Banking customer service is no longer about waiting in line or on hold. It’s about instant, effortless, intelligent interaction, and a voicebot in financial institutions is making it happen.

More than virtual assistants, today’s voice bot applications in banking handle thousands of customer queries in real time, deliver secure account updates, guide users through transactions, and offer 24/7 assistance. For banks, the payoff is huge: higher customer loyalty, reduced operational costs, and a smarter, more agile service model.

The future of banking is conversational. As voice AI technology, such as AI chatbots for banking, becomes increasingly competitive in the banking landscape, the ability to serve customers faster, smarter, and more personally is no longer optional; it’s a strategic imperative.

Voicebot in Banking: Market Overview

The growing adoption of voicebot for banking customer experience is being fueled by strong market momentum, technological innovation, and significant investment across the financial sector:

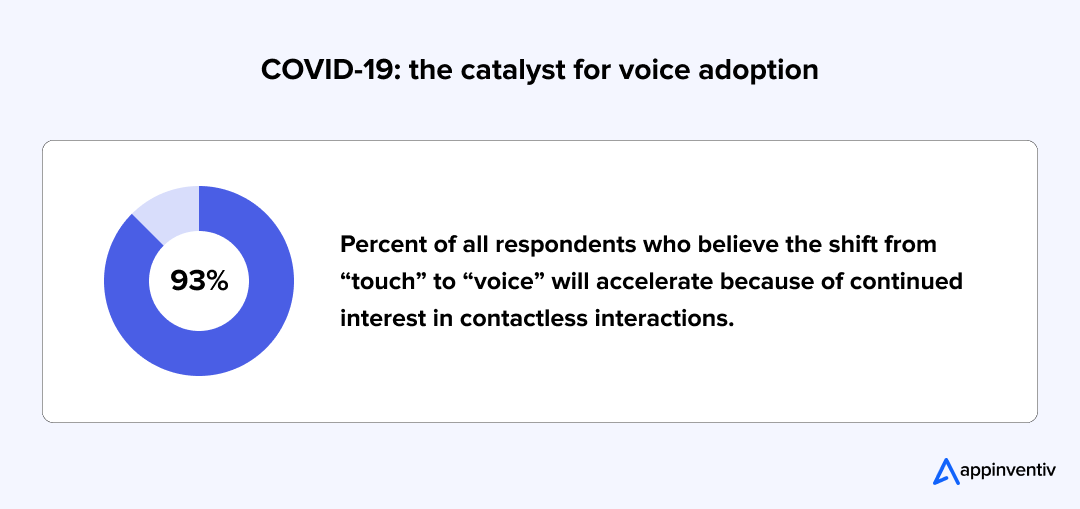

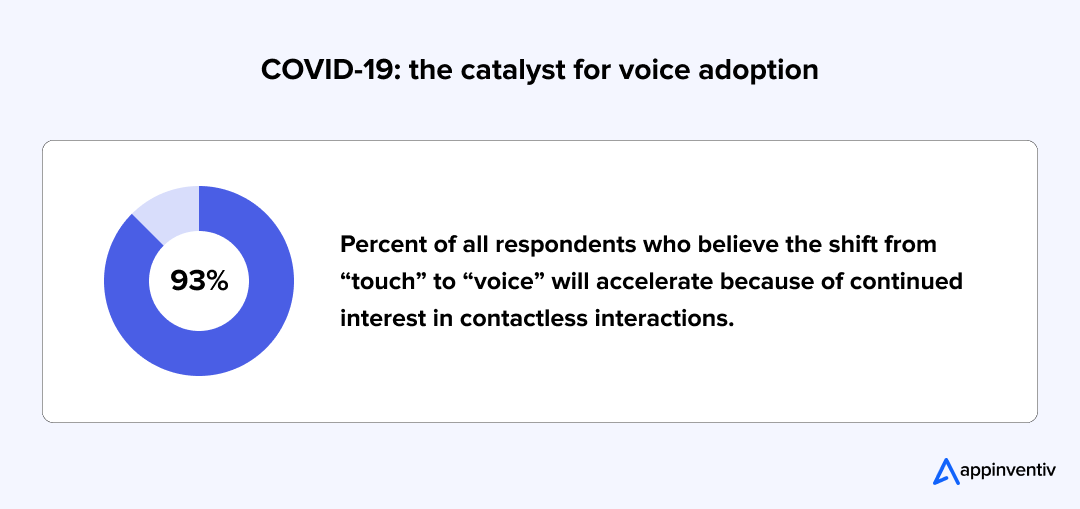

A Cognizant survey of 1,400 respondents revealed that 80% of participants believe voice AI technology in banking will significantly transform the sector. This shift in customer behavior gives voicebot in financial institutions a distinct advantage, as more people embrace voice-based interactions over traditional text and touch methods.

The Voice Assistant Market was valued at USD 4.18 billion in 2024. The market is expected to grow from USD 4.85 billion in 2025 to USD 25 billion by 2035, with a CAGR of 16.08% during the forecast period (2025-2035).

The banking sector’s spending on AI and generative AI reached $31.3 billion in 2024, up from $20.64 billion in 2023.

According to Statista, with an expected annual growth rate of 27%, this spending is projected to hit $40 billion in 2025 and exceed $81 billion by 2028.

In this blog, we explore how voice bots for banking are redefining customer service, the real-world impact they’re making, and why now is the perfect time for banks to invest in intelligent, scalable voice solutions.

AI Voicebot in Banking: How They Work?

Voice bot applications in banking are like having a smart virtual assistant who you can simply talk to, just like you would with a real person. Powered by AI and Natural Language Processing (NLP), these bots go beyond the old-school IVR (Interactive Voice Response) systems that made you press endless numbers on your phone.

An AI voice bot in banking leverages AI and NLP technologies to interpret customer queries, process data, and provide accurate, relevant answers through voice. They can understand natural, everyday language, making interactions more seamless and intuitive for customers.

The result? a much smoother, more natural banking experience where you can just speak normally and get things done faster.

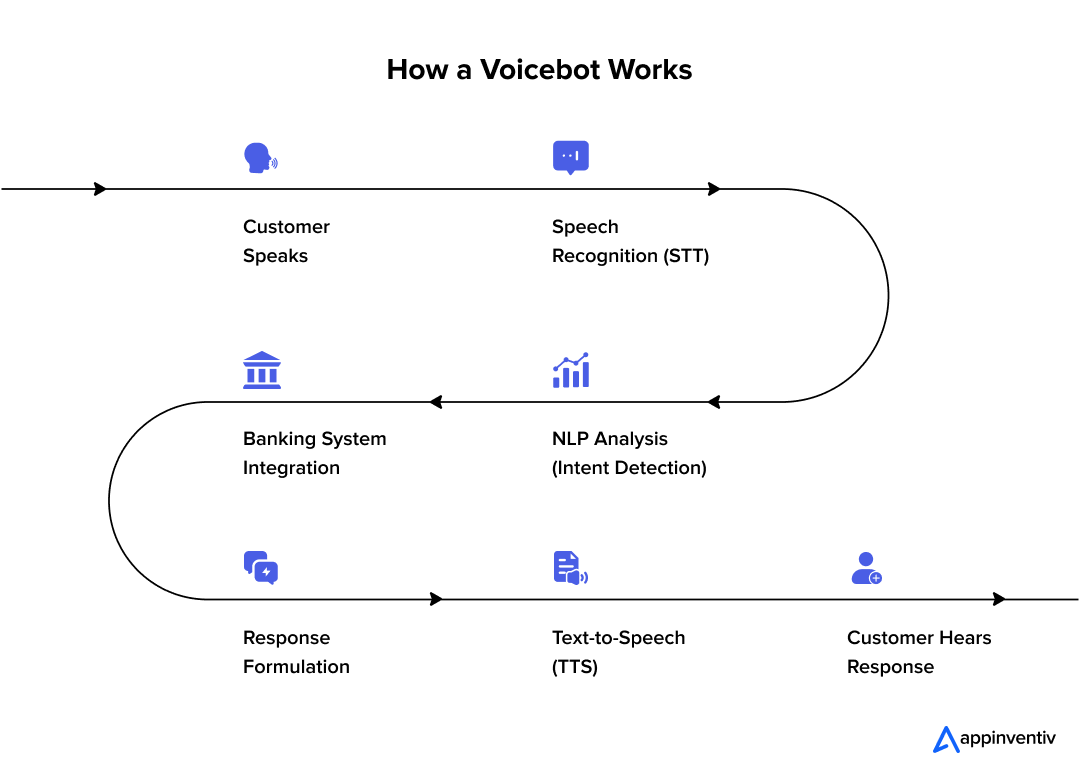

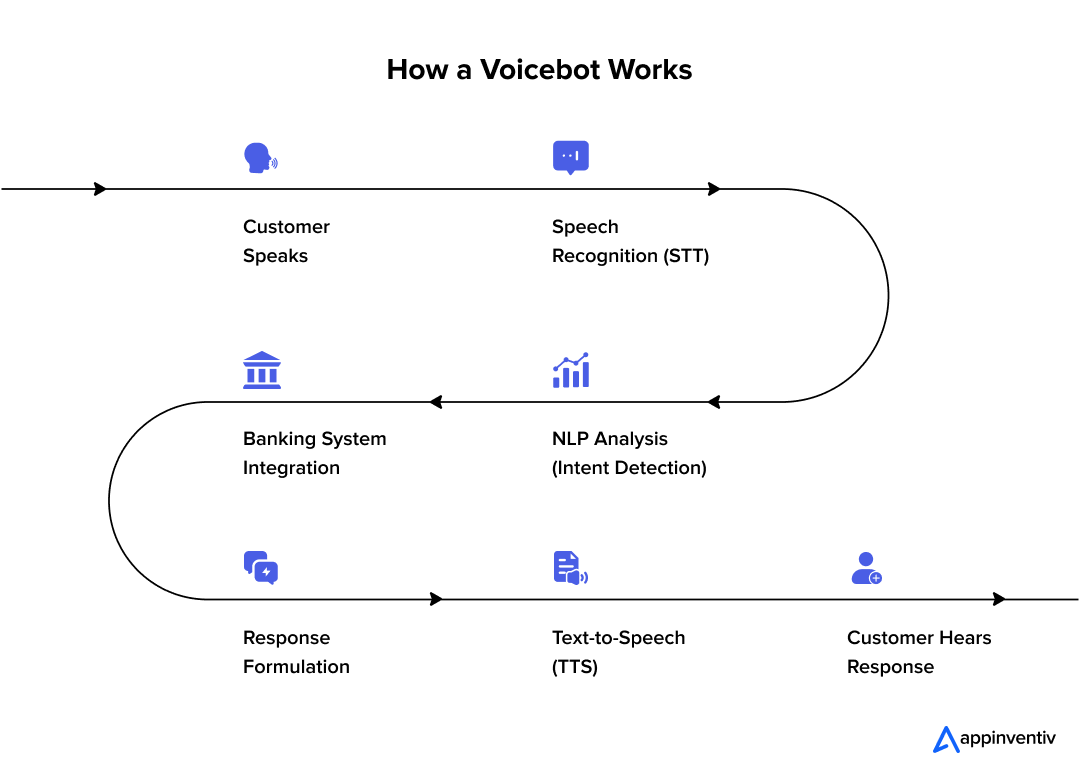

Here’s how integrating a voicebot in banking systems typically looks:

- Speech Recognition: When a customer speaks, the voicebot captures the spoken words and uses a Speech-to-Text (STT) engine to convert the audio into text.

- Intent Recognition: AI models analyze the text to identify the customer’s intent, whether they want to transfer money, check a balance, or pay a bill.

- Backend Integration: Once the intent is understood, the voice AI in banking securely connects with the backend systems (like core banking or CRM) to fetch or process the requested information.

- Response Generation: The bot formulates a relevant response based on retrieved action or information.

- Voice Response: Finally, the bot uses Text-to-Speech (TTS) technology to deliver the answer back to the customer in natural-sounding speech.

In more advanced setups, Generative AI and large language models (LLMs) help an AI-powered voice bot in banking carry on more complex, context-aware conversations, almost like talking to a real financial advisor.

Use Cases for Voice Bots in Banking

Let’s look at real-world examples and use cases for voice bots in banking. A voicebot in financial institutions is no longer just a trend. Across India and worldwide, banks and financial companies are using voice bots in exciting ways, reshaping how customers interact, get support, and manage their money.

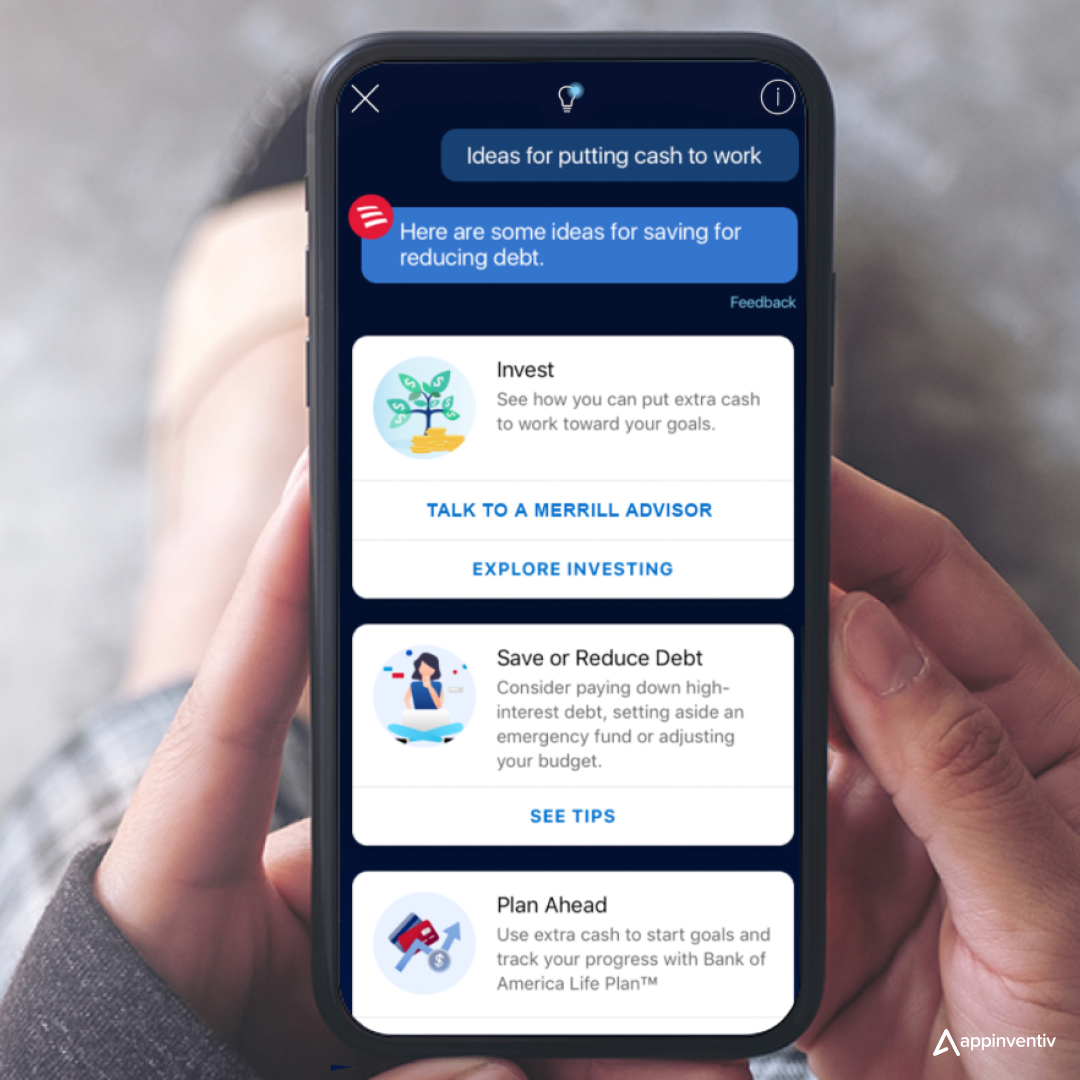

Bank of America – Erica: Elevating Customer Support Through Voice AI

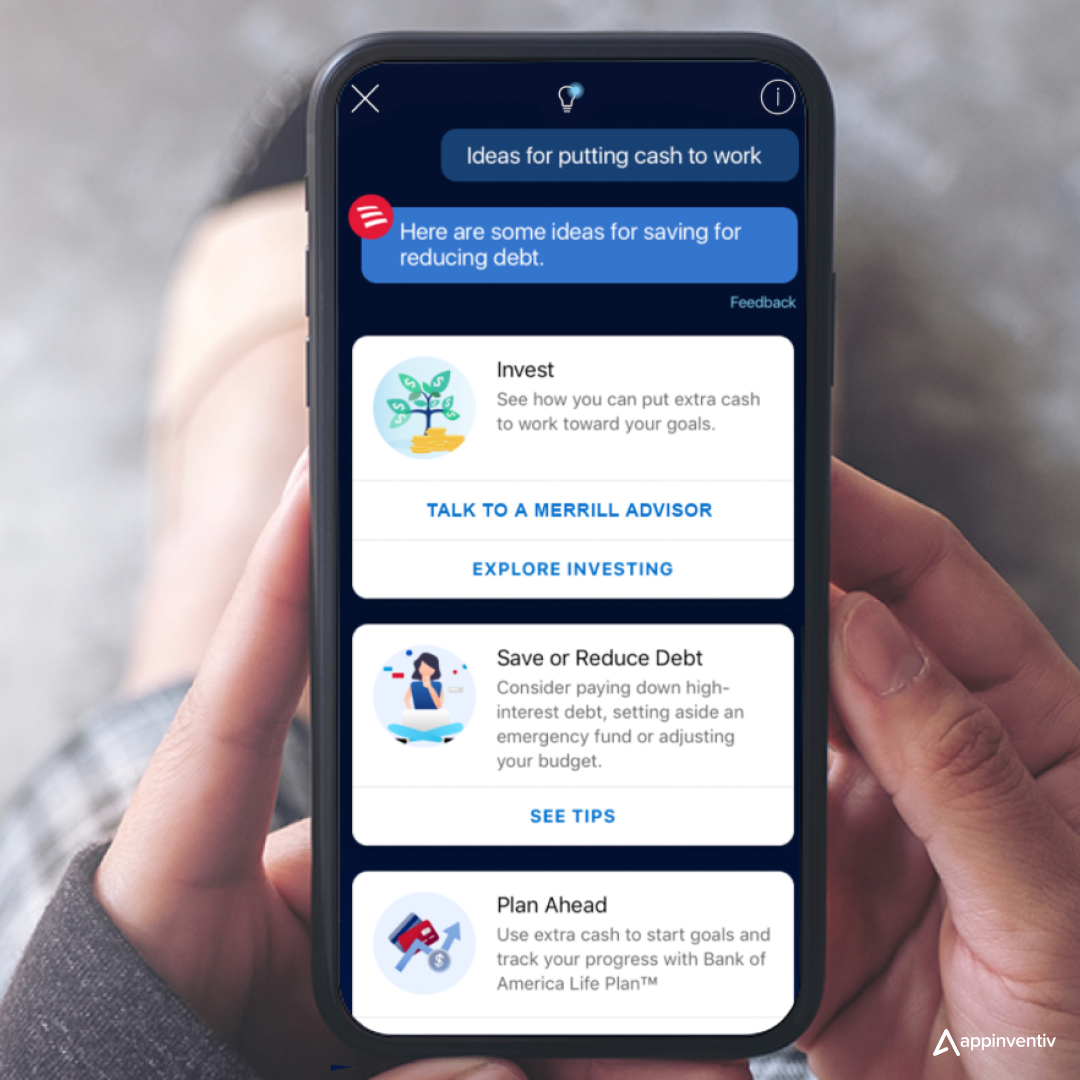

Bank of America’s Erica is a powerful example of how a voicebot in financial institutions is moving beyond scripted FAQs to deliver intuitive, intelligent, personalized banking experiences. Introduced in 2018, Erica is a tri-modal virtual assistant that allows users to interact via voice, text, or taps, making digital banking more human, inclusive, and flexible for its 37 million+ users.

At launch, Erica could assist with everyday tasks such as:

- Searching past transactions across all Bank of America accounts

- Checking credit score details

- Helping users navigate the app (e.g., finding routing numbers or nearest ATMs)

- Scheduling appointments

- Managing bill payments

- Locking/unlocking debit cards

- Transferring money via Zelle

These features made Erica immediately useful to customers looking for quick, frictionless banking support. According to the bank, Erica was initially trained to understand 200,000 variations of customer queries, and this has now scaled to nearly 500,000 variations, reflecting the growing sophistication of its NLP capabilities.

Impact:

- According to Bank of America, Erica has processed over 1 billion interactions since its launch, highlighting its central role in digital engagement and customer service.

- The assistant helped 19.5 million customers in a year, showcasing how voicebots drive scalable, proactive service delivery across retail banking.

- Erica proactively nudged customers with over 400 million insights related to upcoming bills, duplicate charges, and refund tracking, making it a core part of BofA’s personalized CX strategy.

YES Bank – Conversational AI for Retail Banking

YES BANK made headlines as one of India’s earliest adopters of machine learning and voice AI in banking with the launch of YES ROBOT, a voice- and text-enabled banking assistant designed to handle financial and non-financial tasks via conversational AI.

Customers could chat or speak with the bot to apply for over 65 banking products, check their loan eligibility, or even book fixed and recurring deposits, all using just an OTP for authentication. There are no passwords, no registrations, just straight-up convenience.

By leveraging conversational AI, YES bank is not only reducing turnaround times and support costs but also redefining the role of voicebot in banking. The roadmap includes integrations with platforms like WhatsApp, Alexa, and Google Assistant, enabling voice-first banking across touchpoints.

Impact:

- By December 2018, YES ROBOT had facilitated deposits worth ₹5.2 billion (approx. $70 million).

- By 2019, the bot had already handled over 8.3 million customer interactions, with an intent recognition accuracy exceeding 90%.

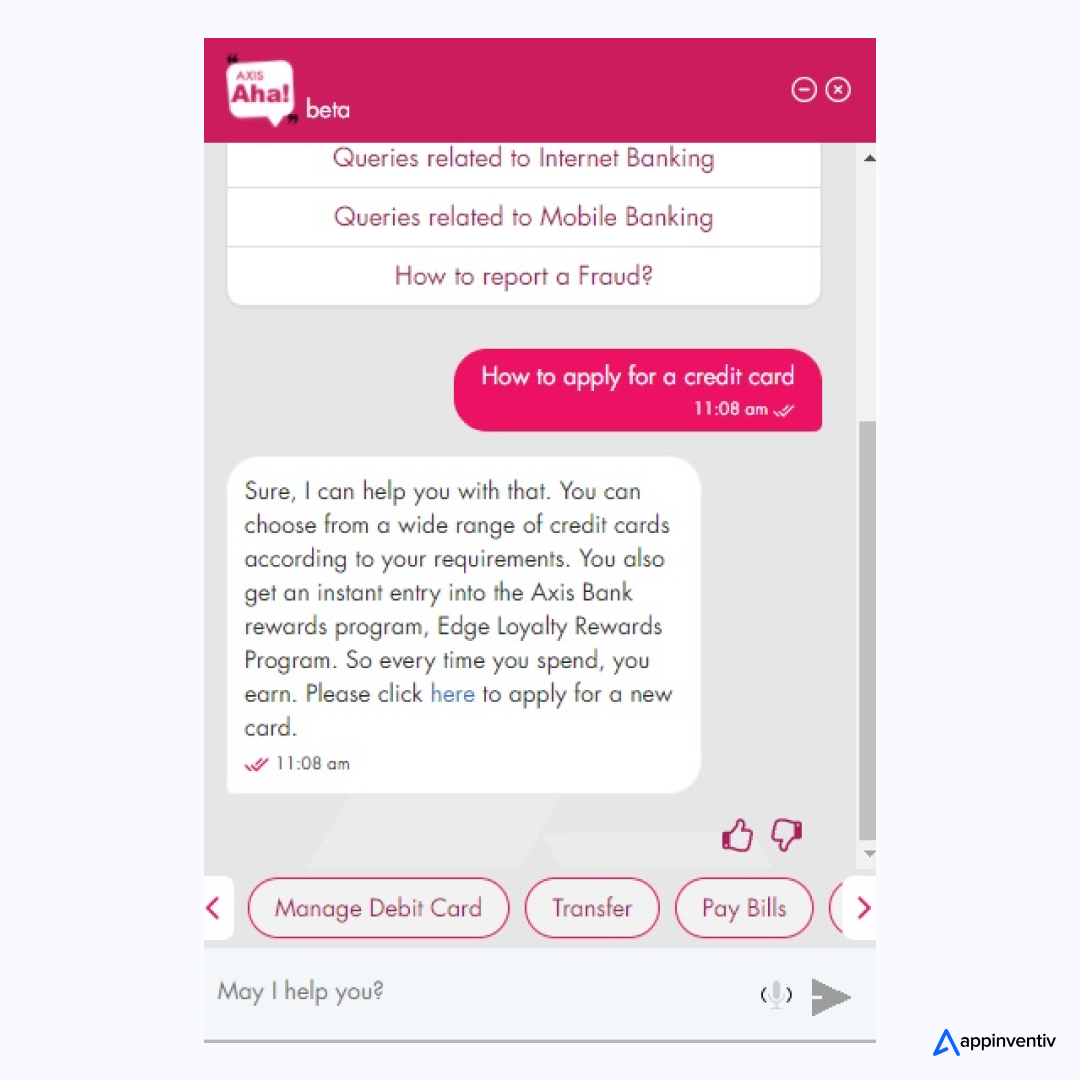

AXIS Bank- Humanizing Voice Banking with AXAA

When customer query volumes surged during the COVID-19 lockdowns, Axis Bank faced a familiar challenge: maintaining service quality without overburdening support teams. In response, Axis Bank introduced AXAA, an AI-powered multilingual voicebot integrated into its phone banking IVR system.

Developed in collaboration with Vernacular.ai, AXAA leverages advanced speech recognition and natural language understanding (NLU) to interpret customer intent and context in real-time and does so with near-human nuance. It understands customer intent, detects query urgency, and navigates requests without transferring calls unless necessary.

Impact:

- AXAA can manage approximately 100,000 customer queries daily, significantly enhancing the bank’s customer service capacity.

- The AI assistant achieved over 90% accuracy in understanding and responding to diverse customer queries across 17 essential services.

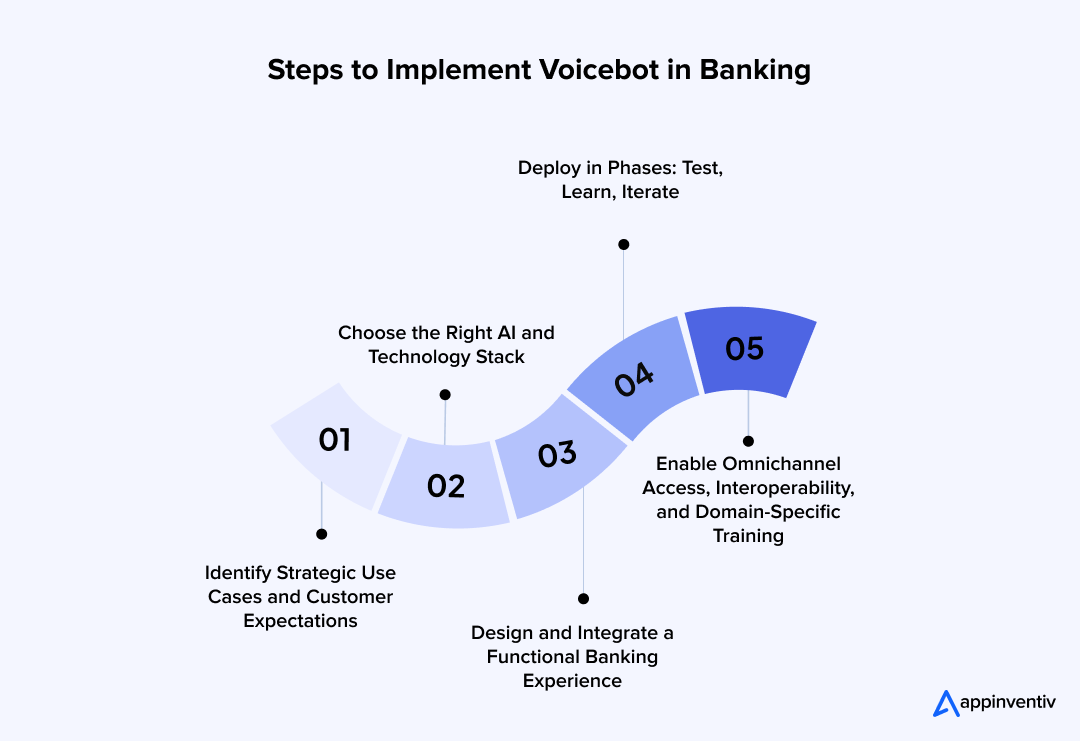

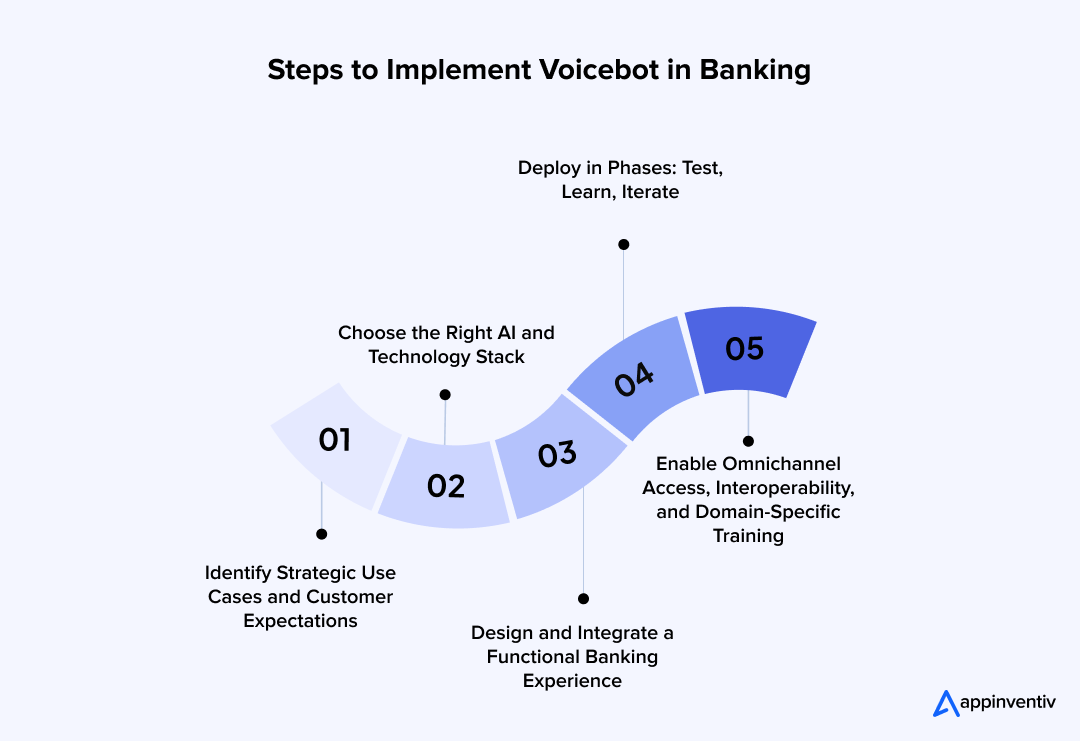

Steps for Implementing Voicebot in Banking

Implementing voicebots in banking requires banking-specific training, secure backend integrations, and careful experience design. Unlike general-purpose voice assistants, voicebots in financial institutions must understand complex banking terminology, comply with regulatory standards, and deliver highly accurate responses across sensitive use cases like fund transfers, account inquiries, and fraud alerts.

As the role of voicebot in banking continues to expand, these steps for implementing voicebots in banking walk you through every phase:

Identify Strategic Use Cases and Customer Expectations

Before building anything, banks need to pinpoint the opportunities for voice bots in banking, where they can create the most impact, whether it’s reducing call center load, improving loan servicing, or streamlining account inquiries. Start by analyzing call center logs, mobile app behavior, and customer surveys to identify repeat interactions that can be automated without compromising service quality.

- Use CRM and call center data to map high-volume, repetitive customer queries.

- Conduct surveys and usability testing to uncover common friction points.

- Benchmark competitors’ AI offerings to find innovation gaps.

By doing this, you’ll avoid building a voicebot that merely replicates a chatbot. This will ensure your voicebot for banking customer experience solves real problems, not just adds complexity.

Choose the Right AI and Technology Stack

Your voicebot is only as smart and secure as the data and technology behind it. Start with quality training data and choose tools built for banking needs to get it right.

- Use high-quality, structured datasets from past customer interactions, anonymized for privacy to train the AI voicebot in banking on real-world banking behavior and questions.

- Based on your budget, compliance requirements, and language needs, select the right NLP platform, such as Microsoft Azure Bot Services.

- Implement bias mitigation protocols using diverse and inclusive data sources to avoid skewed results and ensure ethical AI deployment. This step is especially important as voice AI in banking continues to scale across customer-facing operations.

Consider your needs for:

- Speech-to-text (ASR) and natural language understanding (NLU)

- Multi-language support

- Integration with your core banking and CRM systems

- Voice biometrics for security

- Omnichannel support (mobile, IVR, web, smart devices)

Design and Integrate a Functional Banking Experience

In voice assistant banking, great UX must meet backend performance. This is where functionality meets UX. Think of it as onboarding a smart, secure relationship manager who understands your systems and customers.

- Define your voice persona based on user segments, warm and advisory for retail, and direct and efficient for business banking.

- Map modular conversation flows for key services like KYC, fund transfers, balance checks, or lost card blocking.

- Connect to core systems like CBS, CRM, payment gateways, and fraud engines to enable real-time, transactional experiences.

- Add smart fallbacks to escalate smoothly when the bot can’t handle a query.

Deploy in Phases: Test, Learn, Iterate

When implementing an AI-powered voice bot in banking, avoid a full-scale launch immediately. Instead, start small with a controlled deployment to test core functionalities and identify any issues. You can make informed improvements before scaling by monitoring key performance indicators (KPIs) like containment rate, average handling time, and customer satisfaction.

- Launch a limited-scope pilot (e.g., for balance checks or card PIN resets) to real users.

- Run internal tests and soft launches to check understanding, voice clarity, security, and escalation logic.

- Use A/B testing to refine tone, flow structure, and handoff paths.

Enable Omnichannel Access, Interoperability, and Domain-Specific Training

Your voicebot must be available wherever your customers are, whether that’s via IVRs, mobile apps, WhatsApp, smart speakers (Alexa, Google Assistant), or online banking portals. Omnichannel access ensures that users can interact with the voicebot seamlessly across platforms, without losing context.

- Deploy the bot with session continuity across all key touchpoints, such as mobile apps, IVRs, net banking portals, WhatsApp, and smart devices.

- Use APIs and session memory to maintain consistent customer context across platforms, ensuring the voicebot can recall previous interactions.

Cost of Implementing a Voicebot for Banking

The cost of implementing a voicebot for banking depends on how sophisticated you want the bot to be, which platforms it must support, how deeply it integrates with your banking infrastructure, and what level of compliance and security it must uphold.

On average, the cost of developing and implementing a voicebot for banking ranges from $30,000 to $300,000+, based on these factors:

Cost Analysis Based on Features and Functionalities

A bank that only wants a voicebot for account balance inquiries and branch hours can opt for a basic version at the lower end. But if you’re building something like Capital One’s Eno or Bank of America’s Erica, voice assistants that understand user intent, behavior, and transaction context, the cost of implementing a voicebot for banking can reach upwards of $250,000 or more.

- Basic Features ($30,000-$100,000): Includes essential functionalities such as balance inquiries, transaction histories, and basic customer support.

- Advanced Features ($100,000-$200,000): Incorporates multilingual support, personalized financial advice, and integration with banking systems.

- AI & Machine Learning Features ($200,000-$300,000+): Adds predictive analytics, sentiment analysis, and continuous learning mechanisms for improved customer interactions.

Cost Analysis Based on Platform Selection

Voicebots can be built for a single channel (e.g., mobile banking app) or across multiple platforms like IVR, Alexa, Google Assistant, and WhatsApp voice. An internal call center automation for IVR can cost around $50,000. But if you’re launching a multilingual voicebot that works across mobile, smart speakers, and call centers, your cost will jump significantly due to the added integration and testing layers.

- Single Platform ($30,000–$100,000): Includes in-app voice assistant only.

- Omnichannel Platform ($80,000-$200,000+): Cross-platform integration (IVR, web, mobile, smart speakers).

Cost Analysis Based on Integration with Third-Party Systems

A voicebot that only reads data from CRM is relatively cheap. However, enabling a voice assistant to initiate fund transfers or loan applications requires secure, two-way communication with your banking infrastructure, demanding a much higher investment.

- Standard Integrations ($20,000–$40,000): Includes integration with payment gateways, CRM systems, and basic analytics tools.

- Complex Integrations ($30,000–$60,000+): These involve core banking, KYC, transaction engines, loan processing APIs, and regulatory databases.

Cost Analysis Based on Compliance and Security

If your voicebot is purely informational (e.g., branch hours), basic SSL and GDPR compliance may suffice. But if users can transfer funds or access sensitive account data via voice, you’ll need advanced compliance layers and security audits, which can drive the cost of implementing a voicebox for banking.

- Basic Compliance ($5,000–$15,000): Adherence to standard data protection regulations, tokenization, and implementation of basic security protocols.

- Advanced Security & Compliance ($20,000–$50,000+): End-to-end encryption, PCI-DSS, 2FA, audit logging, and biometric voice authentication.

Cost Analysis Based on Voice UX and Conversational Design

Unlike graphical UI, voice UX requires conversation mapping, tone modulation, fallback handling, and persona development.

- Basic UX ($5,000-$10,000): This includes a structured and rule-based voice interface, where the bot responds using predefined menu options.

- Advanced Voice UX ($15,000-$40,000): Human-like conversational flow using AI/ML, NLU, and emotional intelligence.

Cost Analysis Based on Maintenance and Support

As your customer base grows, you may want to add new languages or integrate with new services. That requires a dedicated NLP team and DevOps support.

- Basic Support (15-20% of Dev Cost): Includes essential maintenance activities such as fixing bugs, performing minor updates, monitoring system uptime, and ensuring basic functionality remains intact.

- Advanced Voice UX ($20,000- $60,000/year): Covers continuous NLP model training, performance analytics, multilingual support, sentiment tuning, intent accuracy improvement, and integration of new capabilities.

Future Trends of Voice Bots in Banking

With the integration of Generative AI, voice biometrics, and smarter device connections, voice bot applications in banking are becoming more intuitive and secure.

| Trend |

Description |

Example/Impact |

| Generative AI Integration |

Voicebots are evolving to utilize generative AI models like GPT to provide more natural, context-aware, and personalized interactions. |

NatWest’s collaboration with OpenAI aims to enhance its digital assistants, improve customer satisfaction, and reduce reliance on human advisors. |

| Integration with Smart Devices |

Expanding voicebot accessibility through integration with various smart devices like wearables, smart speakers, and in-car systems. |

The expansion of smart devices beyond phones, including smart speakers, cars, and wearables, makes voice banking accessible in more contexts. |

| Enhanced Security with Voice Biometrics |

Leveraging voice biometrics for user authentication, analyzing unique vocal patterns. And reducing dependence on PINs and passwords. |

Banks like HSBC use voice biometrics to verify customers in seconds, cutting fraud and speeding up authentication without needing PINs or passwords. |

Key Challenges of Voicebot in Banking

From interpreting layered queries to ensuring regulatory compliance, the limitations of voicebot technology in banking are often revealed only after deployment. So, let’s take a look at some of the key challenges of voicebot in banking and the solutions banks can implement to overcome them.

Intent Recognition and Context Handling

Human banking queries often involve layered intents, contextual dependencies, and natural language quirks. Most voicebots aren’t yet equipped to accurately interpret requests like “Transfer my last paycheck to savings and check if I’m over budget,” leading to fragmented responses.

This gap in understanding affects critical KPIs such as first-call resolution, call deflection, and can even pose compliance risks if financial data is misinterpreted.

Solution:

Leverage domain-specific NLP models trained on real banking conversations, combined with features like contextual memory and intent chaining to enable deeper, more accurate dialogue management.

Security and Compliance Gaps

Every AI-powered voice bot in banking operates in an environment where data privacy laws like GDPR, CCPA, and PSD2 mandate strict control over how personal data is captured, processed, and stored.

If not encrypted, auditable, and consented to, it can lead to significant legal exposure. However, many voice systems fall short, especially if they skip proper user verification or fail to log interactions securely.

Solution:

Voicebot systems must incorporate multi-factor authentication (MFA), consent tracking, and secure storage practices. Regular audits and privacy-by-design principles are non-negotiable when handling voice data.

Underwhelming ROI Without Clear Use Case Alignment

Many banks invest in voice AI in banking, expecting immediate savings or transformation, only to realize later that they’ve overengineered a tool that solves the wrong problems. A voicebot that handles balance checks and branch hours won’t justify enterprise-grade investment unless tied to high-impact KPIs like agent load reduction or NPS improvement.

Solution:

Start with targeted, high-ROI use cases like password resets, fraud alerts, KYC appointment scheduling, or missed EMI reminders. Measure success based on business value, not just automation rates.

Inflexibility with Real-Time Transaction Handling

Many voicebots are still limited to FAQ-style interactions. When a user asks for something real-time, like disputing a transaction, pausing a debit card, or modifying auto-pay schedules, the bot either fails or pushes the user to a live agent.

Solution:

Banks need middleware platforms and real-time APIs that allow voicebots to securely access customer data and perform transactional tasks. Without these integrations, voicebots will remain glorified call deflection tools rather than full-service assistants.

Unlock the Future of Banking with AI-Powered Voicebots With Appinventiv

Integrating AI voicebot in banking is no longer a futuristic concept; it’s a present-day necessity.

Key Takeaways:

- Enhanced Customer Experience: An AI-powered voice bot in banking provides 24/7 assistance, and it understands natural language to resolve queries efficiently.

- Operational Efficiency: By automating routine tasks, voicebots reduce the workload on human agents, allowing them to focus on more complex issues.

- Security and Compliance: Advanced voicebots incorporate multi-factor authentication and adhere to regulations like GDPR and PSD2, ensuring secure transactions.

Why Choose Appinventiv:

With a dedicated team of over 1,200 experts, we have delivered more than 1,500 projects globally. Our dynamic team of AI wizards are proficient in crafting custom banking solutions for various global banks.

Keeping the clients’ custom requirements in mind, we provide budget-friendly AI development services, while building solutions tailored to your niche.

Our approach encompasses:

- Customized Solutions: We understand that each financial institution has unique requirements. Our solutions are tailored to meet these specific needs.

- Regulatory Compliance: We prioritize adherence to global banking regulations, ensuring that our solutions are both innovative and compliant.

- Advanced Technology Integration: Leveraging the latest in AI and machine learning, we develop voicebots that are not only intelligent but also adaptive to evolving customer needs.

By choosing Appinventiv, you’re partnering with a team committed to delivering cutting-edge, secure, and customer-centric solutions.

Ready to transform your banking experience? Contact Appinventiv today!

FAQs

Q. What is a voicebot in banking?

A. A voicebot in banking is a smart, AI-powered assistant that lets customers speak to their bank just like they would with a person. Whether it’s checking balances, reporting a lost card, or scheduling a KYC appointment, the bot understands what the customer is saying and responds instantly, making banking feel quicker and easier.

Q. What are the benefits of Voicebots for Banking?

A. Unlike traditional IVR systems, where customers punch numbers to follow preset paths, modern AI-driven voicebots in financial institutions listen, understand, and respond intelligently.

- Enhanced Security and Fraud Prevention

- 24/7 Customer Support and Reduced wait times

- Improved Operational Efficiency and Cost Savings

- Seamless Omnichannel Integration

- Personalized and Contextual Interactions

Q. How do voicebots improve customer service in banks?

A. A voicebot in financial institutions makes support more personal and accessible at any time. Instead of waiting on hold, customers can get help right away, just by speaking. For banks, this means improved customer experience, fewer support tickets, and more efficient service delivery.

Q. Are voicebots safe to use for sensitive banking tasks?

A. Yes, when built right. The role of a voicebot in banking goes beyond just convenience. Using technologies like voice biometrics, two-factor authentication, and encryption also includes handling confidential tasks securely, from fund transfers to loan applications, without compromising compliance or customer trust.

Q. What are some real-world examples of voicebots in banking?

A. A great voicebot in banking example is a bot that helps customers block a lost card, check EMI status, or even get financial advice, just through voice commands. Some banks use voicebots inside mobile apps, while others integrate them with call centers, WhatsApp, or smart speakers.

Q. How long does it take to launch a voicebot in banking, and what are the current limitations?

A. Timelines depend on complexity, like a basic FAQ bot can go live in a couple of months, while a fully integrated AI voicebot in banking may take 9-12 months. However, the limitations of voicebot technology in banking, like handling nuanced queries or switching context, still exist, though they’re rapidly improving with smarter NLP and better training data. At Appinventiv, our voicebot implementation service for banking is designed to balance speed with performance and is tailored to your needs.

Q. What are the top use cases for voicebots in banking?

A. The most common use cases for voice bots in banking include balance checks, transaction history, fraud alerts, and onboarding, automating tasks that save time for both customers and agents. For the future trends of voice bots in banking, you may expect more emotionally intelligent bots that can detect tone, offer proactive insights, and handle complex tasks through deeper system integration.

Product Development & Engineering

IT Managed & Outsourcing

Consulting Services

Data Services

Didn't find what you're looking for? Let us know your needs, and we'll tailor a solution just for you.