliant while ensuring a seamless user experience. Whether catering to collection agencies, enterprises, or self-service debtor portals, a strong design foundation enhances usability, efficiency, and legal adherence.

Intuitive UI/UX for Different Stakeholders

Debt collection software is used by agents, business owners, and debtors, each with distinct needs. The interface should be:

- Minimalistic and Role-Based: Agents require case dashboards, while business owners need financial analytics. Debtors should have a simple, stress-free payment portal.

- Clear Navigation: Organize menus into logical sections – “Accounts,” “Payments,” “Disputes,” and “Reports”, to reduce cognitive load.

- High-Contrast & Accessible: WCAG-compliant design ensures usability for visually impaired users.

Design Tip: Implement a progressive disclosure approach, where users see essential data first, with deeper insights available on demand.

Workflow-Centric Information Architecture

Debt collection follows a structured process: case assignment, communication, payment follow-ups, case management, and dispute resolution. Your debt recovery software development outcome should also reflect this workflow:

- Step-by-Step Case Progression: Use Kanban boards or timeline views to track collection stages visually.

- Customizable Dashboards: Allow agents to configure their workspaces with priority accounts, overdue cases, and alerts.

- Drag-and-Drop Workflow Automation: Let users define triggers (e.g., “If unpaid after 15 days, escalate case”).

Design Tip: Provide pre-built workflow templates and dedicated case management software for different collection scenarios, from soft reminders to legal escalations.

Human-Centric Debt Collection Experience

Since debt collection is a sensitive process, the automated debt collection software must also balance efficiency with empathy:

- Conversational UI for Self-Service: A chatbot or guided flow can help debtors understand repayment options without pressure.

- Emotionally Aware Messaging: Use a neutral, professional tone in pre-set communication templates.

- Flexible Payment Plans: Allow users to simulate and adjust real-time repayment schedules.

Design Tip: Include a “Negotiate Payment Plan” button within the debtor portal, allowing users to propose new terms digitally.

Omnichannel Communication Hub

Effective debt collection relies on seamless communication across channels. The design should offer:

- Unified Inbox for All Channels: Merge emails, calls, SMS, and WhatsApp messages into a single interface.

- Contextual Chat Windows: Show debtor history within chat interfaces to personalize conversations.

- Scheduled & Automated Outreach: Allow users to pre-set call/SMS/email sequences based on debtor actions.

Design Tip: Introduce an “Urgency Score” metric that helps agents prioritize cases needing immediate action.

High-Performance Payment UX

A frictionless payment experience improves recovery rates. To aid this, your UI should include:

- One-Click Payment Buttons: Embed “Pay Now” CTAs in reminders and dashboards.

- Multiple Payment Options: Support credit/debit cards, ACH, PayPal, and BNPL solutions.

- Payment Orchestration: Simplifies all the complexities of multiple payment providers. Payment Orchestration Development centralizes all transactions in one place and automatically processes it.

- Recurring Payment Scheduling: Let debtors set up auto-debits without manual intervention.

Design Tip: Use progressive form filling and auto-populating debtor details to reduce drop-offs in the payment process.

Interactive & Actionable Data Visualization

Analytics should drive smarter debt collection strategies in your collection software for debt buyers, and to support this, the UI should:

- Use Infographics for Performance Metrics: Display collection success rates, pending dues, and agent efficiency in visual dashboards.

- Offer Dynamic Filtering: Users can segment debtors based on payment history, credit scores, or risk level.

- Enable A/B Testing for Outreach Strategies: Compare messaging tones and escalation approaches.

Design Tip: Include a “What-If Simulator” for agencies to test collection strategies on sample debtor groups.

Choosing the Right Tech Stack for Debt Collection Software

The tech stack plays a crucial role in the performance, scalability, and security of debt collection software. Since different business models require varying levels of automation, integration, and compliance handling, the choice of technologies in your commercial debt collection software development process should align with both short-term needs and long-term growth plans.

Here’s a breakdown of the key components:

Backend Technologies

The backend is responsible for handling workflows, integrations, and compliance-driven automation. The choice depends on whether you need a monolithic or microservices-based approach.

-

Frameworks & Architectures

- Microservices (Spring Boot, NestJS)

- Serverless Functions (AWS Lambda, Azure Functions)

- Message Queues (Kafka, RabbitMQ)

Frontend Technologies

The frontend of debt collection automation software development must be designed for intuitive navigation, real-time updates, and seamless customer interactions across different channels.

-

Mobile App Development

- React Native / Flutter

- Swift (iOS) / Kotlin (Android)

Database Management

The database should support high-performance queries, secure transactions, and data integrity in debt collection software for banks.

-

Relational Databases (Structured Data & Compliance)

- PostgreSQL

- MySQL

- SQL Server

-

NoSQL Databases (For Real-Time Interactions & Unstructured Data)

-

Data Warehousing (For Advanced Analytics & Decision Engines)

- Google BigQuery / Amazon Redshift

Cloud Infrastructure & DevOps

Cloud-based deployment offers flexibility, scalability, and security while reducing the infrastructure costs of your debt collection software.

-

Cloud Providers

- AWS (Amazon Web Services)

- Google Cloud Platform (GCP)

- Microsoft Azure

-

Containerization & Orchestration (For Scaling Applications Efficiently)

-

CI/CD Pipelines (For Faster Development & Deployment)

- GitHub Actions / GitLab CI/CD / Jenkins

Security & Compliance

Since debt collection software deals with sensitive financial and personal data, strong security measures and compliance adherence are critical.

-

Data Encryption

- AES-256 encryption for data at rest

- TLS 1.3 encryption for data in transit

-

Authentication & Access Control

- OAuth 2.0 / OpenID Connect for secure user authentication

- Role-Based Access Control (RBAC) to prevent unauthorized data access

-

Compliance & Regulatory Standards

- PCI-DSS

- GLBA (Gramm-Leach-bliley Act), FDCPA (Fair Debt Collection Practices Act)

- SOC 2 / ISO 27001

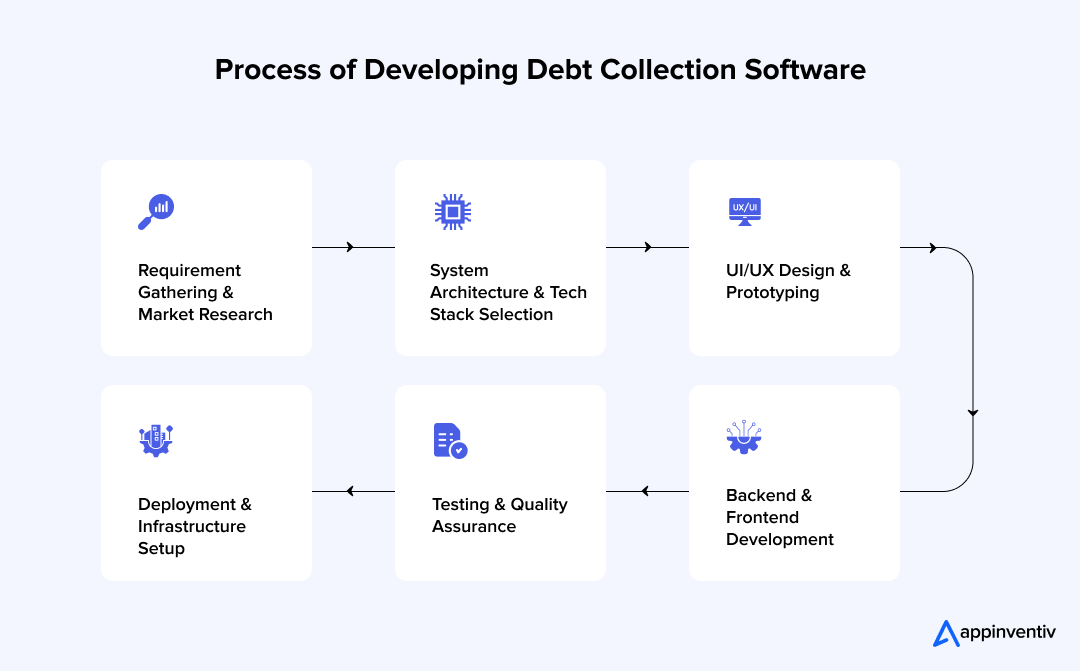

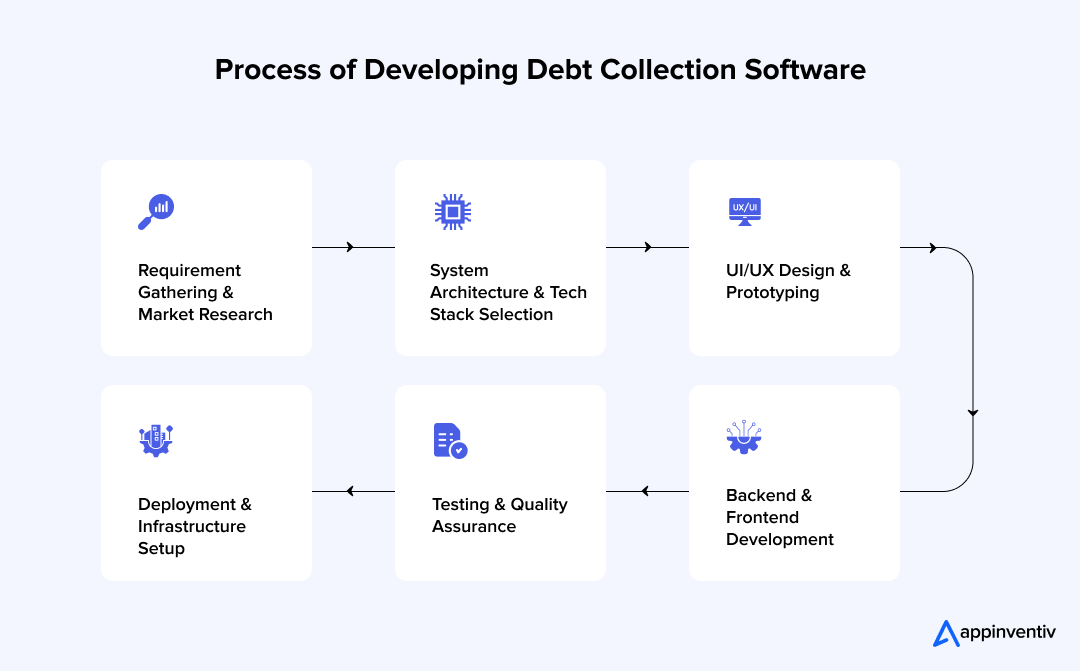

Debt Collection Software Development Process

Debt collection agency software development performed with the intent to build a scalable, compliant, and efficient debt collection software requires a structured development process. A well-defined roadmap ensures smooth execution, reducing technical debt and compliance risks.

Requirement Gathering & Market Research

Before starting software development for debt collection, defining the scope, objectives, and target users is essential. This phase helps understand stakeholders’ pain points and ensures that the software meets business needs.

- Identify the business model (B2B, B2C, in-house, or third-party collection agencies).

- Conduct competitor analysis to evaluate existing solutions.

- Gather compliance requirements based on regional and Financial Regulatory Compliance Software Development (e.g., FDCPA, GDPR).

- Define the must-have vs. nice-to-have features.

- Create user personas (debt collectors, customers, legal teams, financial officers).

Deliverables:

System Architecture & Tech Stack Selection

Once the requirements are finalized, the next step is to design the system architecture and choose the appropriate technology stack.

- Select monolithic vs. microservices architecture based on scalability needs.

- Define database structures for account management, transaction logs, and customer interactions.

- Plan API integrations for third-party payment gateways, credit bureaus, and communication channels.

- Establish security protocols to meet compliance requirements.

Deliverables:

- System Design Document

- API Documentation & Integration Plan

- Database Schema Design

UI/UX Design & Prototyping

A well-designed UI improves efficiency, accessibility, and user adoption. The design should cater to both debt collectors and customers, ensuring ease of navigation and interaction.

- Create high-fidelity wireframes for the dashboard, account management, dispute handling, and payment portals.

- Design intuitive self-service interfaces to allow customers to make payments, request settlements, or dispute claims.

- Implement accessibility standards (WCAG) to accommodate users with disabilities.

- Test user flows to ensurea seamless omnichannel experience (web, mobile, email, SMS)

Deliverables:

- Interactive UI Prototypes

- User Flow Diagrams

- Accessibility & Responsiveness Guidelines

Backend & Frontend Development

This debt collection software development phase involves coding the core functionalities, user interfaces, and system integrations.

- Develop secure authentication & authorization (OAuth 2.0, Role-Based Access Control)

- Implement core debt management functionalities (automated reminders, payment tracking, portfolio segmentation)

- Integrate third-party payment processors (Stripe, PayPal, ACH transfers)

- Set up communication APIs (Twilio for SMS, SendGrid for emails, AI-driven chatbots)

- Build customizable workflows & automation tools for different debt recovery strategies

Deliverables:

- Fully Functional Backend & Frontend Codebase

- API Endpoints & Documentation

- Initial Deployment on Staging Servers

Testing & Quality Assurance

Software development for debt collection must undergo extensive testing to ensure compliance, security, and seamless functionality.

- Unit Testing: Validate individual components and APIs

- Integration Testing: Ensure seamless interaction with external services (credit bureaus, payment gateways)

- Security Testing: Conduct penetration testing to detect vulnerabilities

- Performance Testing: Simulate high-load scenarios to check system stability

- User Acceptance Testing: Collect feedback from real users before production deployment.

Deliverables:

- Test Case Reports

- Security & Compliance Audit Logs

- Bug Fixing & Optimization Plan

Deployment & Infrastructure Setup

Once testing is complete, the software is deployed to a production environment by debt collection software developers.

- Set up cloud infrastructure (AWS, Azure, Google Cloud) with auto-scaling capabilities.

- Implement CI/CD pipelines for automated updates and bug fixes.

- Configure monitoring tools (New Relic, Datadog) for real-time performance tracking.

- Establish disaster recovery & backup solutions to ensure data integrity.

Deliverables:

- Live Deployment on Cloud Servers

- Infrastructure Monitoring Setup

- Performance Benchmarks & Logs

Development Cost of Debt Collection Software

The cost of software development for debt collection varies significantly based on complexity, features, compliance requirements, and integrations. Here’s a breakdown of estimated costs based on different development models and software complexities.

Basic Debt Collection Software ($30,000 – $60,000)

A simple MVP with essential features suitable for startups and small agencies.

Development Costs Breakdown

- UI/UX Design: $5,000 – $10,000

- Frontend & Backend Development: $15,000 – $30,000

- Third-party API Integrations: $5,000 – $10,000

- Testing & Deployment: $5,000 – $10,000

Key Features

- Basic accounts & receivable management

- Manual debt tracking & reminders

- Simple workflow automation

- Standard reporting & dashboards

- One or two payment integrations (e.g., Stripe, PayPal)

- Limited user roles & access control

Best For

Small collection agencies, startups testing the market

Mid-Level Debt Collection Software ($60,000 – $150,000)

A more scalable and feature-rich software with advanced automation and reporting.

Development Costs Breakdown

- UI/UX Design: $10,000 – $20,000

- Frontend & Backend Development: $30,000 – $80,000

- AI & Decision Engine Implementation: $10,000 – $20,000

- API & Compliance Integration: $10,000 – $20,000

- Testing & Security Audits: $5,000 – $15,000

- Cloud Hosting & DevOps Setup: $5,000 – $15,000

Key Features

- AI-powered decision engine & portfolio segmentation

- Customizable workflow management

- Omnichannel communication (email, SMS, chatbot, IVR)

- Self-service portal for debtors

- Compliance management tools (FDCPA, GDPR)

- Advanced analytics & real-time reporting

- Multiple third-party integrations (credit bureaus, payment processors, CRM)

- Secure role-based access control

Best For

Growing collection agencies, financial institutions, and law firms

Enterprise-Grade Debt Collection Software ($150,000 – $500,000+)

A fully customizable, AI-driven, and highly scalable enterprise solution designed for large-scale financial institutions and BPOs.

Development Costs Breakdown

- UI/UX Design & Branding: $20,000 – $50,000

- Frontend & Backend Development: $80,000 – $200,000

- Advanced AI & Predictive Analytics: $30,000 – $100,000

- Third-party & Enterprise System Integrations: $30,000 – $80,000

- Security, Compliance & Audits: $20,000 – $50,000

- Infrastructure & Cloud Deployment: $20,000 – $50,000

Key Features

- AI-driven collection strategies with machine learning

- Real-time risk assessment & credit scoring

- Regulatory compliance automation for multiple regions

- Multi-language & multi-currency support

- Custom APIs & system integrations (ERP, CRM, accounting software)

- Automated dispute resolution & legal case tracking

- High-security architecture (end-to-end encryption, fraud detection, biometric authentication)

- Cloud-based or on-premise deployment

Best For

Large-scale financial institutions, enterprise BPOs, government agencies.

How to Lower the Development Costs of Debt Collection Software

Debt collection software development can be costly, but strategic decisions can help optimize expenses without sacrificing quality, security, or compliance. Here’s how to control costs effectively:

Start with an MVP

Instead of developing a fully featured solution upfront, start with an MVP that covers only core functionalities.

✅ Prioritize essential features like receivables management, automated reminders, and reporting.

✅ Avoid unnecessary customizations in the initial version.

✅ Use market feedback to refine and expand features over time.

Potential Savings: 30–50% reduction in initial development costs.

Leverage Open-Source Technologies

Many core functionalities can be built using open-source frameworks instead of proprietary software.

✅ Use open-source databases (PostgreSQL, MySQL) instead of paid alternatives.

✅ Leverage free AI & ML libraries (TensorFlow, Scikit-Learn) for automation.

✅ Implement open-source workflow engines like Camunda for process automation.

Potential Savings: 10–30% on software licensing and backend costs.

Choose Cloud-Based Infrastructure Over On-Premise

Hosting on cloud platforms can eliminate high infrastructure costs.

✅ Use AWS, Azure, or Google Cloud for scalable hosting.

✅ Opt for serverless architectures to reduce maintenance expenses.

✅ Consider SaaS-based APIs for payment processing and communication.

Potential Savings: 25–40% on infrastructure setup and maintenance.

Use Third-Party APIs Instead of Building Everything from Scratch

Instead of developing all features in-house, use third-party integrations where possible.

✅ Payment Processing: Stripe, PayPal, or Plaid instead of custom payment gateways.

✅ Credit Bureau & Risk Assessment: Experian, Equifax, or TransUnion APIs.

✅ Omnichannel Communication: Twilio for SMS, email, and IVR automation.

Potential Savings: 20–40% on custom development time.

Outsource Development to Cost-Effective Regions

Instead of hiring an expensive in-house team, consider outsourcing development.

✅ Offshore software developers from Eastern Europe, South Asia, or Latin America offer high-quality development at lower hourly rates.

✅ Work with specialized agencies with expertise in fintech and debt collection.

✅ Opt for a hybrid model, outsource development, but keep compliance and security in-house.

Potential Savings: 40–60% compared to hiring a full in-house team.

Implement Low-Code/No-Code Solutions for Basic Functionalities

For non-core functionalities, consider using low-code or no-code platforms.

✅ Use Zapier, Microsoft Power Automate, or OutSystems for workflow automation.

✅ Build admin panels using Retool or Appsmith instead of custom UI development.

✅ Deploy drag-and-drop chatbot builders for basic customer interactions.

Potential Savings: 20–50% on UI and automation development.

Plan for Scalability from Day One

Unplanned scaling leads to costly refactoring later. Design the system for growth from the start.

✅ Use microservices architecture to enable modular scaling.

✅ Choose flexible database structures to accommodate growing data needs.

✅ Implement containerization (Docker, Kubernetes) to optimize cloud costs.

Potential Savings: 15–30% on long-term infrastructure and rework expenses.

How to Get a Competitive Edge in Your Debt Collection Software Business?

Building a successful debt collection software platform requires more than just technical expertise. The industry is evolving, driven by new regulations, consumer expectations, and the need for efficiency. Many existing solutions fail to address key pain points, leaving room for innovation. Here’s how to create a platform that stands out:

Address the Gaps in Legacy Systems

Many collection agencies still rely on outdated systems that lack automation, real-time analytics, and omnichannel communication. These inefficiencies lead to poor debt recovery rates and compliance risks.

What’s needed?

- Cloud-based infrastructure for better scalability and remote access.

- Seamless integrations with accounting software, CRMs, and payment gateways.

- AI-powered insights to optimize collection strategies in real time.

Simplify Compliance Management

Debt collection is heavily regulated, with different legal requirements across states and countries. Failing to meet these standards can result in lawsuits and fines. Many agencies struggle with keeping up.

How to tackle this?

- Automated compliance updates that adjust policies dynamically.

- Built-in audit trails for tracking interactions and ensuring transparency.

- Role-based access control to protect sensitive consumer data.

Enhance Data Security & Privacy

With the rise of digital transactions, debt collection platforms handle vast amounts of sensitive data. A security breach could result in severe reputational and financial damage.

How to ensure security?

- End-to-end encryption for all communications and stored data.

- Multi-factor authentication (MFA) is used to prevent unauthorized access.

- Regular security audits and vulnerability testing.

Leverage AI for Personalized Debt Recovery

Traditional one-size-fits-all collection methods no longer work. Borrowers have different financial situations, and agencies need to personalize their approach. AI-driven insights can help.

How AI can optimize debt recovery:

- Smart segmentation to classify debtors based on repayment behavior.

- Automated yet empathetic outreach via chatbots, email, or SMS.

- Predictive analytics to determine the best time and method for contact.

Improve the Debtor Experience

Debt collection is often seen as aggressive and impersonal, leading to consumer resistance. Shifting to a more customer-centric approach can improve repayment rates.

Ways to enhance user experience:

- Self-service portals where debtors can negotiate, schedule payments, or ask questions.

- Omnichannel communication allows consumers to respond via their preferred medium (phone, SMS, email, chat).

- Transparent fee structures and real-time payment updates to build trust.

Monetization Strategies: How to Make the Platform Profitable

To sustain and grow your software, you need a strong revenue model. Here are some options:

- Subscription-based pricing – Charge agencies a monthly/annual fee based on the number of users or accounts managed.

- Pay-per-use model – Let agencies pay based on the volume of transactions or interactions.

- Tiered pricing – Offer different feature sets at varying price points, catering to both small agencies and large enterprises.

- Revenue-sharing – Charge a percentage of successfully collected debts.

Continuous Optimization & Customer Feedback

Building a great product isn’t enough, and you need to keep improving it based on real-world usage.

Best practices for long-term success:

- Regular A/B testing of collection strategies and user interfaces.

- Customer feedback loops to refine features based on agency needs.

- Scalability planning to handle growing demand without performance drops.

By addressing these key areas, your debt collection software won’t just be another tool in the market; it will be a game-changer for agencies looking for efficiency, compliance, and better customer relationships.

Role of Appinventiv in Debt Collection Software Development

Appinventiv, one of the best software development companies, known for building custom debt collection solutions that cater to agencies, enterprises, and financial institutions. With a strong focus on compliance, automation, and seamless integrations, our Lending software development services enable businesses to enhance their debt recovery operations while improving customer experience.

One of Appinventiv’s key strengths lies in how we develop scalable and cloud-based debt collection platforms. Whether a business requires a SaaS-based solution for quick deployment or a fully customized enterprise-grade system, we ensure the software aligns with operational and regulatory requirements.

Our Enterprise software development is a crucial aspect of our solutions, allowing businesses to streamline their collection strategies, optimize communication channels, and leverage predictive analytics for improved recovery rates. We empower businesses to segment debt portfolios efficiently and implement personalized collection tactics by integrating smart decision engines and real-time data processing.

We are also trusted as a custom software development company for building software that adheres to industry standards and legal frameworks such as the FDCPA, GDPR, and CFPB guidelines, ensuring that your businesses operate within the required legal boundaries.

Another critical factor in successful debt collection software is seamless integration with existing financial ecosystems. The products we build enable businesses to connect their platforms with CRM systems, payment gateways, banking APIs, and multi-channel communication tools, ensuring smooth end-to-end operations. This integration enhances data accuracy, reduces manual efforts, and improves the overall efficiency of the debt recovery process.

Beyond development, Appinventiv provides continuous support, maintenance, and future-ready enhancements to keep the software up-to-date with evolving industry trends.

Whether a company is looking to build a new debt collection platform or upgrade an existing one, Appinventiv is a strategic enterprise software development partner combining innovation with regulatory expertise. With a track record of successful fintech solutions, we have and continue to help businesses navigate the complexities of debt recovery while ensuring efficiency, security, and compliance.

FAQs

Q. How long does it take to develop a debt collection software?

A. The development timeline for debt collection software depends on factors such as the complexity of features, integrations, compliance requirements, and customization needs.

A basic version with standard functionalities like account management, automated reminders, and reporting can take 3-6 months to develop. However, if the software requires AI-driven automation, omnichannel communication, predictive analytics, and regulatory compliance tools, the timeline may extend to 6-12 months or more.

Additionally, if third-party integrations are involved, development can take longer due to testing and security compliance checks.

Q. How much does it cost to build a debt management collection system?

A. The cost of developing debt collection software varies based on feature complexity, customization, team size, and tech stack. A basic web-based debt collection platform with essential functionalities can cost between $30,000 and $60,000. For a mid-range solution with AI-driven decision engines, automated workflows, and omnichannel communication, the cost can range from $70,000 to $150,000. Enterprise-level software with advanced machine learning, compliance automation, real-time analytics, and multi-platform integrations can cost $200,000 or more.

IT Managed & Outsourcing

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.